How Much To Open A Roth Ira At Fidelity

2500 or 200 per month for ROTH and Traditional IRA. The commission for an online US.

:max_bytes(150000):strip_icc()/fidelity_investments_productcard-5c742f0e46e0fb000143628b.png) Vanguard Vs Fidelity Investments

Vanguard Vs Fidelity Investments

Fidelity full and partial account transfers are free.

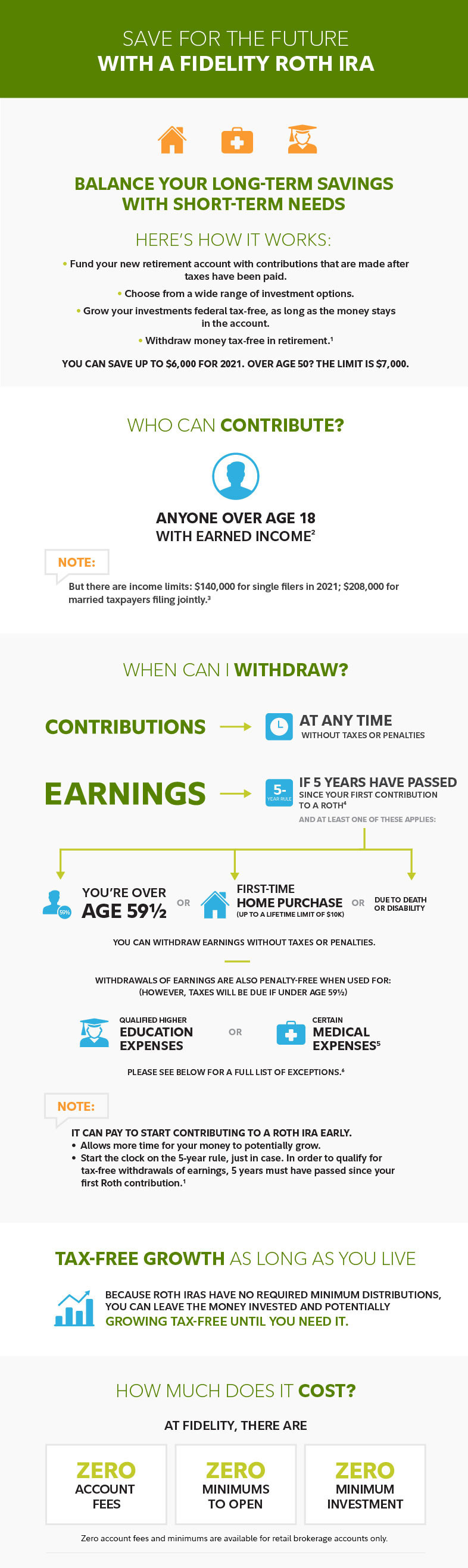

How much to open a roth ira at fidelity. Well IRA contribution limits for both 2016 and 2017 are the same. If your income is over the limits you still may be able to have a Roth IRA by converting existing money in a traditional IRA or other retirement savings account. 035yr for 50000 and above.

There is a bit of a catch with that contribution. No account fees or minimums to open Fidelity retail IRA accounts. When you file and have an AGI of less than 124k you can contribute the full 6k directly to a Roth Account.

Keep in mind that you have from January 1st until April 15th of the following year to be able to contribute that amount. However you cannot contribute to a Roth IRA if your income exceeds 140000. Fidelity minimum balance requirement for brokerage or IRA.

No additional underlying fees for investments invests in zero expense ratio Fidelity mutual funds 050yr advisory fee. No additional underlying fees for investments invests in zero expense ratio Fidelity mutual funds Support. Theres also an extra 1000 catch-up contribution permitted for those age 50 or older letting those folks sock away as.

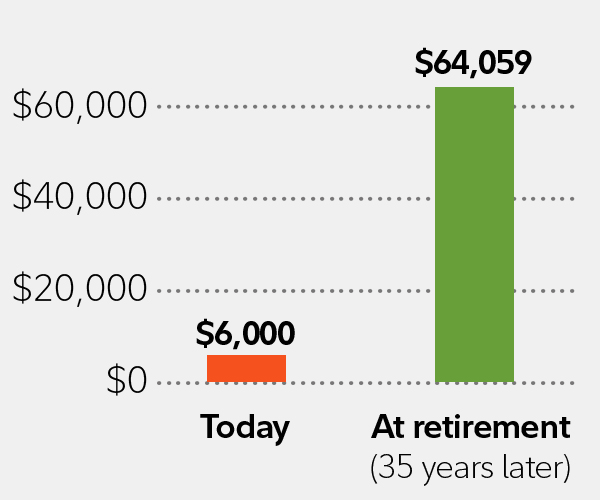

Equity trade is 495 per trade. To max out your Roth IRA in 2020 you would ideally be investing 500 per month in your Roth IRA. Opening a Roth IRA account at Fidelity A walkthrough.

By taking some or all of the money youd ordinarily need to withdraw as a RMD and converting it from a traditional IRA or 401k to a Roth IRA or a Roth 401k you can convert at your current tax rate which may fluctuate in the future and potentially reduce your taxable income in future years. And if youre age 50 or older you can save up to 7000 for 2020 and 2021. This is for persons in the US.

Certain investments like mutual funds require a minimum initial investment. Fidelity minimum initial deposit to open ROTH IRA Traditional IRA Simple IRA or SEP IRA. But for a retirement account there is no minimum required.

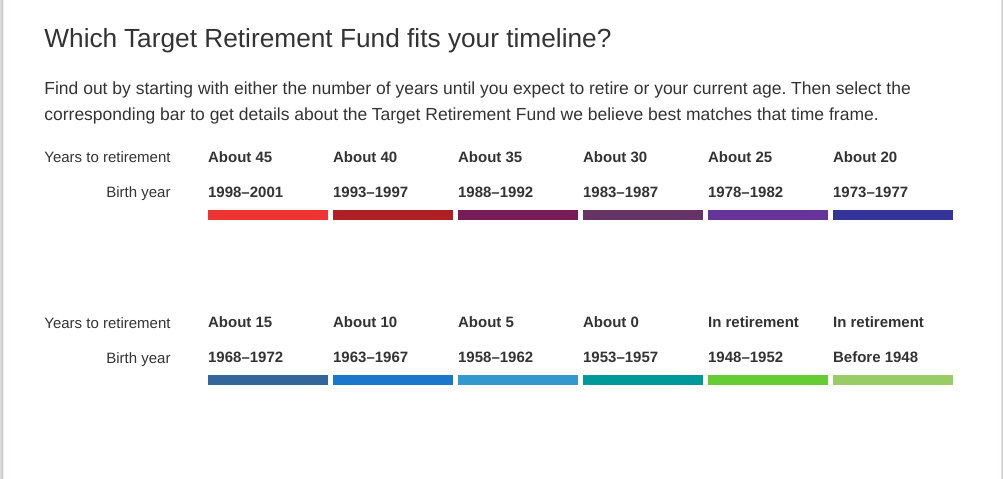

For the 2019 tax year the Roth IRA allows you to contribute up to 6000 if youre under the age of 50 or 7000 if youre over the age of 50. Maybe you want to start at 50 per month and then slowly work your way up there. Make your first contribution Consider maximizing your contributions each year up to 6000 for 2020 and 2021.

With Fidelity you have a broad range of investment options including an option to have us manage your money for you. Partial contributions are allowed for certain income ranges. When you and your partner file taxes together and have an AGI between 196k-206k you can make a partial Roth contribution.

2500 in cash andor securities. In my previous post I went through the process of deciding on a Roth IRA broker. For you to contribute to Roth IRA you must have earned income.

But if youre 50 or older that increases to 7000 per year. Roth IRA contribution limits and eligibility are based on your modified adjusted gross income MAGI depending on tax-filing status. The Roth IRA has no opening or annual fees.

For 2020 the maximum contribution to a Roth IRA is 6000 per year. Opens in a new window. Nonetheless depending on the types of investments held some fund management or trading fees may apply.

Additionally you dont have to pay taxes when you make qualified withdrawals1. For a regular brokerage account Fidelity requires a minimum opening deposit of 2500. 6000 7000 if age 50 or older 2021.

Expenses charged by investments eg funds managed accounts and certain HSAs and commissions interest charges and other expenses for transactions may still apply. A Roth IRA can be a powerful way to save for retirement since potential earnings grow tax-free. Money can grow tax-free.

Filed under Investing Retirement Reviews Slideshow. 6000 7000 if age 50 or older Minimum investment. See the section If you earn too much to contribute at the end of this article 1.

In this post Ill describe how my account opening experience with Fidelity was. If you make more than 139k you will need to use the Backdoor Roth to contribute to a Roth. There is no minimum to open the account.

Opens in a new window. There are several IRA types available at Fidelity. If you are married you can make spousal contributions even if your spouse does not have earned income.

Traditional IRA contributions are not limited by annual income. Fidelity Brokerage Services LLC Member NYSE SIPC 900 Salem Street Smithfield RI 02917. Find out which IRA may be right for you and how much you can contribute.

Withdrawals are tax-free too. Fidelity minimum amount to open brokerage margin account. Account Features - 5 5.

Opens in a new window. Starting in 2020 as long as you are still working there is no age limit to be able to contribute to a Traditional IRA. For people under 49 years or younger you can only contribute up to 6000.

That is a lot of money for many people so you can just use that as a goal.

Frequently Asked Questions On Roth Ira Money Cone

Backdoor Roth Ira Ultimate Fidelity Step By Step Guide Fatroth

How To Setup A Backdoor Roth Ira In Fidelity Youtube

How To Setup A Backdoor Roth Ira In Fidelity Youtube

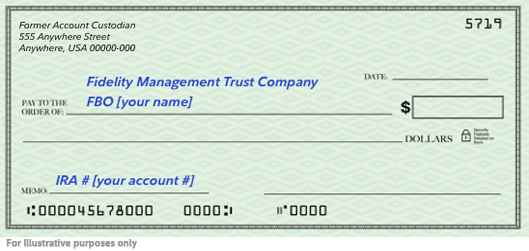

Ira Transfer Moving Your Ira Fidelity

Ira Transfer Moving Your Ira Fidelity

Fidelity Mutual Fund Calculator Performance Return

Fidelity Mutual Fund Calculator Performance Return

Converting Ira To Roth Ira Fidelity

Converting Ira To Roth Ira Fidelity

Fidelity Ira Fees Roth Retirement Account Cost 2021

Fidelity Ira Fees Roth Retirement Account Cost 2021

The Backdoor Roth Tutorial With Fidelity

The Backdoor Roth Tutorial With Fidelity

How To Open A Fidelity Roth Ira A Step By Step Guide Simplernerd

How To Open A Fidelity Roth Ira A Step By Step Guide Simplernerd

Where To Open A Roth Ira The 5 Best Places For Beginners Rose Shafa

Where To Open A Roth Ira The 5 Best Places For Beginners Rose Shafa

Step By Step Tutorial Of The Mega Backdoor Roth Through Fidelity Investments Cerebral Tax Advisors

Step By Step Tutorial Of The Mega Backdoor Roth Through Fidelity Investments Cerebral Tax Advisors

Vanguard Vs Fidelity Which Company Is The Right Choice For You Choosefi

Vanguard Vs Fidelity Which Company Is The Right Choice For You Choosefi

Save For The Future With A Roth Ira Fidelity

Save For The Future With A Roth Ira Fidelity

How To Close Fidelity Account Closing Fee 2021

How To Close Fidelity Account Closing Fee 2021

How To Invest Your Ira Fidelity

How To Invest Your Ira Fidelity

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Post a Comment for "How Much To Open A Roth Ira At Fidelity"