How To Value A Company With Negative Ebitda

This metric is used to determine whether a company is over or undervalued. An investor who is extremely knowledgeable about the markets and has a reputation of making successful investments.

Btig Research Downgrade Q2 Holdings Qtwo Yes Stock S Trading Above Fair Value Https T Co Gpyjjxxozd Https T Investing Fair Value Fundamental Analysis

Btig Research Downgrade Q2 Holdings Qtwo Yes Stock S Trading Above Fair Value Https T Co Gpyjjxxozd Https T Investing Fair Value Fundamental Analysis

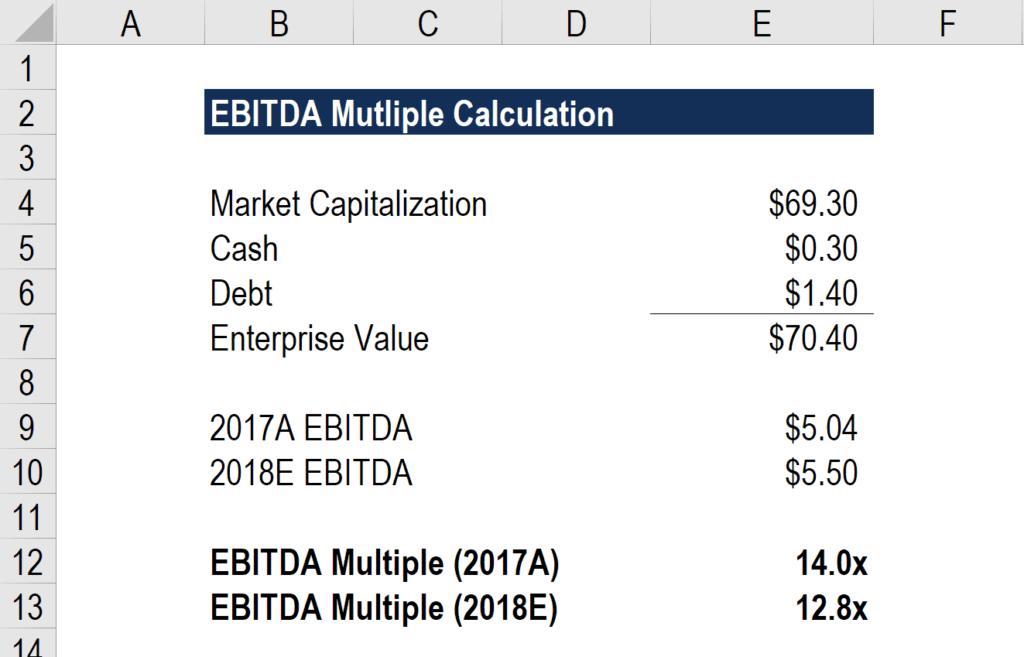

To determine the EBITDA multiple you must first find the companys enterprise value.

How to value a company with negative ebitda. These investors are widely known to the investing public for. EBITDA Multiple also referred to as Enterprise Multiple is a ratio that compares a companys total market value Enterprise Value to EBITDA.

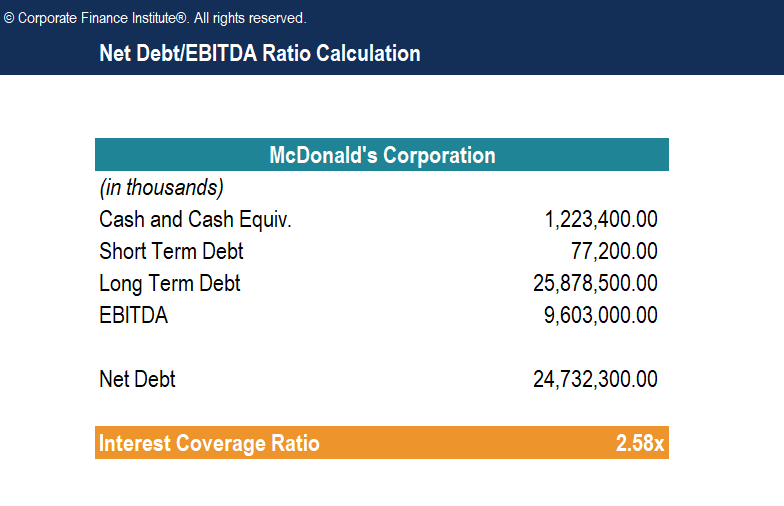

Net Debt To Ebitda Ratio Guide Formula Examples Of Debt Ebitda

Net Debt To Ebitda Ratio Guide Formula Examples Of Debt Ebitda

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Ev To Ebitda Multiples Must Be Consistent Novartis The Footnotes Analyst

Ev To Ebitda Multiples Must Be Consistent Novartis The Footnotes Analyst

Musings On Markets Data Update 7 For 2020 Debt Delusions And Reality In 2020 Debt Data Financial Statement

Musings On Markets Data Update 7 For 2020 Debt Delusions And Reality In 2020 Debt Data Financial Statement

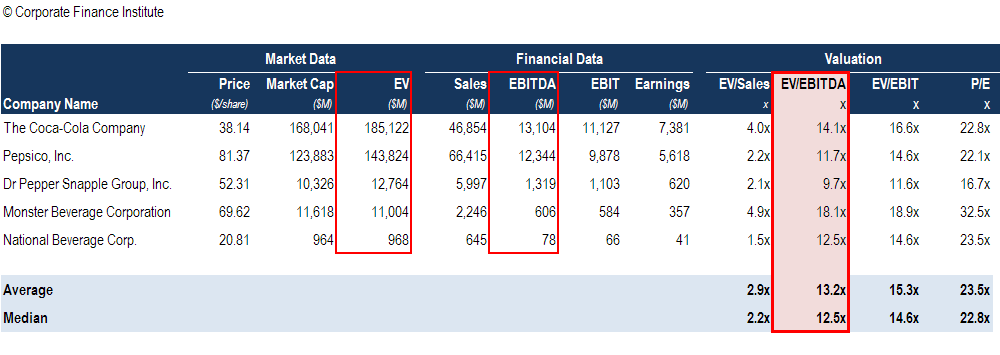

Ev Ebitda Guide Examples Of How To Calculate Ev Ebitda

Ev Ebitda Guide Examples Of How To Calculate Ev Ebitda

How To Use Ebitda To Value Your Company Inc Com

How To Use Ebitda To Value Your Company Inc Com

Westfinance I Will Build Excel Financial Model Forecasts Budget Business Plan For 50 On Fiverr Com Business Planning Business Plan Model Budgeting

Westfinance I Will Build Excel Financial Model Forecasts Budget Business Plan For 50 On Fiverr Com Business Planning Business Plan Model Budgeting

How To Calculate Fcfe From Ebitda Overview Formula Example

How To Calculate Fcfe From Ebitda Overview Formula Example

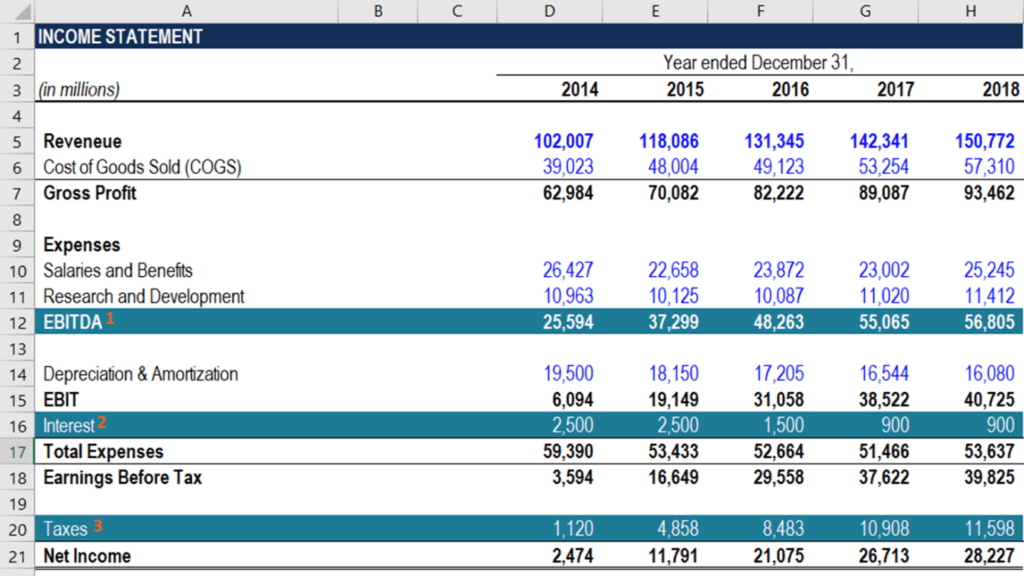

Ebitda Multiple Formula Calculator And Use In Valuation

Ebitda Multiple Formula Calculator And Use In Valuation

-min2.png) How To Impact Ebitda And Increase Company Valuation Systemart Llc

How To Impact Ebitda And Increase Company Valuation Systemart Llc

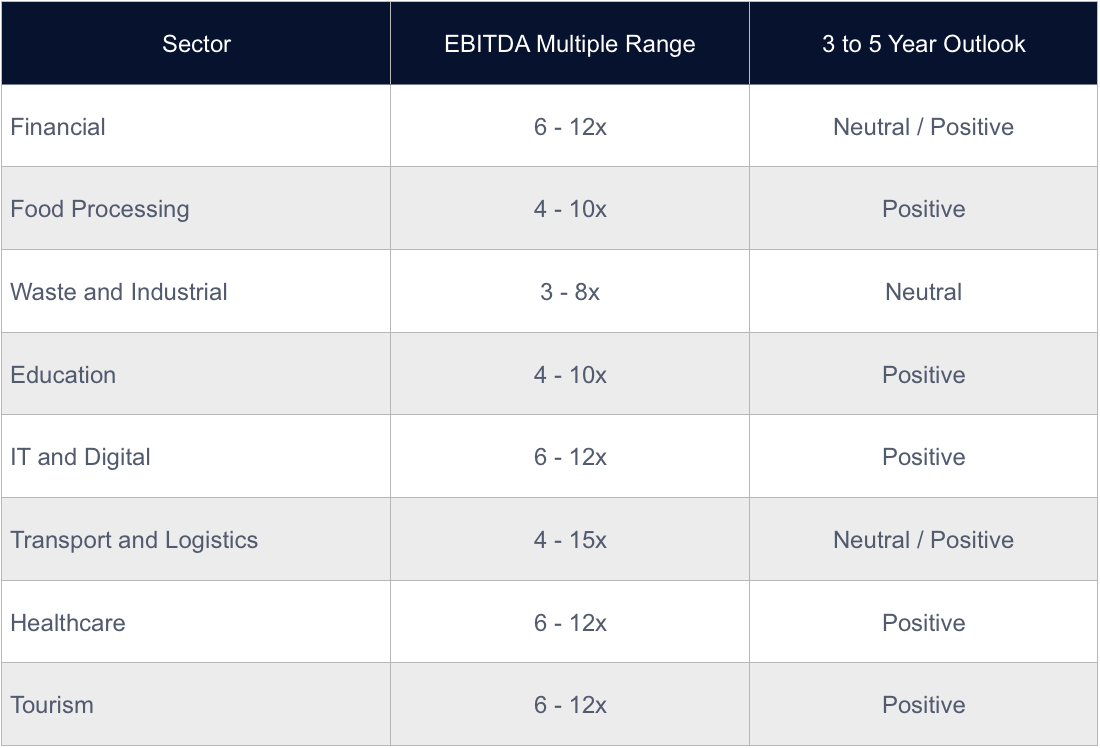

Business Valuation Multiples By Industry Nash Advisory

Business Valuation Multiples By Industry Nash Advisory

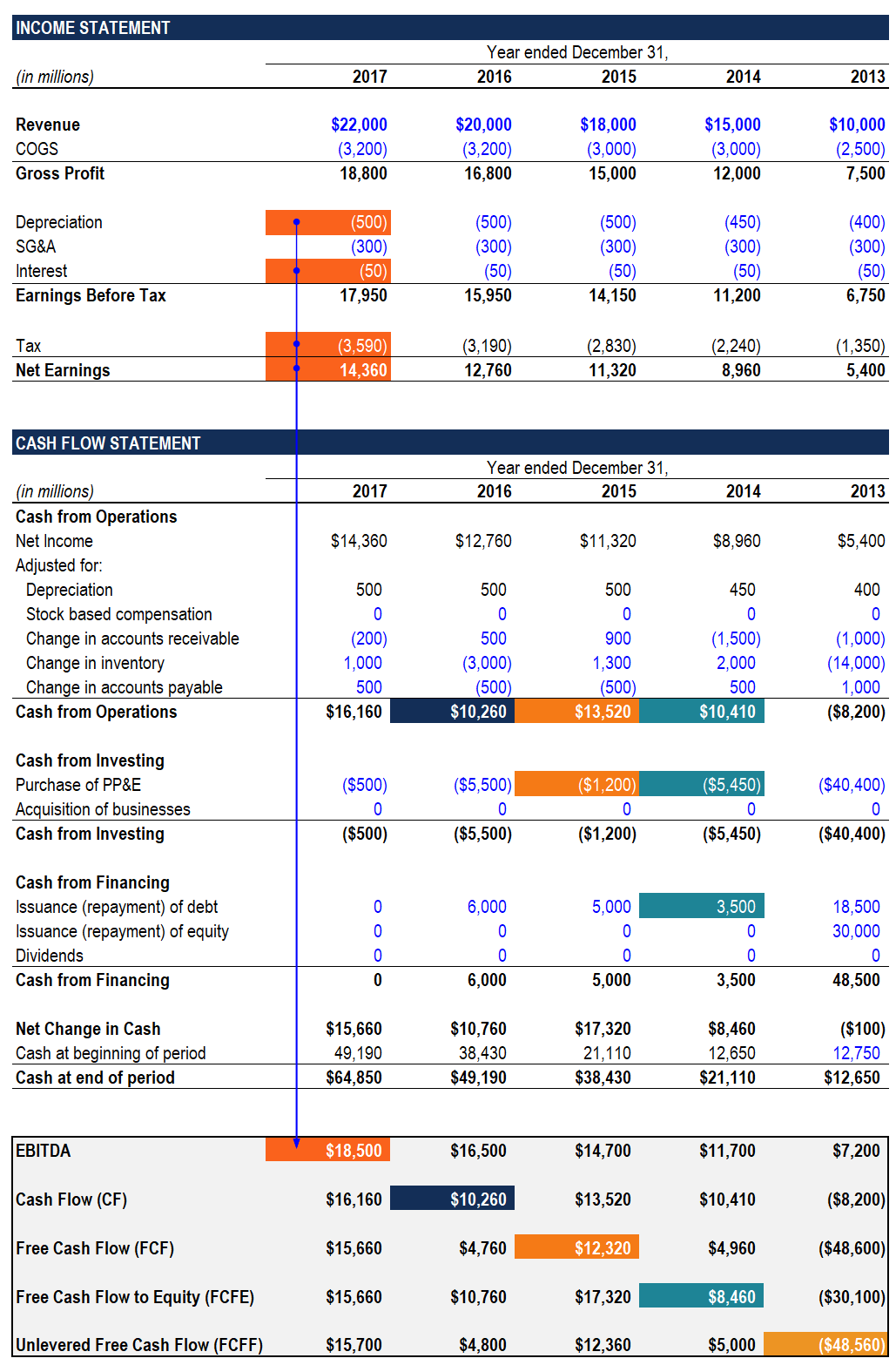

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff

Value Company With Negative Free Cash Flows Wall Street Oasis

Value Company With Negative Free Cash Flows Wall Street Oasis

Ebit Vs Ebitda Pros Cons And Important Differences To Know

Ebit Vs Ebitda Pros Cons And Important Differences To Know

Ebitda Margin Formula Definition And Explanation

Ebitda Margin Formula Definition And Explanation

What Factors Drove Sprint S Ebitda Expansion During The Last Quarter The Expanse Driving Factors

What Factors Drove Sprint S Ebitda Expansion During The Last Quarter The Expanse Driving Factors

Ev To Ebitda How To Calculate Ev Ebitda Valuation Multiple

Ev To Ebitda How To Calculate Ev Ebitda Valuation Multiple

Calculating Ebitda How Profitable Is Your Business Doeren Mayhew

Calculating Ebitda How Profitable Is Your Business Doeren Mayhew

Minority Interest In Enterprise Value Guide Example Formula

Minority Interest In Enterprise Value Guide Example Formula

Post a Comment for "How To Value A Company With Negative Ebitda"