Can I Set Up A Roth Ira For My Grandchild

Your child not you must have earned income from a job during the. Now your child must bring in some kind of earned income in order for you to be able to open an IRA in their name and allowances dont count.

How To Tap Into A Roth Ira For College Savings Education

How To Tap Into A Roth Ira For College Savings Education

An IRA can help your child or grandchild save for retirement a first home or educational expenses.

Can i set up a roth ira for my grandchild. The short answer is YES. Assets pass to a secondary IRA. A time-honored practice when setting up an account or trust for grandchildren is to buy shares in one or a few favored companies then leave them alone.

Your grandchild will not be able to deduct contributions from her income when she files her federal income tax return but the funds in her IRA will grow tax-deferred until she withdraws them. So a Roth IRA can be a great emergency fund for your kids in addition to a great retirement. Your grandchild must have earned income to be able to contribute to a Roth IRA and the contribution cant be more than they earned during the year or the maximum of 5500 the IRSs cap for.

A grandparent seeking to fund a Roth IRA is allowed as long as the grandchild has earned income. Could the sweet baby in this thumbnail have their own ROTH IRA. Another way to leave Roth assets to your grandchildren is to name them as secondary beneficiaries while you name one of your children as primary beneficiary.

However if your grandchildren are minors youll have to make some choices about setting up a financial custodian or a trust to manage the money until they reach adulthood. His contributions may not exceed the amount. The key to opening a Roth IRA for your grandchild is earned income.

The grandchildren and their parents often are told to leave the stocks alone and hold them until the money is needed. With a custodial Roth IRA the grandparents maintain control of the account until the child turns either 18 or 21 depending on the state. Learn more in this videoCalculate what your child might make with.

If she has a traditional job where her employer files a W-2 then you need no. Roth IRA You can set up a Roth individual retirement account for your grandchild. With a Custodial IRA you can open a traditional or Roth IRA but I recommend choosing the Roth.

Because your child is a minor they cant open their own account. Can I open a Roth IRA for my 16-year-old grandson as a gift. While both traditional and Roth IRAs are options the Roth variety often is preferable as it.

One way to do that is to establish a custodial account Roth IRA or what is known at Fidelity as a Roth IRA for Kids and more generally as a Roth IRA for minors. Roth IRA contributions but not investment earnings can be withdrawn at any time without penalty. Basically a childs Roth IRA is one that you act as custodian for.

You can also determine if your grandchildren will be able to control the money at a certain age as either co-trustees or full owners. After the grandchild reaches the specified age she can use it however she wishes. A Roth IRA for Kids provides all the benefits of a regular Roth IRA but is geared toward children under the age of 18.

Leaving an IRA to your grandchildren can be an excellent tax-advantaged way to contribute to their financial future. Even if the parent or grandparent doesnt qualify for a Roth IRA of their own because of income restrictions individuals earning above 139000 and couples earning above 206000 annually cannot make qualified contributions to a Roth IRA they can contribute to a child or grandchilds Roth IRA as long as the child has earned income equal to or greater than the amount of the contribution. Distribution requirements and taxes also play a part so best to get the facts ahead of time and make sure all involved know what to expect.

To avoid dipping into your own retirement you may be able to set up a Roth IRA in your childs or grandchilds name. However as long as your kid meets eligibility requirements. Custodial IRA Accounts Grandparents can open a custodial Roth IRA at financial institutions that offer them.

Your grandchild must have a job that earns a wage. As long as your grandson earned income from a job in 2014 he may contribute to a Roth IRA. Earned Income The IRS doesnt have a minimum age requirement for an IRA owner to establish a new IRA and make annual contributions to the account.

That way their retirement savings will grow tax-free. By setting up a trust you can state how you want the money you leave to your grandchildren to be managed the circumstances under which it can be distributed and when it should be withheld.

Starting A Roth Ira For A Child Or Grandchild Mid Hudson

Starting A Roth Ira For A Child Or Grandchild Mid Hudson

2019 Roth Ira Withdrawal Rules Infographic Inside Your Ira Roth Ira Withdrawal Roth Ira Investing For Retirement

2019 Roth Ira Withdrawal Rules Infographic Inside Your Ira Roth Ira Withdrawal Roth Ira Investing For Retirement

Is A Roth Ira Considered A Brokerage Account

Is A Roth Ira Considered A Brokerage Account

What You Need To Know Before Establishing A Roth Ira For Your Kids

What You Need To Know Before Establishing A Roth Ira For Your Kids

5 Rules For Opening A Roth Ira For Your Kid Business Kenoshanews Com

5 Rules For Opening A Roth Ira For Your Kid Business Kenoshanews Com

Make Your Child Retire A Millionaire By Vinod Sharma Making Of A Millionaire Medium

Make Your Child Retire A Millionaire By Vinod Sharma Making Of A Millionaire Medium

:max_bytes(150000):strip_icc()/roth-ira-vs-traditional-ira-written-in-the-notepad--1090754116-525e8e6001494031bda19fa01ad1cf2f.jpg) Inherited Ira And 401 K Rules Explained

Inherited Ira And 401 K Rules Explained

A Roth Ira At Age 15 Thanks To The Parent Match

A Roth Ira At Age 15 Thanks To The Parent Match

Retirement Plans Evaluating The New Roth Ira Conversion Opportunity Aaii

Retirement Plans Evaluating The New Roth Ira Conversion Opportunity Aaii

Starting A Roth Ira For A Teen Ta Check Financial

Start A Roth Ira For Kids Youtube

Start A Roth Ira For Kids Youtube

Rules For Using A Roth Ira For Buying Your First House Mortgage Solutions Financial

Rules For Using A Roth Ira For Buying Your First House Mortgage Solutions Financial

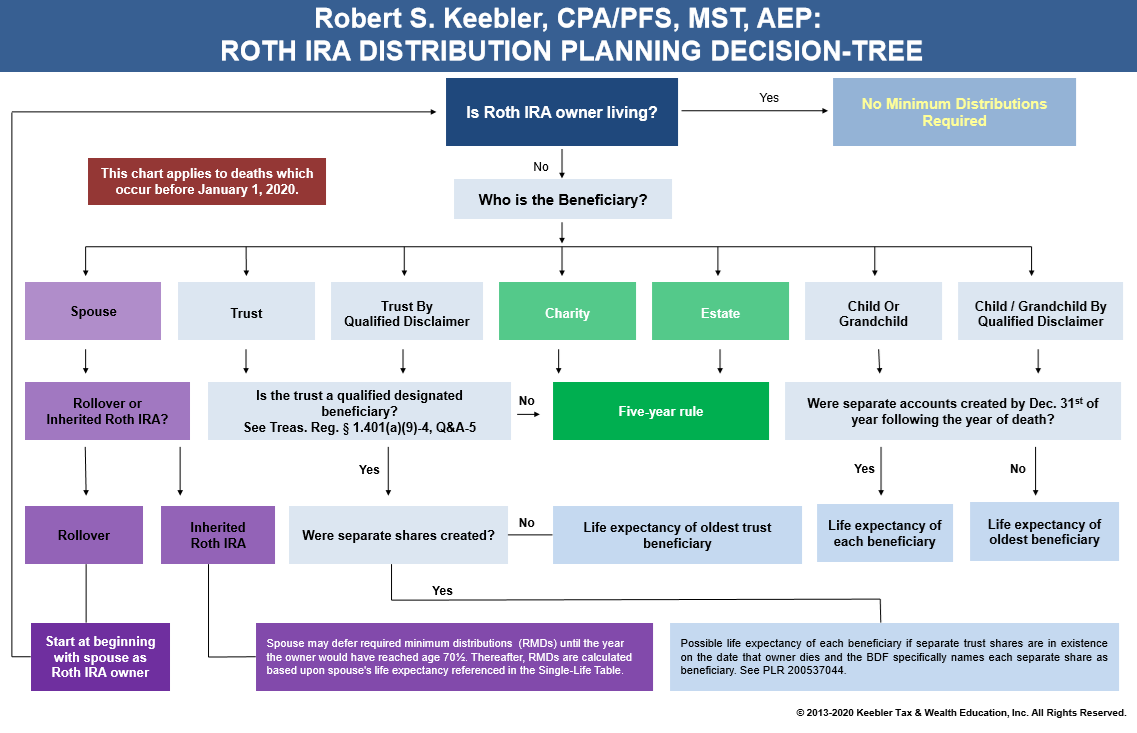

Roth Ira Distribution Chart Ultimate Estate Planner

Roth Ira Distribution Chart Ultimate Estate Planner

The Value Of A Roth In An Estate Pay Taxes Later

The Value Of A Roth In An Estate Pay Taxes Later

Roll Overs Horse Races And Backdoor Roth Ira Strategy S

Roll Overs Horse Races And Backdoor Roth Ira Strategy S

Roth Ira Vs Traditional Ira Which One Is Better My Money Design

Roth Ira Vs Traditional Ira Which One Is Better My Money Design

Is A Backdoor Roth Ira A Good Move For Higher Income Earners

Is A Backdoor Roth Ira A Good Move For Higher Income Earners

Post a Comment for "Can I Set Up A Roth Ira For My Grandchild"