How Much Does It Cost To Open A Roth Ira With Fidelity

However you can still contribute money into both a 401k and a Roth IRA if you qualify. 0 commission for online US stock ETF and options trades.

How To Open A Fidelity Roth Ira A Step By Step Guide Simplernerd

How To Open A Fidelity Roth Ira A Step By Step Guide Simplernerd

No account fees or minimums to open Fidelity retail IRA accounts.

How much does it cost to open a roth ira with fidelity. No matter which type of IRA you choose or if you contribute to both youll face an IRA contribution limit for each tax year. How Much Can You Put into a Roth IRA. You dont have to have the Roth IRA account opened in the tax year youre looking to contribute.

Account Features - 5 5 Like most IRA products offered by other brokerages Fidelitys Roth IRA has no fees attached to its opening or maintenance. The broker does not assess any fees for inactivity and there is no minimum balance requirement. 6000 7000 if age 50 or older 2021.

Expenses charged by investments eg funds managed accounts and certain HSAs and commissions interest charges and other expenses for transactions may still apply. With a traditional IRA and a Roth IRA the contribution limit is a shared limit you can contribute a total of up to 6000 per year 7000 if age 50 or older and its up to you to decide. Does your employer offer a 401kBefore you open a Roth IRA you may want to check to see if your employer offers matchingThats free money youre passing up.

There is no minimum to open the account. Deadline to Open a Roth IRA. How Much to Start a Roth IRA.

Every mutual fund at Fidelity has at least a 2500 minimum initial purchase requirement. Any costs stemming from its use will come from trading fees or commissions related to investment transactions. ETFs are funds that hold a basket of securities that track an index such as the SP 500.

In 2020 you can contribute up to 6000 in total to an IRA if youre under the age of 50. When I came to the realization that I needed to start saving for my future in retirement I found that the best way to start was with a Roth IRA. There is no minimum amount required to open a Fidelity Go account.

Yes you can choose to convert an eligible rollover distribution from your old 401k directly to a Roth IRA. You can open a Roth IRA account with as little as 500. The first 5000 in your account is managed free.

For a regular brokerage account Fidelity requires a minimum opening deposit of 2500. Roth IRA traditional IRA and 401k were all foreign terms to me just a few years ago. An IRA at Fidelity comes with no special fees.

Equity trade is 495 per trade. Upon conversion of the 6000 to Roth the IRS will see this as a taxable event. Actually starting to invest was foreigner.

If youre 50 or older the limit is 7000. For example if you decide in February of 2010 that you want to open a Roth IRA you can open a Roth and then characterize the contribution for the 2009 tax year. There is a bit of a.

Many Roth IRA providers give you the option to trade stocks and exchange traded funds ETFs. The commission for an online US. If you want the Premium package youll need at least 100000 in your account and will pay 04 percent in fees but youll receive unlimited access to a team of certified financial planners.

If you have assets in a Designated Roth Account ie Roth 401k and would like to roll these to an IRA you can only do so to a Roth IRA. However in order for us to invest your money according to the investment strategy youve chosen your account balance must be at least 10. There are plenty of resources online to help you understand the inner workings of Roth IRAs.

Certain investments like mutual funds require a minimum initial investment. Wealthfront offers free financial planning for college planning retirement and homebuying. Your account is professionally managed for a very low fee of 025 of your account balance.

There is no opening cost closing cost or annual fee for Fidelitys Traditional Roth SEP SIMPLE and rollover IRAs Trading fees. For 2020 the maximum contribution to a Roth IRA is 6000 per yearBut if youre 50 or older that increases to 7000 per year. 6000 7000 if age 50 or older Minimum investment.

For example some Fidelity institutional class funds have minimums as high as 10000000. There is no setup charge nor is there an annual fee. In an attempt to complete a successful backdoor Roth IRA contribution you contribute 6000 to a traditional IRA.

You will owe taxes on the amount of pretax assets you roll over. American Century has several funds with a 5000000 minimum and John Hancock requires 250000 purchase amounts in several funds. Certain funds have higher minimums.

How To Protect Your Retirement Savings Fidelity Investing Investing For Retirement Saving For Retirement

How To Protect Your Retirement Savings Fidelity Investing Investing For Retirement Saving For Retirement

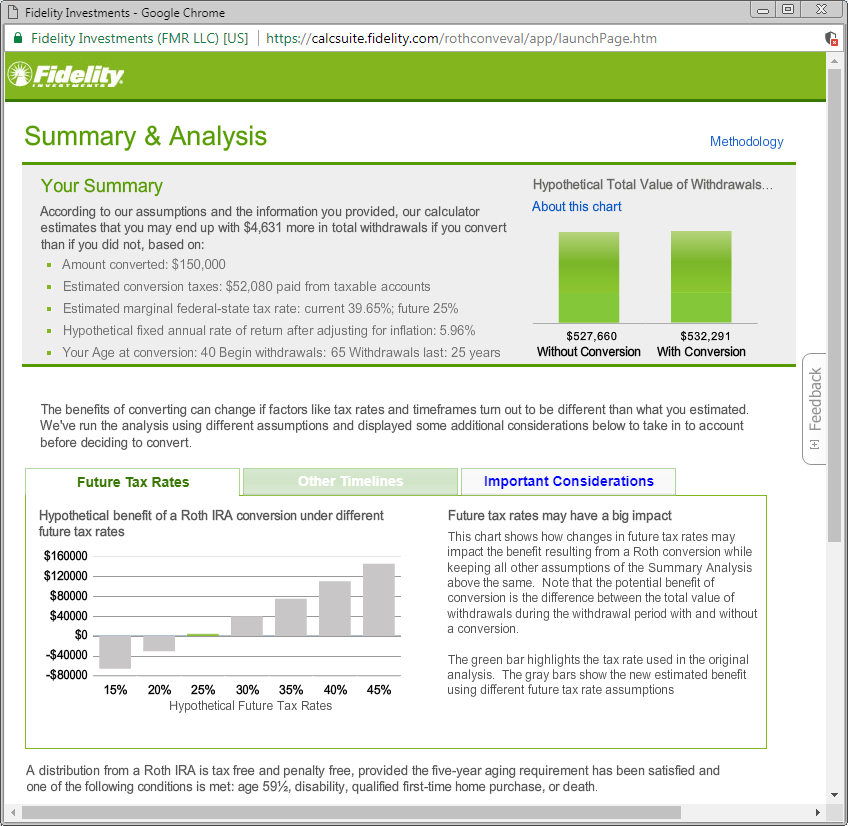

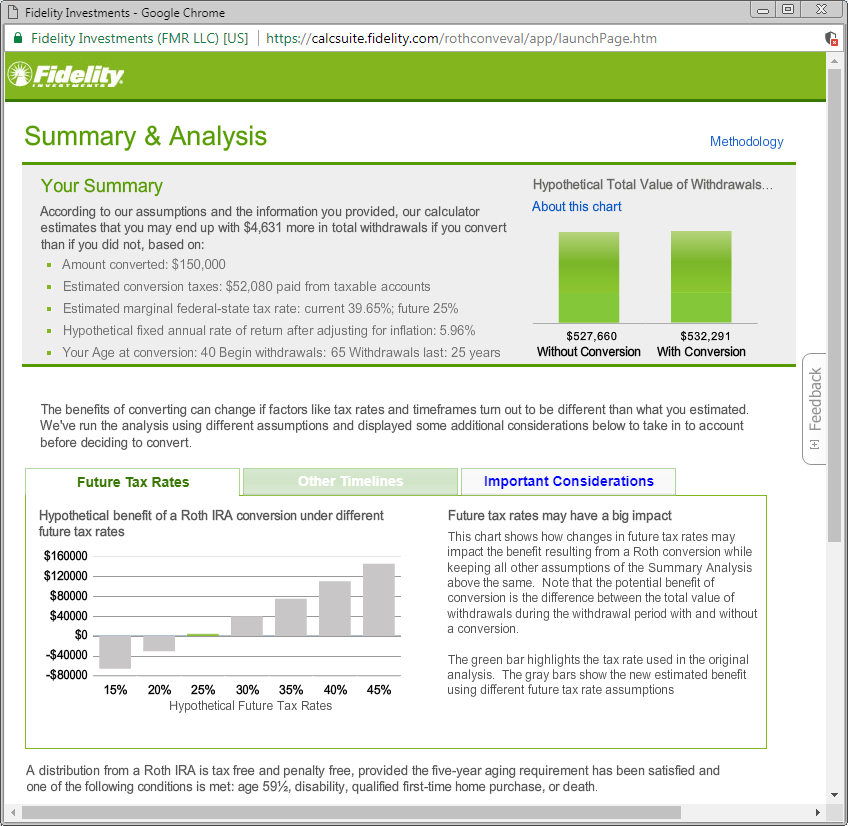

Roth Conversion Calculator Fidelity Investments

Roth Conversion Calculator Fidelity Investments

/CharlesSchwabvs.Fidelity-5c61bb5f46e0fb00017dd690.png) Charles Schwab Vs Fidelity Investments

Charles Schwab Vs Fidelity Investments

Roth Ira Conversions When Why And How To Convert A Traditional Ira To A Roth Ira Seeking Alpha

Roth Ira Conversions When Why And How To Convert A Traditional Ira To A Roth Ira Seeking Alpha

Best Places To Open A Roth Ira In 2021

Best Places To Open A Roth Ira In 2021

Roth Ira Converting Traditional Ira Or 401 K Fidelity

Roth Ira Converting Traditional Ira Or 401 K Fidelity

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Roth Ira Investing Investing

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Roth Ira Investing Investing

Converting Ira To Roth Ira Fidelity

Converting Ira To Roth Ira Fidelity

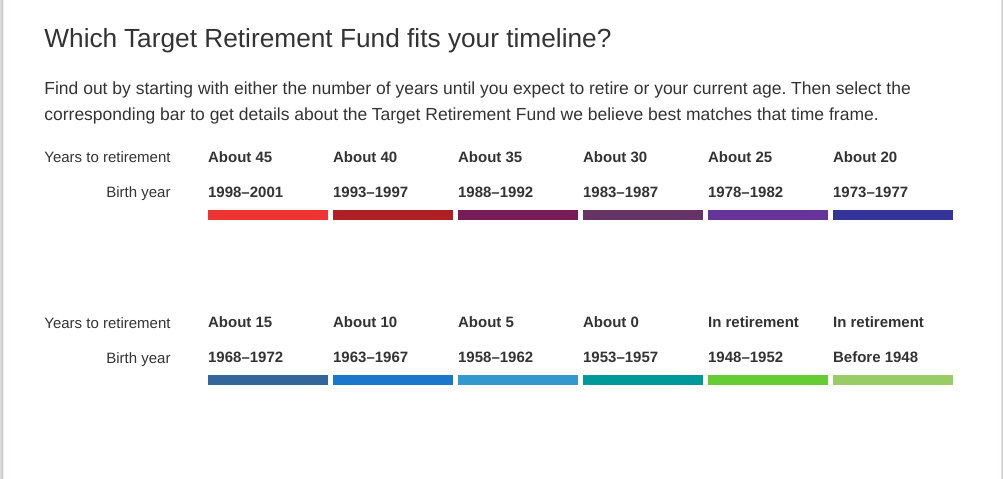

How To Invest Your Ira Fidelity

How To Invest Your Ira Fidelity

Fidelity Ira Fees Roth Retirement Account Cost 2021

Fidelity Ira Fees Roth Retirement Account Cost 2021

Backdoor Roth Ira Ultimate Fidelity Step By Step Guide Fatroth

Frequently Asked Questions On Roth Ira Money Cone

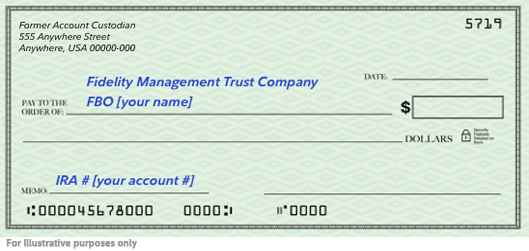

Ira Transfer Moving Your Ira Fidelity

Ira Transfer Moving Your Ira Fidelity

The Backdoor Roth Tutorial With Fidelity

The Backdoor Roth Tutorial With Fidelity

:max_bytes(150000):strip_icc()/fidelity_investments_productcard-5c742f0e46e0fb000143628b.png) Fidelity Investments Vs T Rowe Price

Fidelity Investments Vs T Rowe Price

Vanguard Vs Fidelity Which Company Is The Right Choice For You Choosefi

Vanguard Vs Fidelity Which Company Is The Right Choice For You Choosefi

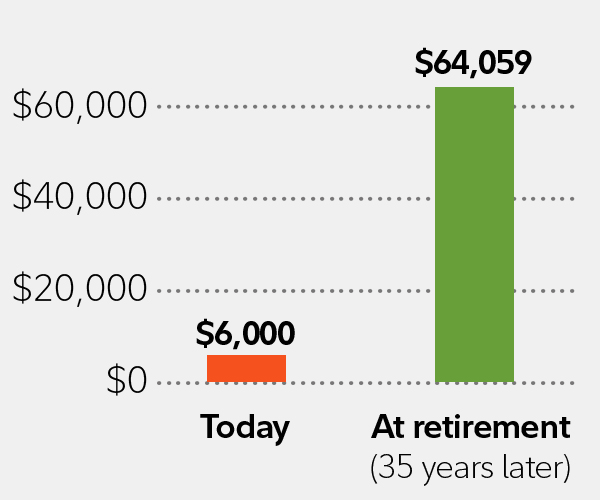

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

Post a Comment for "How Much Does It Cost To Open A Roth Ira With Fidelity"