How To Set Up Roth Ira In Quickbooks Desktop

Set up the ContribDeductions tab to set the amount of the Employee Contribution per pay period. The deposit transaction in checking will be a split with the first line being a transfer in from the IRA for the gross amount followed by split lines for any withholding amounts.

Why Hosting Drake Software On Cloud Is The Right Choice For Your Firm Public Cloud Cloud Services Clouds

Why Hosting Drake Software On Cloud Is The Right Choice For Your Firm Public Cloud Cloud Services Clouds

Select Custom Setup and click Next.

How to set up roth ira in quickbooks desktop. At the lower left of the Payroll Item List click Payroll Item New. Set up company contributions. Select Company Contribution and click Next.

From the QuickBooks Desktop menus at the top click Lists Payroll Item List. Since the total 402g limit is 16500 I have prorated it based on 58ths and 38ths. From the QuickBooks Desktop menus at the top click Lists Payroll Item List.

If someone defers 5 or over the match is 4. From the QuickBooks Desktop menus at the top click Lists Payroll Item List. When setting up these deductions be sure to manually enter the limit.

Entering Individual Roth IRA Contributions Entering a Basis in Roth or Traditional IRA Individual Roth IRA Distribution is showing as Taxable on Form 1040 Calculating a Loss on a Traditional or Roth IRA Distribution to app. Set transfers out to gross taxable distributions. If you are using QB for your personal finances.

To set up a retirement plan company contribution item using Custom Setup. Excel is easier for just that one item. Select Custom Setup and click Next.

The good news is that the IRS doesnt require a minimum amount to open a Roth IRA. Set up a Roth 401k Set up a Roth 401k plan in Intuit Online Payroll and QuickBooks Online Payroll. At the lower left of the Payroll Item List click the Payroll Item button New.

Just use a spreadsheet. Choose Custom Setup allows editing of all settings. Locate the section labeled Roth IRA.

Recommended for expert users and click on Next. Then choose 408 k 6 SEP in the Tax tracking type window. At the lower left of the Payroll Item List click the Payroll Item button New.

Choose Company Contribution if this item will be used for company enter a name select the name of the agency to which liability is paid. Enter 1 to calculate the maximum contribution. The graphic is from QW2019 R1427 HBRP ie Qs latest greatest and highest level product.

The maximum compensation in a retirement plan for. Setting up a new retirement plan in QuickBooks Desktop 2017 Were starting a simple IRA plan for our small office. While theres a Roth IRA maximum contribution amount theres no minimum according to IRS rules.

Give the item a name that will be easily recognized for example Roth 401k or Roth 403b or Roth 457b. Enter the appropriate contribution amount in the field labeled Roth IRA contributions 1 maximum code 27 Taxpayer code 77 Spouse. Choose Deduction if this item will be used for employee contribution enter a name and select the name of the agency to which liability is paid.

In the Deduction and Contributions section select Edit. If your bank allows you to you can set up monthly transfers from your bank account to your Roth IRA. How do I set up company contributions in QuickBooks.

If your bank doesnt offer Roth IRA accounts you can open one with a brokerage firm. According to QB instructions I am to set up 2 payroll items. The program will calculate the correct amount when generating a batch payroll.

In QuickBooks Online Payroll select the Payroll menu then select Employees Select the employees name. When you are ready to start your personal finance accounting fire up Quickbooks on your personal computer. One for employee deduction one for company match including corresponding expense account.

Set up a Roth 401k Roth 403b or Roth 457b. That allows individuals to save thousands of dollars more in tax-free retirement income than they can through a Roth IRA. Its just an IRA account with the tax attributes set appropriately.

The match here is an example of a safe harbor match of 100 up to 3 and 50 from 3-5. Enter a name for the item in the Enter name for deduction box. How do I enter Roth IRA contributions.

Our Quickbooks account for Roth 401k contributions was set up incorrectly and has been calculating an employees - Answered by a verified Tech Support Rep We use cookies to give you the best possible experience on our website. The program calculates and prints the Roth IRA Contribution Worksheet contained in the Form 8606 instructions. But you dont have to handle the process on your own.

An IRA is a long-term asset so make one up in that category. After-the-fact payroll or deleting a check requires manual calculation and adjustments. To enter Roth IRA contributions.

Select Custom Setup and click Next. Go to Screen 24 Adjustments to Income. Most large firms also offer online access to start the account application.

Alternatively you can decide to make an annual contribution as long as you still meet the. Set up the Employer matching Contribution on the ContribDeductions tab. After-tax Roth deduction limits are not supported.

The following articles are the top questions referring to Roth Contributions. If a limit is not set they may contribute past the limit resulting in the need for payroll corrections. BTW I had a Roth IRA until recently when I emptied it out to provide for living expenses.

If you have any query related to QuickBooks accounting software then contact to Caro Associates LLC. The process of using the software for your personal accounting needs is pretty much the same as business accounting only with a few minor differences. If the employee is eligible for the catch-up limit enter this amount as the annual limit.

Traditional 401k and 3 of pay as a Roth 401k. And theres no ROTH IRA type. You should also also edit your IRA account and click on tax schedules.

Once Quickbooks has loaded use the built-in setup Wizard to walk you through the rest. Opening a Roth IRA can be as simple as visiting your banks website and filling out an online application. Select Deduction click Next.

How To Set Up Process Payroll In Quickbooks

How To Set Up Process Payroll In Quickbooks

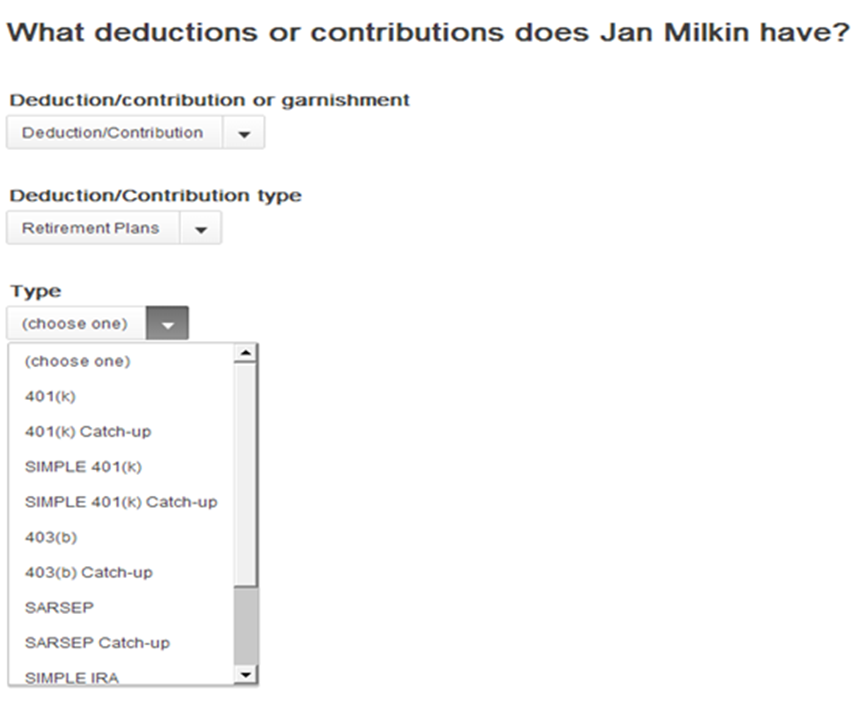

Retirement Plan Deduction In Quickbooks Payroll Set Up 401 K Simple Ira

Retirement Plan Deduction In Quickbooks Payroll Set Up 401 K Simple Ira

Why Invoice Invoice Factoring Financing Is Better Than Bank Overdraft Credit Good Things Factors Invoicing

Why Invoice Invoice Factoring Financing Is Better Than Bank Overdraft Credit Good Things Factors Invoicing

Solved After Tax Roth 401 K Employee Deductions Compan

Solved After Tax Roth 401 K Employee Deductions Compan

Quickbooks Tip Are You Memorizing Transactions Should You Be

Use Of Sage 50 Password Recovery Tool In 2020 Sage 50 Sage Accounting Software Sage

Use Of Sage 50 Password Recovery Tool In 2020 Sage 50 Sage Accounting Software Sage

Retirement Plan Deductions Contributions

Retirement Plan Deductions Contributions

State Retirement Savings Plan Savers Program

State Retirement Savings Plan Savers Program

How Do I Create A Paycheck For An Employee

How Do I Create A Paycheck For An Employee

How To Add An Account To Your Chart Of Accounts Experts In Quickbooks Consulting Quickbooks Training By Accountants

How To Add An Account To Your Chart Of Accounts Experts In Quickbooks Consulting Quickbooks Training By Accountants

Payroll Set Up Payroll Preferences

Payroll Set Up Payroll Preferences

Asset Tables Novel Investor Investors Novels Asset

Asset Tables Novel Investor Investors Novels Asset

Paul Gaulkin Is A Good Business Man He Is Professional Man In Our Work He Is Provide Best And Unique Advice To Its Customers H Diy Taxes Self Employment Tax

Paul Gaulkin Is A Good Business Man He Is Professional Man In Our Work He Is Provide Best And Unique Advice To Its Customers H Diy Taxes Self Employment Tax

Value Of Professional Tax Preparer Financial Apps Quickbooks Online Quickbooks

Value Of Professional Tax Preparer Financial Apps Quickbooks Online Quickbooks

Irs Announces 2016 Pension Plan Contribution Limits How To Plan Pension Plan Pensions

Irs Announces 2016 Pension Plan Contribution Limits How To Plan Pension Plan Pensions

Post a Comment for "How To Set Up Roth Ira In Quickbooks Desktop"