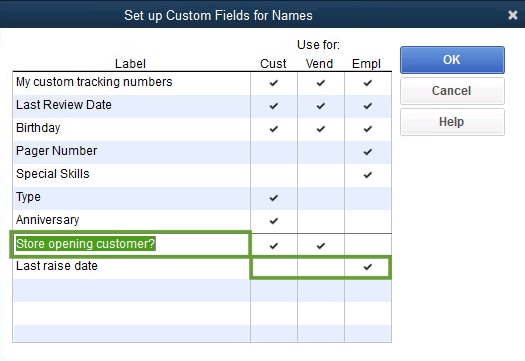

How To Set Up Simple Ira In Quickbooks Desktop

The new version of QuickBooks lets you register for the service in under 60 seconds. How do I set up company contributions in QuickBooks.

Create An Invoice In Quickbooks Desktop Pro Instructions Quickbooks Create Invoice Invoice Template

Create An Invoice In Quickbooks Desktop Pro Instructions Quickbooks Create Invoice Invoice Template

To do this task please follow these steps.

How to set up simple ira in quickbooks desktop. The chart is usually sorted in order by account number to ease the task of locating specific accounts. Above is a screenshot of the all-important tax tracking type window. My client Donna wants all of her paper investments such as certificates of deposits mutual funds and IRAs tracked in her QuickBooks financial software.

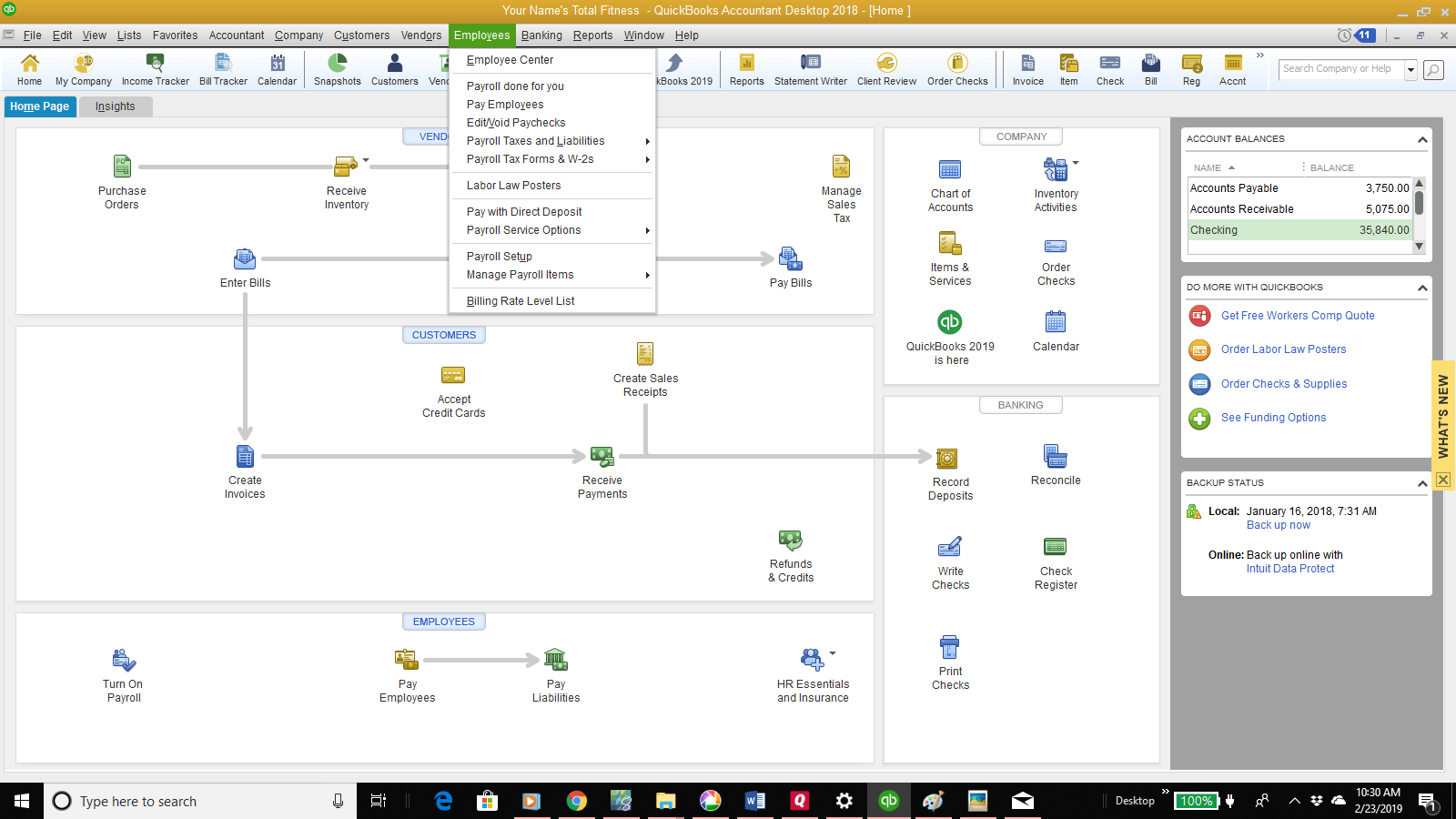

Sometimes QuickBooks Desktop can get a bit confusing. Heres a step by step guide to getting started with QuickBooks for the very first time. Open Quickbooks desktop and click on the Lists menu and select Payroll Item List.

Go to Lists and choose Payroll Item List. At the lower left of the Payroll Item List click the Payroll Item button New. Thats why it is so important to understand how it works.

Assumptions You have an active QuickBooks Desktop Payroll subscription and would like to set up a retirement plan catch-up payroll item for your employees. If you have any query related to QuickBooks accounting software then contact to Caro Associates LLC. The employee owns and controls the SIMPLE IRA.

An IRA is a long-term asset so make one up in that category. Set up company contributions. How To Set Up Payroll In QuickBooks.

QuickBooks will also suggest Payroll Expenses as the expense account. If you are using QB for your personal finances. Moreover how do I set up a simple IRA company match in QuickBooks.

The 401k SIMPLE 401k 403b SARSEP and SIMPLE IRA plans are tax-deferred. To set up a retirement plan company contribution item using Custom Setup. Gusto Payroll Clearing Account in order to isolate the Gusto payroll expenses and the individual bank transactionsThis will effectively match and reconcile both items using only aggregate amounts.

Excel is easier for just that one item. Click on the Payroll Item drop down and select New. In the Other Activities section click on the Create Custom Payments link.

Select Custom Setup and click Next. We should set the employee deduction item for the IRA contributions to the same schedule. Those payroll items still exist in the sample file.

QuickBooks is designed to deduct the employee share of premiums from each paycheck and create a payroll liability to the insurer. Mark to select the SEP IRA check and. QuickBooks Simple Start For Dummies Cheat Sheet.

Normally people use more specialized personal bookkeeping software such as Quicken to track all of their investment activities simply because Quicken can normally be tapped in to automatically update your investment. From the QuickBooks Desktop menus at the top click Lists Payroll Item List. At the lower left of the Payroll Item List click the Payroll Item button New.

Step 1 Register for QuickBooks. Form 5305-SA a custodial account. According to QB instructions I am to set up 2 payroll items.

Fortunately when it comes to payroll Intuit has really simplified the process with a step-by-step payroll setup tool that walks you through the process. Fortunately from the available dropdown QuickBooks offers us just the selection we need. Recommended for expert users and click on Next.

Lets go through this process together so you can have your payroll up and running in no time. How to set up SEP ira in QB desktop. The SIMPLE 401k and SIMPLE IRA plans differ primarily in the areas of employee eligibility loan provisions and company contribution limits.

We have made a selection in this window. If payroll is not turned on in your Quickbooks file then you will not see the Payroll Item List selection. From the QuickBooks Desktop menus at the top click Lists Payroll Item List.

Set up a SIMPLE IRA for each eligible employee using either IRS model. Here is the scenario. To set up a retirement plan company contribution item using Custom Setup.

Getting Started With QuickBooks. Just use a spreadsheet. You have a group health insurance plan set up in payroll to deduct an employee contribution and keep track of an employer contribution.

The accounts are usually numeric but can also be alphabetic or alphanumeric. Form 5305-S a trust account or. Go to Employees and choose Payroll Center.

If you have a QuickBooks Desktop account one way to reconcile expenses is to set up a payroll holding account with the title. Each of these plans can be set up with a catchup provision to allow higher deductions for qualifying older employees. Select Company Contribution and click Next.

Choose Custom Setup allows editing of all settings. Setting up a new retirement plan in QuickBooks Desktop 2017 Were starting a simple IRA plan for our small office. Select the Pay Liabilities tab.

Keeping track of your accounting with QuickBooks Simple Start means organizing your debits and credits applying user interface tips using calculating and editing tricks working efficiently with keyboard shortcuts and right-clicking on your mouse to perform basic tasks in QuickBooks Simple Start. Choosing the SIMPLE IRA-Company Portion and clicking on the Edit button brings up the following screen. You can set up a retirement catch-up payroll item for 401k 403b 457b 408k or SIMPLE IRA.

Set the date range and click on OK. Today were going to explain everything you need to know about setting up QuickBooks quickly and easily. You can set up SIMPLE IRAs with banks insurance companies or other qualified financial institutions.

The Chart of Accounts is the backbone of your accounting system. How to Set Up an Employer Contributions Health Insurance Payroll Item in Quickbooks Desktop. Setting up your own expense account in this case Employee Benefits will be a better choice.

One for employee deduction one for company match including corresponding expense account. How to set up SEP Ira in QB pro desktop payroll enhanced. Select Custom Setup and click Next.

You will need to create a new payroll item for the. We want QuickBooks to show the SIMPLE IRA company contribution amounts to show as due by the 10 th of the following month.

Setup And Run Payroll In Quickbooks Desktop Pro Premier And Or Enterprise Youtube

Setup And Run Payroll In Quickbooks Desktop Pro Premier And Or Enterprise Youtube

Http Http Download Intuit Com Http Intuit Cmo Payroll Support Pdfs Misc Qbpayrollgettingstarted Pdf

Support For Quickbooks Desktop 2017 In 2020 What You Should Know Out Of The Box Technology

Support For Quickbooks Desktop 2017 In 2020 What You Should Know Out Of The Box Technology

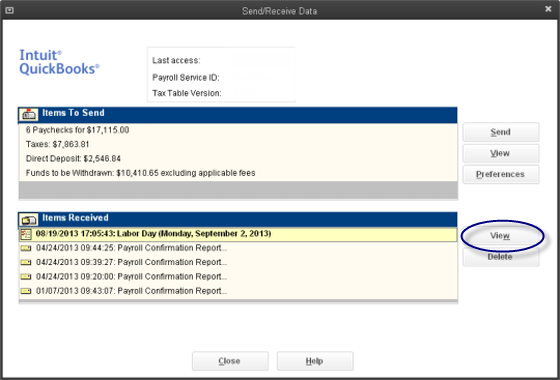

View And Print Past Payroll Confirmation Reports

View And Print Past Payroll Confirmation Reports

How To Process A Credit Card Donation In Quickbooks Desktop Quickbooks Credit Card Cards

How To Process A Credit Card Donation In Quickbooks Desktop Quickbooks Credit Card Cards

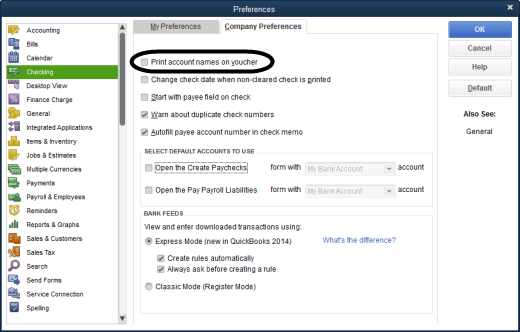

Customize A Paycheck Layout Or Pay Stub

Customize A Paycheck Layout Or Pay Stub

Amazon Com Quickbooks Desktop Pro 2020 Accounting Software For Small Business With Amazon Exclusive Sh Accounting Software Quickbooks Best Accounting Software

Amazon Com Quickbooks Desktop Pro 2020 Accounting Software For Small Business With Amazon Exclusive Sh Accounting Software Quickbooks Best Accounting Software

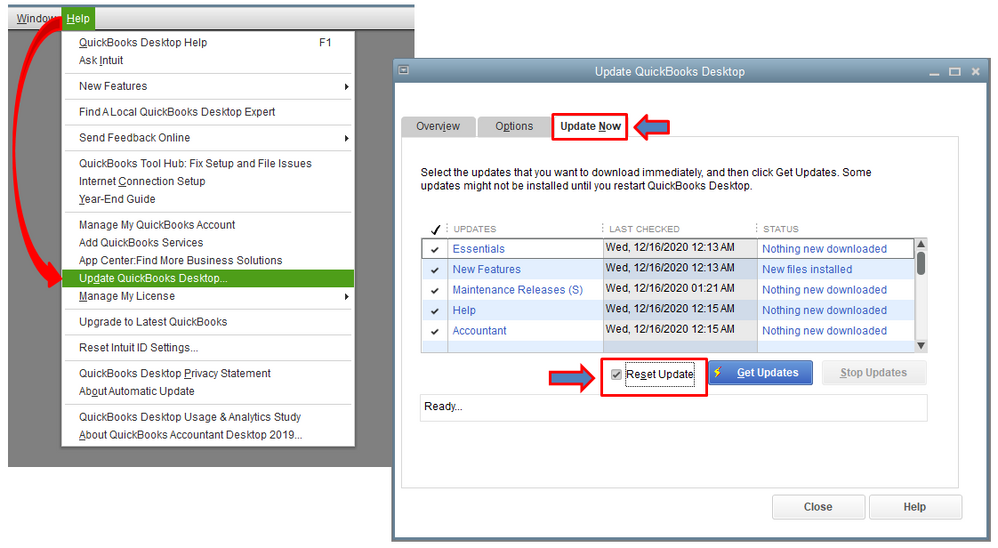

Update Quickbooks Desktop To The Latest Release Quickbooks Quickbooks Help Software Update

Update Quickbooks Desktop To The Latest Release Quickbooks Quickbooks Help Software Update

Duplicate An Estimate In Quickbooks Desktop Pro Instructions Quickbooks Quickbooks Tutorial Quickbooks Pro

Duplicate An Estimate In Quickbooks Desktop Pro Instructions Quickbooks Quickbooks Tutorial Quickbooks Pro

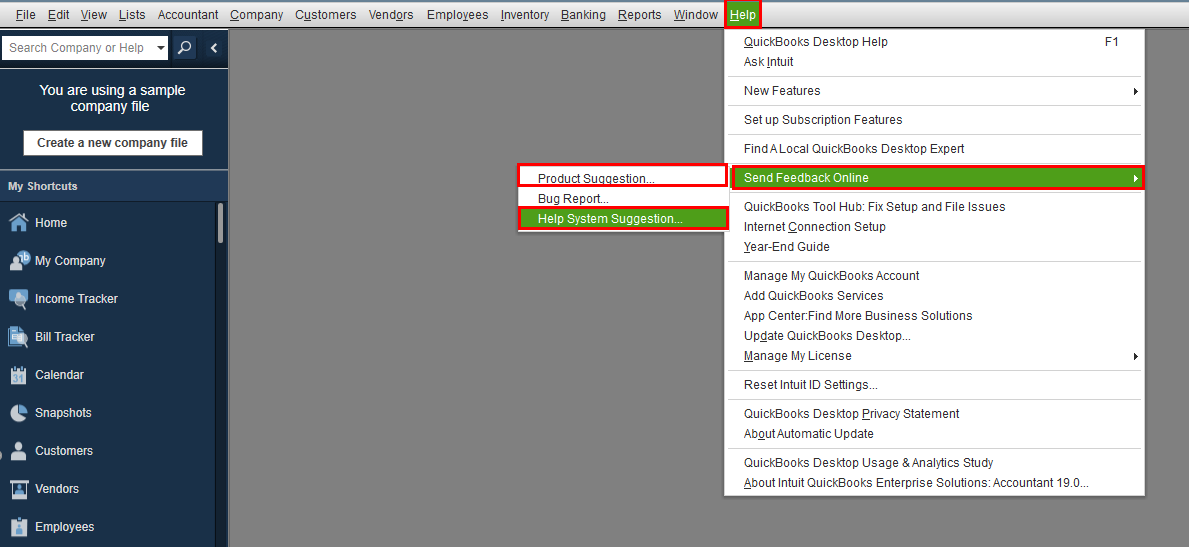

Create And Use Custom Fields In Quickbooks Desktop

Create And Use Custom Fields In Quickbooks Desktop

Post a Comment for "How To Set Up Simple Ira In Quickbooks Desktop"