Can I Open A Roth Ira For My Non Working Spouse

If your spouse already has an IRA they can keep their existing account. The non-working spouse must be under 70 12 in the year of the contribution for a traditional IRA.

How A Backdoor Roth Ira Conversion Works Yes You Can Still Contribute Even If You Earn Too Much He Roth Ira Roth Ira Conversion Roth Ira Contributions

How A Backdoor Roth Ira Conversion Works Yes You Can Still Contribute Even If You Earn Too Much He Roth Ira Roth Ira Conversion Roth Ira Contributions

You need to earn income to contribute to a Roth IRA or a Traditional IRA.

Can i open a roth ira for my non working spouse. See this page for income and other limits for both types of IRAs. See the discussion of IRA deduction limits. Key Points To make a contribution to either a traditional or Roth IRA you have to have what the IRS defines as earned income The one exception is a spousal IRA for a non-working spouse.

You must be married and filing a joint tax return in order to open a spousal IRA. Once you determine that you meet the eligibility requirements its possible for you to open an IRA in your name and have your working spouse contribute to it. If one spouse has eligible compensation that spouse can make IRA contributions for an IRA for the nonworking spouse.

See the discussion of IRA Contribution Limits. If your spouse is earning low or no annual wages your spouse may be able to open a spousal IRA to save tax-efficiently for retirement. It allows a contribution to be made for a nonworking spouse.

Theres no such thing as a joint account when it comes to a Roth IRA so only your spouse can open his or her account. Theyll need to open their own IRA through a brokerage. To contribute to a Roth IRA the joint income.

As long as you. The amount of earned income you have must equal or exceed the amount of your Roth IRA contribution. Its not a joint account but rather a separate IRA set up in your spouses name.

A nonworking spouse can open and contribute to an IRA A non-wage-earning spouse can save for retirement too. However the IRS makes an exception for married couples who file a joint return. If you dont qualify for an IRA but have other sources of income you should still make saving for retirement a priority.

The working spouse can also make a contribution to their own IRA with each spouse being eligible to make a contribution up to the annual limit. And likewise your spouses Roth IRA is theirs. You can certainly make your spouse the beneficiary of your account but while youre alive your Roth IRA is yours.

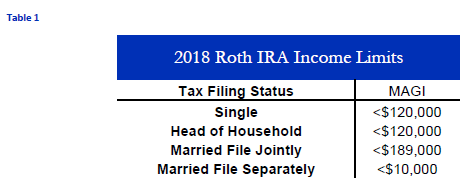

To contribute to a traditional IRA the nonworking spouse must be under 70 12 years old as of the end of the year in which the contribution is made. On that note you cant open an IRA for your spouse. If you have too much income then you are not eligible to make a Roth IRA contribution.

But if youre married you can use a spousal Roth IRA to boost your retirement savings potentialeven if only one spouse. There are no age restrictions on a Roth IRA for a non-working spouse. Usually if a person doesnt have their own compensation she cant contribute to a Roth IRA.

However an exception involves a spousal IRA. Traditional and Roth IRAs have the same contribution limits but different. A spousal IRA is simply an.

Although most IRA accounts require the account holder to have evidence of earned income a working spouse can open a Roth IRA account for a non-working spouse with no earned income. A nonworking spouse can open a traditional IRA or a Roth but only if he or she qualifies. A spousal IRA is an IRA that can be opened for a non-working or non-participant spouse says Christine Centeno a financial planner and founder of Simplicity Wealth Management in Glen Allen.

Only the individual in question can open and fund a Roth IRA. If youre married you can use your earnings to contribute to either a traditional or Roth IRA for your spouse which you would open in his or her name to increase tax-advantaged retirement. The rules say your wife cant put anything into her Roth IRA for the year since she didnt work not even any savings she might have.

Provided the other spouse is working and the couple files a joint federal income tax return the nonworking spouse can open and contribute to their own traditional or Roth IRA. If you or your spouse is covered by an employer-sponsored retirement plan and your income exceeds certain levels you may not be able to deduct your entire contribution. Yes you can contribute to a traditional andor Roth IRA even if you participate in an employer-sponsored retirement plan including a SEP or SIMPLE IRA plan.

Under the spousal IRA rules the amount that a married couple can contribute to an IRA for a nonworking spouse in 2020 is 6000 which is the same limit that applies for the working spouse. If you have enough earned income in addition to your own Roth IRA contribution you may make a Roth IRA contribution for a non-working spouse. For couples as long as one of you has earned income and you file a joint federal income tax return the non-working spouse can establish a traditional or Roth IRA and make a contribution to it.

Open An Ira For Your Non Working Spouse Opening An Ira Ira Roth Ira

Open An Ira For Your Non Working Spouse Opening An Ira Ira Roth Ira

How To Use Your Roth Ira To Buy A Home Forbes Advisor

How To Use Your Roth Ira To Buy A Home Forbes Advisor

The Rules For What You Can Do With An Ira Inherited From Your Spouse Social Security Benefits Social Security Benefit

The Rules For What You Can Do With An Ira Inherited From Your Spouse Social Security Benefits Social Security Benefit

Http Www Bairdfinancialadvisor Com Ecabgroup Mediahandler Media 341883 2020 20traditional 20vs 20roth 20ira 20overview Pdf

Backdoor Roth Ira Ultimate Guide And Tutorial

Backdoor Roth Ira Ultimate Guide And Tutorial

The Basics Of The Roth Ira Millennial Wealth Management

The Basics Of The Roth Ira Millennial Wealth Management

Fun D Fact Roth Iras Have Many More Rules To Differentiate Themselves From Other Iras These Are Just A Few If You Are Deb Ira Retirement Accounts Roth Ira

Fun D Fact Roth Iras Have Many More Rules To Differentiate Themselves From Other Iras These Are Just A Few If You Are Deb Ira Retirement Accounts Roth Ira

6 Things You Absolutely Need To Know About An Inherited Ira Inherited Ira Funeral Planning Estate Planning Checklist

6 Things You Absolutely Need To Know About An Inherited Ira Inherited Ira Funeral Planning Estate Planning Checklist

:max_bytes(150000):strip_icc()/roth-ira-vs-traditional-ira-written-in-the-notepad--1090754116-525e8e6001494031bda19fa01ad1cf2f.jpg) The Rules On Rmds For Inherited Ira Beneficiaries

The Rules On Rmds For Inherited Ira Beneficiaries

How A Backdoor Roth Ira Conversion Works Yes You Can Still Contribute Even If You Earn Too Much He Roth Ira Roth Ira Conversion Roth Ira Contributions

How A Backdoor Roth Ira Conversion Works Yes You Can Still Contribute Even If You Earn Too Much He Roth Ira Roth Ira Conversion Roth Ira Contributions

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

Congratulations Your Income Is Too High Non Deductible Ira Contributions Part 1 Seeking Alpha

Congratulations Your Income Is Too High Non Deductible Ira Contributions Part 1 Seeking Alpha

The 5 Year Rules For Roth Ira Withdrawals Nerdwallet

The 5 Year Rules For Roth Ira Withdrawals Nerdwallet

Why Most Pharmacists Should Do A Backdoor Roth Ira

Why Most Pharmacists Should Do A Backdoor Roth Ira

Account Suspended Investing Money Roth Ira Investing Roth Ira

Account Suspended Investing Money Roth Ira Investing Roth Ira

Minimize Taxes On A Roth Ira Conversion Betterment

Minimize Taxes On A Roth Ira Conversion Betterment

Https Www Nb Com Documents Public En Us B0183alkcc04 Pdf

Post a Comment for "Can I Open A Roth Ira For My Non Working Spouse"