How To Delete A Bounced Check In Quickbooks

Select the check to void from the Expense Transactions list to open it in the Check screen. From your QuickBooks home screen navigate to Customer Payments and select Receive Payments.

Quickbooks License Error Message Display 3371 Quickbooks Error Message Error

Quickbooks License Error Message Display 3371 Quickbooks Error Message Error

So you wont have to repeat it.

How to delete a bounced check in quickbooks. Record a Bounced Check in QuickBooks Online. Keep in mind that you can only record a bounced check if the check is not waiting to be cleared. The first step is to record the bounced check in a journal entry.

Under Other select Journal Entry. The check is now deleted from your records and cannot be retrieved. In the Type field select Check.

If you prefer to call us directly well ask you a series of questions to confirm your personal info and the reason for your call. From the Customers menu choose Customer Center. In the Payment date field enter the date you found out the check bounced.

There are a number of reasons why you may have old uncleared checks on your books. Select the customers name. Enter the date the check bounced in the Journal date field.

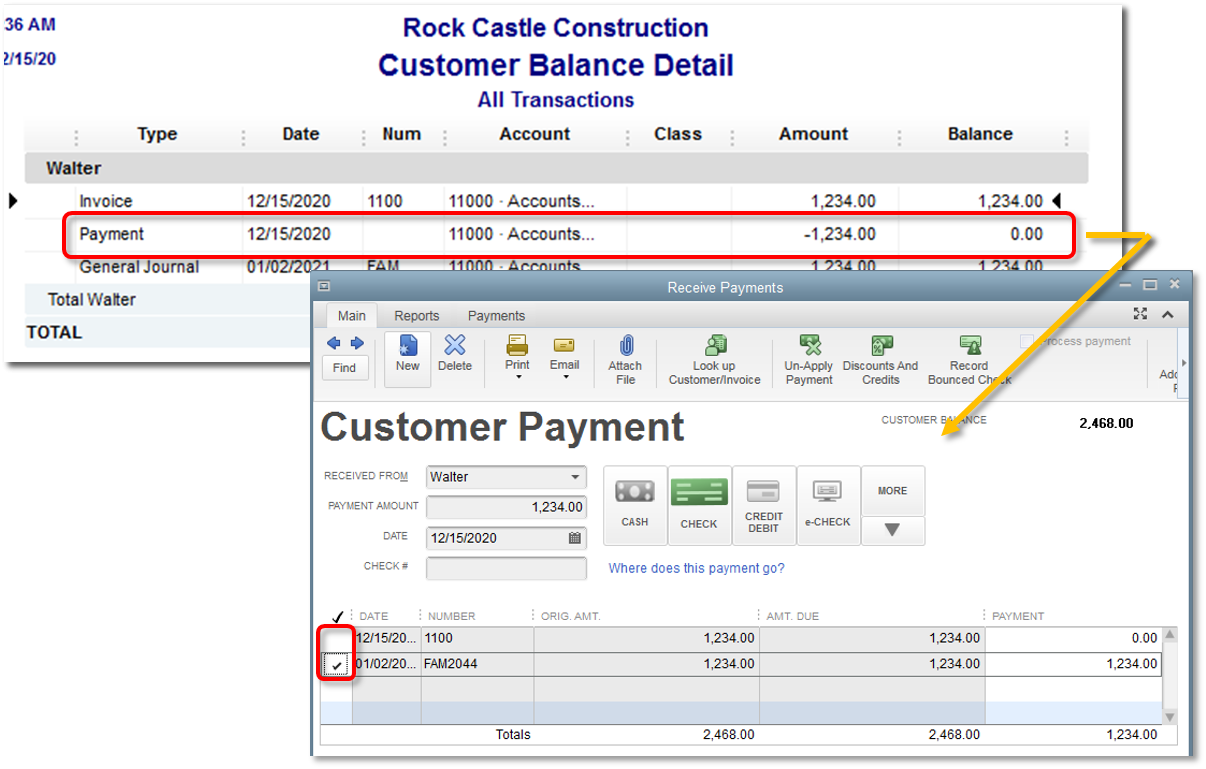

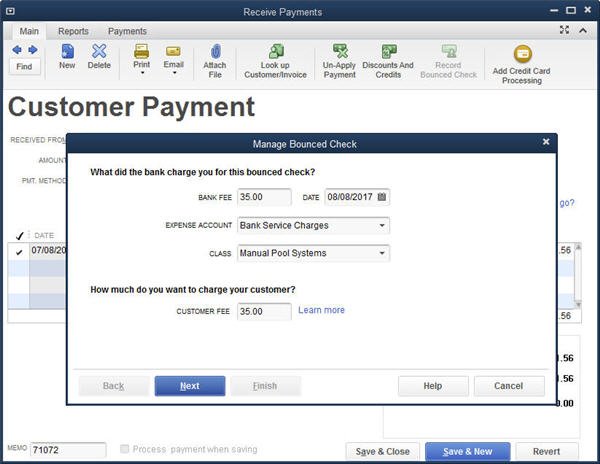

Select and open the Category details dropdown. Bounced Checks in QuickBooks Desktop Pro- Instructions. In the Manage Bounced Check window enter the following information then select Next.

For new checks void is the only option. Select the Lists menu and choose Item List Select New in the Item drop-down list. On the receive payments window select the Record Bounced Check icon on the Main ribbon tab.

On the first line select Accounts Receivable from the Account menu. In the Debits column enter the amount of the bounced check. Go to the Transactions tab.

Select Record Bounced Check in the upper right corner of the Receive Payments Screen. You can easily do that by recording bounced checks through QuickBooks. Display that received payment within this window.

Under payment method select Check. To delete a check. This learn QuickBooks instructional class you will learn how to record a bounced check from a customer who paid you and received a sale receipt.

Heres our toll free number. Indicating the reason for the voided check will help explain any missing checks when you reconcile the bank account. In the Amount field enter the amount of the bounced check.

Select the date range in which the check was received and select Apply. Then click the Record Bounced Check button in the Main tab of the Ribbon at the top of the window. The check must not be waiting to be cleared in the Undeposited Funds account as it would have to have cleared the bank in order to bounce.

Click the Show drop-down menu located on top of the Type column then select Received Payments. A picture of the Manage Bounced Check window in QuickBooks Desktop Pro. Select Item List from QuickBooks Lists menu.

Therefore if you want to reconcile your bank account you must keep track of the additional fees you were charged as well as the bounced check itself. In the Description field enter a note such as bounced check or NSF check When youre done select Save and close. QuickBooks General Help Line.

How to hit your target every time. We recommend having a QuickBooks expert call you. To delete the bounced check.

In the Category field select Accounts Receivable. Double click the payment that you recorded as a bounced check. Open the check in the Write Checks window.

Record the bounced check in a journal entry. Type the customers name in the Received From field. Theyll have the info youve already entered.

Click the Items button and select New This will be an empty item simply to track the bounced check. Record the bad check number the amount of the check and the check date. Select Other Charge in the Type drop-down list and then enter a name for the item such as Bad.

Changes the original amount of the check to 000 adds the text void. From the menu select Edit Delete Check. Select More and select Void from the pop-up menu.

Void a check without opening the transaction. The following sections will show you how to record a bounced check using. The How to Record Bounced Check Online on QuickBooks If you deposit a check that you received from a customer and they dont have enough funds in their bank account the check will be returned to your bank.

QuickBooks new Record Bounced Check feature makes this super simple. When a check bounces the bank balance shown in quickbooks online is overstated since the bounced check is shown as a deposit. How to Clean Up Old Uncleared Checks in QuickBooks.

Review the voided transaction then click Save Close. Whatever the reason it is important to clean any checks that should be cleared off your books in order to make sure you are not overstating your cash balance. Once youve marked the customers payment as an NSF youll need to access the Receive Payments window from which you can click the Record Bounced Check option.

This video will teach you how to enter NSF - Bounced checks from your Customers. When prompted select Yes to confirm you want to void the check. In the Delete Transaction popup click OK.

Want quick easy help.

Pin By Brenda Johnson On Classes Quickbooks Tutorial Quickbooks Quickbooks Pro

Pin By Brenda Johnson On Classes Quickbooks Tutorial Quickbooks Quickbooks Pro

Handle Non Sufficient Funds Nsf Or Bounced Check

Handle Non Sufficient Funds Nsf Or Bounced Check

Buy Quickbooks Pro Desktop Quickbooks Quickbooks Pro Best Accounting Software

Buy Quickbooks Pro Desktop Quickbooks Quickbooks Pro Best Accounting Software

How To Fix Quickbooks Error 15227 Quickbooks Accounting Software Coding

How To Fix Quickbooks Error 15227 Quickbooks Accounting Software Coding

Dealing With Uncleared Checks From Prior Years In Sage 50 Sage 50 Sage Accounting Software

Dealing With Uncleared Checks From Prior Years In Sage 50 Sage 50 Sage Accounting Software

Duplicate An Estimate In Quickbooks Desktop Pro Instructions Quickbooks Quickbooks Tutorial Quickbooks Pro

Duplicate An Estimate In Quickbooks Desktop Pro Instructions Quickbooks Quickbooks Tutorial Quickbooks Pro

How To Record Returned Or Bounced Check In Quickbooks

How To Record Returned Or Bounced Check In Quickbooks

Bounced Checks In Quickbooks Desktop Pro Instructions And Video

Bounced Checks In Quickbooks Desktop Pro Instructions And Video

Quickbooks Notifications Preferences Google Search Quickbooks Preferences Finance

Quickbooks Notifications Preferences Google Search Quickbooks Preferences Finance

How To Record A Bounced Check In Quickbooks Online Youtube Quickbooks Online Quickbooks Online

How To Record A Bounced Check In Quickbooks Online Youtube Quickbooks Online Quickbooks Online

How To Resolve Quickbooks Error 1406 Quickbookserror1406 Fixquickbookserror1406 Resolvequickbookserror1406 Quickbooks Error Solutions

How To Resolve Quickbooks Error 1406 Quickbookserror1406 Fixquickbookserror1406 Resolvequickbookserror1406 Quickbooks Error Solutions

Google Image Result For Https Www Teachucomp Com Wp Content Uploads Blog 7 26 2018 Keyboards Keyboard Shortcuts Computer Shortcut Keys Mac Keyboard Shortcuts

Google Image Result For Https Www Teachucomp Com Wp Content Uploads Blog 7 26 2018 Keyboards Keyboard Shortcuts Computer Shortcut Keys Mac Keyboard Shortcuts

Post a Comment for "How To Delete A Bounced Check In Quickbooks"