How To Set Up A Roth Ira In Quickbooks

Under a Payroll Deduction IRA employees establish an IRA either a Traditional or Roth IRA with a financial institution and authorize a payroll deduction amount for it. The Payroll Deduction IRA is probably the simplest retirement arrangement that a business can have.

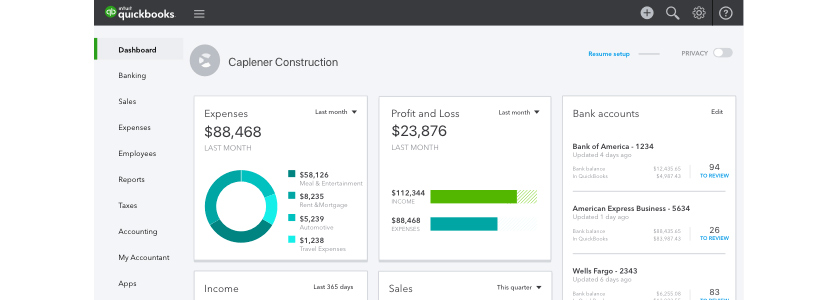

Handy Tricks For Navigating Quickbooks Online Sda Cpa Group

Handy Tricks For Navigating Quickbooks Online Sda Cpa Group

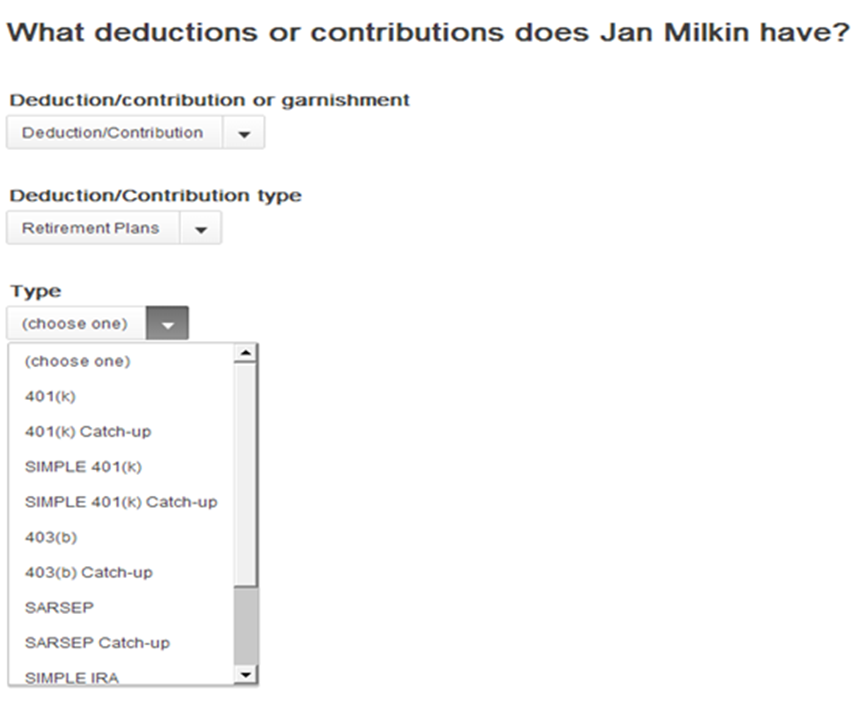

Select Retirement Plans as the category and After-tax Roth 401k as the type.

How to set up a roth ira in quickbooks. Opening a Roth IRA can be as simple as visiting your banks website and filling out an online application. Traditional 401k and 3 of pay as a Roth 401k. BTW I had a Roth IRA until recently when I emptied it out to provide for living expenses.

Set up a Roth 401k Select Employees. Since the total 402g limit is 16500 I have prorated it based on 58ths and 38ths. Under Payroll select Deductions Contributions.

10 of the Best Stocks to Buy This Year. How to Set up a Backdoor Roth IRA A tax loophole lets high earners contribute indirectly to a Roth IRA. The maximum compensation in a retirement plan for.

At the lower left of the Payroll Item List click Payroll Item New. If you are using QB for your personal finances. How do I enter Roth IRA contributions.

Most large firms also offer online access to start the account application. Select Company Contribution and click Next. Any size business can provide this.

Employers can contribute up to 25 of each eligible employees. If someone defers 5 or over the match is 4. While a Roth IRA isnt for everyone you might be surprised at how beneficial it can be and how easy it is to set up.

From the QuickBooks Desktop menus at the top click Lists Payroll Item List. Enter 1 to calculate the maximum contribution. Give the item a name that will be easily recognized for example Roth 401k or Roth 403b or Roth 457b.

If your bank doesnt offer Roth IRA accounts you can open one with a brokerage firm. Its just an IRA account with the tax attributes set appropriately. The employer has no filing requirements.

If your bank allows you to you can set up monthly transfers from your bank account to your Roth IRA. When setting up these deductions be sure to manually enter the limit. No plan document needs to be adopted under this arrangement.

Select the Gear icon at the top Payroll Settings. Enter the appropriate contribution amount in the field labeled Roth IRA contributions 1 maximum code 27 Taxpayer code 77 Spouse. Our Quickbooks account for Roth 401k contributions was set up incorrectly and has been calculating an employees - Answered by a verified Tech Support Rep We use cookies to give you the best possible experience on our website.

To set up a retirement plan company contribution item using Custom Setup. After-tax Roth deduction limits are not supported. If you have any query related to QuickBooks accounting software then contact to Caro Associates LLC.

Just use a spreadsheet. Select Custom Setup and click Next. In the Deductions for Benefits section select Add a Deduction.

Entering Individual Roth IRA Contributions Entering a Basis in Roth or Traditional IRA Individual Roth IRA Distribution is showing as Taxable on Form 1040 Calculating a Loss on a Traditional or Roth IRA Distribution to app. If the employee is eligible for the catch-up limit enter this amount as the annual limit. In QuickBooks Online Payroll select the Payroll menu then select Employees Select the employees name.

SEP IRAs are attractive for the self-employed freelancers and small businesses because they are easy to set up and administer. A business of any size even self-employed can establish a Payroll Deduction IRA program. To enter Roth IRA contributions.

The program calculates and prints the Roth IRA Contribution Worksheet contained in the Form 8606 instructions. Only employees make the contributions. The following articles are the top questions referring to Roth Contributions.

The graphic is from QW2019 R1427 HBRP ie Qs latest greatest and highest level product. The match here is an example of a safe harbor match of 100 up to 3 and 50 from 3-5. Click Add a New DeductionContribution.

Excel is easier for just that one item. In the Deductions for Benefits section select Add a Deduction. In the Deductions Contributions section select Edit.

Recording a SEP IRA contribution in QBs. But you dont have to handle the process on your own. Select Retirement Plans as the category and After-tax Roth 401k as the type.

Set up a Roth 401k Roth 403b or Roth 457b. For Type select the applicable retirement plan. And theres no ROTH IRA type.

Enter the name of the. For Category select Retirement Plans. If a limit is not set they may contribute past the limit resulting in the need for payroll corrections.

Updated Feb 24 2021. Under a Payroll Deduction IRA an employee establishes an IRA either a Traditional or a Roth IRA with a financial. From the QuickBooks Desktop menus at the top click Lists Payroll Item List.

Alternatively you can decide to make an annual contribution as long as you still meet the. At the lower left of the Payroll Item List click the Payroll Item button New. Locate the section labeled Roth IRA.

Enter a name for the item in the Enter name for deduction box. Select Deduction click Next. Go to Screen 24 Adjustments to Income.

In the Deductions Contributions section select Edit. Select Custom Setup and click Next. An IRA is a long-term asset so make one up in that category.

FACEBOOK TWITTER LINKEDIN By Amy Fontinelle. Select the employees name.

How To Set Up Sep Ira Contribution What Expense Account Do I Use

How Do I Create A Paycheck For An Employee

How Do I Create A Paycheck For An Employee

Top 7 Features Of Quickbooks Enterprise For Construction Businesses In 2020 Quickbooks Construction Business Enterprise

Top 7 Features Of Quickbooks Enterprise For Construction Businesses In 2020 Quickbooks Construction Business Enterprise

Get Free Quickbooks Training With Easy How To Use Video Tutorials And Visual Guides That Walk You Step By St Quickbooks Tutorial Quickbooks Quickbooks Training

Get Free Quickbooks Training With Easy How To Use Video Tutorials And Visual Guides That Walk You Step By St Quickbooks Tutorial Quickbooks Quickbooks Training

Payroll Set Up Payroll Preferences

Payroll Set Up Payroll Preferences

Imgur The Most Awesome Images On The Internet Flow Chart Finance Personal Finance

Imgur The Most Awesome Images On The Internet Flow Chart Finance Personal Finance

State Retirement Savings Plan Savers Program

State Retirement Savings Plan Savers Program

Retirement Plan Deductions Contributions

Retirement Plan Deductions Contributions

Create A P In Quickbooks Statement Template Profit And Loss Statement How To Memorize Things

Create A P In Quickbooks Statement Template Profit And Loss Statement How To Memorize Things

Ways To Install Quickbooks On Multiple Pc S

Ways To Install Quickbooks On Multiple Pc S

How To Create Projects In Quickbooks Online Isler Northwest Llc

How To Create Projects In Quickbooks Online Isler Northwest Llc

Quickbooks Self Employed Save More With Quickbooks Turbotax Quickbooks Online Quickbooks Online Self

Quickbooks Self Employed Save More With Quickbooks Turbotax Quickbooks Online Quickbooks Online Self

How To Create Multiple Invoices In Qbo Advanced Quickbooks Quickbooks Training Quickbooks Webinar

How To Create Multiple Invoices In Qbo Advanced Quickbooks Quickbooks Training Quickbooks Webinar

Cual Es La Mejor Cuenta De Jubilacion Retirement Accounts Quickbooks Online Business Checks

Cual Es La Mejor Cuenta De Jubilacion Retirement Accounts Quickbooks Online Business Checks

Post a Comment for "How To Set Up A Roth Ira In Quickbooks"