How Much Do U Need To Start A Roth Ira

In 2021 the MAGI limit is 140000. But there are income limits based on your modified adjusted gross income MAGI.

Can I Contribute To Both A Roth And Traditional Ira Pt Money Roth Ira Limits Traditional Ira Ira

Can I Contribute To Both A Roth And Traditional Ira Pt Money Roth Ira Limits Traditional Ira Ira

Most people are eligible to contribute to a Roth IRA provided they have earned income for the year.

How much do u need to start a roth ira. Youll just need your bank account and routing numbers found on your bank checks. It doesnt matter if youre covered by an employers retirement plan such as a 401 k or 403 b. Consider maximizing your contributions each year up to 6000 for 2020 and 2021.

As long as you dont exceed the IRSs income limits you can still contribute the maximum annual amount to a Roth IRA. There are also limits to the amount of income you can have to contribute to a Roth IRA depending on your tax filing status. View important information about our fees and commissions This tax information is not intended to be a substitute for specific individualized tax legal or investment planning advice.

This is how much you are allowed to deposit into your Roth IRA in a given year. For those aged 50 and above the limit is 7000. At that point you have 6000 left consisting of 3500 in contributions and 2500 in earnings.

There is a bit of a catch with that contribution. A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. Name beneficiaries for your IRA.

For 2020 the maximum contribution to a Roth IRA is 6000 per year. Furthermore to qualify to make Roth IRA contributions filers must have earned income ie. Now that you understand the process a bit more figure out which brokerage firm to use for your.

Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rules. 1 These limits usually increase slightly per year. If you fall somewhere in between the ranges listed above you can still contribute but your contribution limit is reduced.

If you are over 50 years old the maximum is increased to 7000. To contribute to a Roth IRA your modified adjusted gross income MAGI must be under 139000 in 2020 single filers or 206000 married filing jointly. Some mutual funds have a 1000 or higher minimum investment though once you make.

If your account is worth 14000 and you pull 8000 out no taxes are due. There are limits to how much money you can put into IRAs each year. The contribution limit in 2021 for those aged 49 and below is 6000.

The limit for someone age 50 or older is 7000 using your age at the end of the calendar year. How much can you contribute to a Roth IRA. Well send instructions once your IRA is open Avoid the 20 annual account service fee by registering your accounts online and signing up for e-delivery.

This is much different than a Traditional IRA which taxes withdrawals. Contributions can be withdrawn any. Open an account with a 0 minimum deposit plus get 0 online equity trade commissions3 regardless of your account balance or how often you trade.

Currently the maximum is 6000. For 2020 you can invest 6000 in either a traditional IRA or a Roth IRA. For the 2019 tax year the Roth IRA allows you to contribute up to 6000 if youre under the age of 50 or 7000 if youre over the age of 50.

In 2020 contributions from individuals with single tax-filing status cannot be made to a Roth if your income exceeds 139000 and in 2021 income cant exceed 140000. If youre 50 or older and need to catch up you can add an extra 1000 for a total of 7000. And if youre age 50 or older you can save up to 7000 for 2020 and 2021.

1 Theres also a limit on who can contribute to a Roth IRA based on your income. Wages tips bonuses self-employment income in the year contributions are made. If youre age 49 or younger you can contribute up to 6000.

It is the earnings that. For the 2020 and 2021 tax years thats 6000 or 7000 if youre age 50 or older. But if youre 50 or older that increases to 7000 per year.

With a Roth IRA you make contributions with money on which youve already paid taxes. 2 This too isnt a fee but youll need enough money to buy whatever investments you want in your Roth IRA. Keep in mind that you have from January 1st until April 15th of the following year to be able to contribute that amount.

Starting in 2020 as long as you are still working there is no age limit to be able to contribute to a Traditional IRA.

Should You Use Your Roth Ira To Buy Your First Home Sofi

Should You Use Your Roth Ira To Buy Your First Home Sofi

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

How To Create A Roth Ira Conversion Ladder

How To Create A Roth Ira Conversion Ladder

How To Start A Roth Ira And Where To Do It Roth Ira Ira Roth

How To Start A Roth Ira And Where To Do It Roth Ira Ira Roth

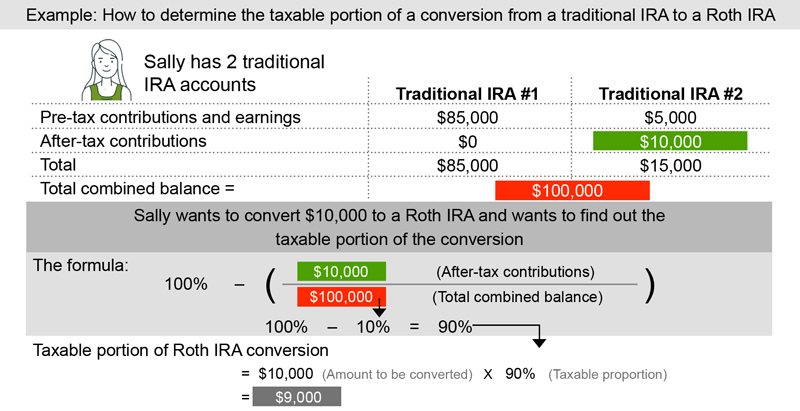

:max_bytes(150000):strip_icc()/roth-ira-vs-traditional-ira-written-in-the-notepad--1090754116-525e8e6001494031bda19fa01ad1cf2f.jpg) How To Set Up A Backdoor Roth Ira

How To Set Up A Backdoor Roth Ira

Roth Ira Rules And Contribution Limits For 2021

Roth Ira Rules And Contribution Limits For 2021

Roth Ira Vs Traditional Ira Which Should You Choose Money Under 30

Roth Ira Vs Traditional Ira Which Should You Choose Money Under 30

Retirement Nextadvisor With Time Required Minimum Distribution Roth Ira Plan For Life

Retirement Nextadvisor With Time Required Minimum Distribution Roth Ira Plan For Life

When Do You Pay Taxes On A Roth Ira Acorns

When Do You Pay Taxes On A Roth Ira Acorns

How To Start A Roth Or Traditional Ira How Much Does It Cost

How To Start A Roth Or Traditional Ira How Much Does It Cost

Funding 401 K S And Roth Iras Worksheet Answers Roth Ira Roth Ira

Funding 401 K S And Roth Iras Worksheet Answers Roth Ira Roth Ira

Why You Need A Roth Ira Feedlinks Net Roth Ira Roth Ira

Why You Need A Roth Ira Feedlinks Net Roth Ira Roth Ira

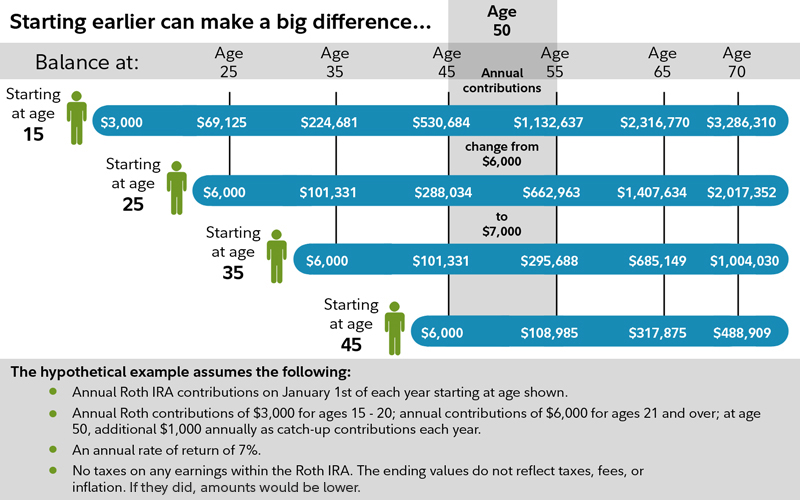

Learn How To Retire With Over 1 Million Dollars In The Bank Using A Roth Ira Al In 2020 Roth Ira Finance Saving Take Money

Learn How To Retire With Over 1 Million Dollars In The Bank Using A Roth Ira Al In 2020 Roth Ira Finance Saving Take Money

Here Are The Key Differences Between A Roth Ira And A Traditional Ira Traditional Ira Money Management Budgeting Money

Here Are The Key Differences Between A Roth Ira And A Traditional Ira Traditional Ira Money Management Budgeting Money

2019 The Year I Maxed Out My Roth Ira Twice Beworth Finance

2019 The Year I Maxed Out My Roth Ira Twice Beworth Finance

Post a Comment for "How Much Do U Need To Start A Roth Ira"