How Much Does It Cost To Open A Roth Ira With Vanguard

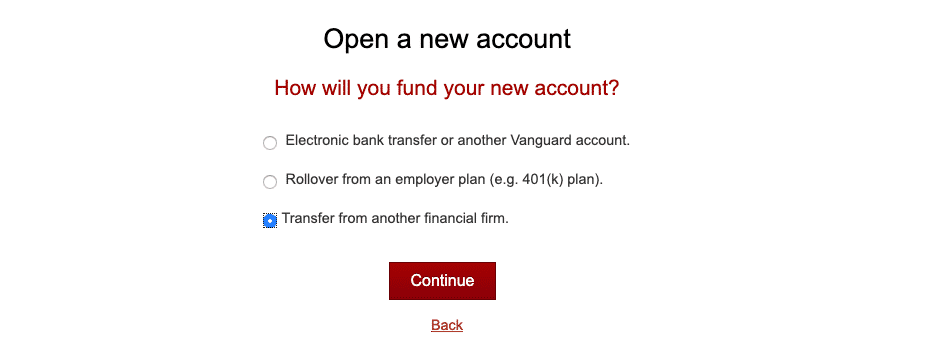

Only mutual funds and ETFs exchange-traded funds with a minimum. Rollover from an employer plan eg 401k plan Transfer investments from another financial firm.

How Do I Buy A Vanguard Mutual Fund Online Vanguard

How Do I Buy A Vanguard Mutual Fund Online Vanguard

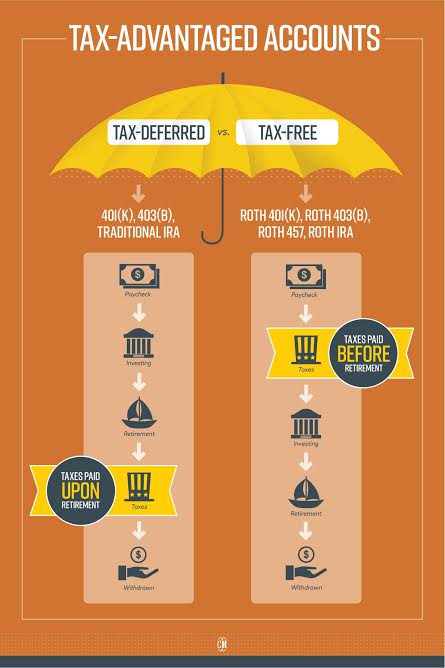

A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement.

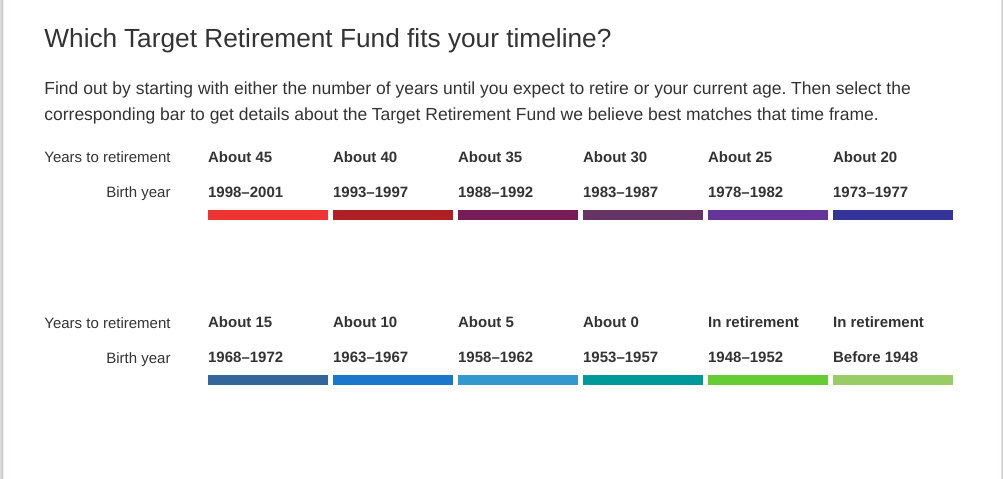

How much does it cost to open a roth ira with vanguard. ETFs are funds that hold a basket of securities that track an index such as the SP 500. 1 for target-date retirement funds. Open your IRA today.

If I put that money into a Roth IRA instead while I would lose the 600 tax break today what I gained down the road could be much greater. 25 for SIMPLE IRA 15 for 403 b 7 20 for Individual 401 kRoth 401 k plans 20 for 529 plan. The desk is open only during the week and closes at 9 pm.

Vanguard is well known for having fund costs that are well below the industry average and Vanguard IRA accountholders have full access to the same low-cost funds that other investors can buy. The broker also imposes another 20 fee if a Vanguard mutual funds balance is below 10000. Avoid account service fees by signing up for e-delivery.

The fee could be avoided by signing to electronic statements. I heard you can open a Roth IRA with Vanguard for a minimum of 1000 if you sign up for electronic statements in your Vanguard Roth IRA and choose the Vanguard STAR fund. For every Vanguard fund in a SIMPLE IRA the broker charges 25.

25 for SIMPLE IRA 15 for 403 b 7 20 for Individual 401 kRoth 401 k plans and 20 for 529 plan. Vanguard has 20 annual fee for regular accounts with balance less than 50000. Most Vanguard mutual funds require a minimum investment of 3000 but that minimum drops to 1000 for mutual funds in an IRA.

If you happen to be outside the US Vanguard offers an international phone number. Well send instructions once your IRA is open Avoid the 20 annual account service fee by registering your accounts online and signing up for e-delivery. 25 for each account.

The firm also does not have inactivity fee for all IRA accounts. If youre closing an education account youll need to contact the education savings desk at 1-866-734-4524. Footnote For the 10-year period ended September 30 2020 9 of 9 Vanguard money market funds 68 of 81 Vanguard bond funds 23 of 24 Vanguard balanced funds and 131 of 156 Vanguard stock fundsfor a total of 231 of 270 Vanguard fundsoutperformed their Lipper peer-group average.

After 45 years that 5000 might have grown to. Both of these charges can be avoided simply by enrolling in electronic delivery of statements. For example if you decide in February of 2010 that you want to open a Roth IRA you can open a Roth and then characterize the contribution for the 2009 tax year.

You dont have to have the Roth IRA account opened in the tax year youre looking to contribute. Many Roth IRA providers give you the option to trade stocks and exchange traded funds ETFs. Still active traders will likely be disappointed by this.

After entering the necessary banking information the next step is determining the initial contribution amount for your Roth IRA account note that the screenshot shows a maximum of 6500 because the limit in 2018 was 5500 plus there is an additional 1000 contribution amount available if youre over 55. See what you get as a Voyager or Flagship Services client. Meanwhile if you want to be a little more proactive in selecting what goes into your Roth IRA Clark also likes these alternatives.

2025 2030 2035 2040 2045 2050 2055 and 2060. Results will vary for other time periods. Roth IRA rules dictate that as long as youve owned your account for 5 years and youre age 59½ or older you can withdraw your money when you want to and you wont owe any federal taxes.

Vanguard does have a 20 annual IRA fee. Deadline to Open a Roth IRA. Vanguard Brokerage Services assesses the fee if the total Vanguard assets Vanguard mutual funds and ETFs in the account are less than 10000.

Another fee is levied on SIMPLE IRAs that have Vanguard funds in them. Vanguard does not offer weekend hours nor does it have an on-line chat function. Vanguard joined in the broker price revolution dropping its stock trading costs to 0 in January 2020 down from as high as 7 before.

See the Vanguard Brokerage Services commission and fee schedules for more information. If none of those waivers apply a 20 fee will be charged annually for each fund account in which you have a balance of less than 10000. Electronic bank transfer or another Vanguard account.

Vanguard IRA annual fees. However Vanguard charges 20 annual maintenance fee for regular accounts with balance less than 50000. There are also annual ira fees.

Exchange-traded funds from Vanguard or other providers generally. How Much to Start a Roth IRA.

Vanguard Backdoor Roth Ira Conversion Walkthrough Minafi

Vanguard Backdoor Roth Ira Conversion Walkthrough Minafi

How To Convert A Roth Ira At Vanguard An Illustrated Tutorial

How To Convert A Roth Ira At Vanguard An Illustrated Tutorial

Vanguard Roth Ira Account Opening Review Pt Money

Vanguard Roth Ira Account Opening Review Pt Money

/Vanguardvs.Fidelity-5c61b9cfc9e77c0001d321d4.png) Vanguard Vs Fidelity Investments

Vanguard Vs Fidelity Investments

My Experience Opening Up A Vanguard Roth Ira Financial Product Reviews

Vanguard Roth Ira Review Is It The Best Roth For You

Vanguard Roth Ira Review Is It The Best Roth For You

Step By Step Guide To Opening A Vanguard Roth Ira Biglaw Investor

Step By Step Guide To Opening A Vanguard Roth Ira Biglaw Investor

The 7 Best Roth Ira Accounts Of 2021 Money

The 7 Best Roth Ira Accounts Of 2021 Money

First Command Review Don T Do Business With Them

First Command Review Don T Do Business With Them

:max_bytes(150000):strip_icc()/personal-capital-vs-vanguard-personal-advisor-services-4dad1d34084c4780aec788ace455b4a3.jpg) Who Offers Ira Accounts With No Minimum Deposit

Who Offers Ira Accounts With No Minimum Deposit

How To Roll Over Your Roth Ira From Betterment To Vanguard And Why I Did It Financial Panther

How To Roll Over Your Roth Ira From Betterment To Vanguard And Why I Did It Financial Panther

Vanguard Roth Ira Step By Step Process Features Benefits Fees

Vanguard Roth Ira Step By Step Process Features Benefits Fees

Vanguard Vs Fidelity Which Company Is The Right Choice For You Choosefi

Vanguard Vs Fidelity Which Company Is The Right Choice For You Choosefi

Backdoor Roth Ira Ultimate Guide And Tutorial

Backdoor Roth Ira Ultimate Guide And Tutorial

How To Invest Vanguard Roth Ira For Beginners 2019 Tax Free Millionaire Youtube

How To Invest Vanguard Roth Ira For Beginners 2019 Tax Free Millionaire Youtube

Vanguard Star Fund Is It The Right Retirement Choice For You The Motley Fool

Vanguard Star Fund Is It The Right Retirement Choice For You The Motley Fool

How To Buy Vanguard Index Funds In 2021 Benzinga

How To Buy Vanguard Index Funds In 2021 Benzinga

Vanguard Roth Ira For Teenagers In 2021 Teen Financial Freedom

Vanguard Roth Ira For Teenagers In 2021 Teen Financial Freedom

/CharlesSchwabvs.Vanguard-5c61ba4646e0fb00014426ee.png)

Post a Comment for "How Much Does It Cost To Open A Roth Ira With Vanguard"