How To File For Unemployment If You Are Self Employed

File a Biweekly claim. File a New Claim You Tube or visit Filing an Unemployment Claim for more information.

Business Owners Self Employed Can Apply For Unemployment Benefits On April 28 Youtube

Business Owners Self Employed Can Apply For Unemployment Benefits On April 28 Youtube

After a lengthy delay Californias gig workers the self-employed independent contractors and freelancers can now apply for unemployment insurance benefits.

How to file for unemployment if you are self employed. Pandemic Unemployment Assistance for the Self-Employed. The updated PPP applications for self-employed workers and sole proprietors who file IRS Form 1040 Schedule C now asks for the total amount of gross income found on line 7 of the tax form. You will only see this.

ViewPay My Overpayment Online. If you are an independent contractor gig or plaaorm worker and you work for an enHty app website or other online plaaorm you could be considered an employee of that business and would enter their businessplaaormapp name as. Generally unemployment benefits are available only for employees not for the self-employed.

ViewPrint 1099G Your four-digit UC PIN is required Obtain my four-digit UC PIN. For example in Iowa self-employed workers will need to provide any of the following documents as proof of income. Initial Claim Requirements Checklist.

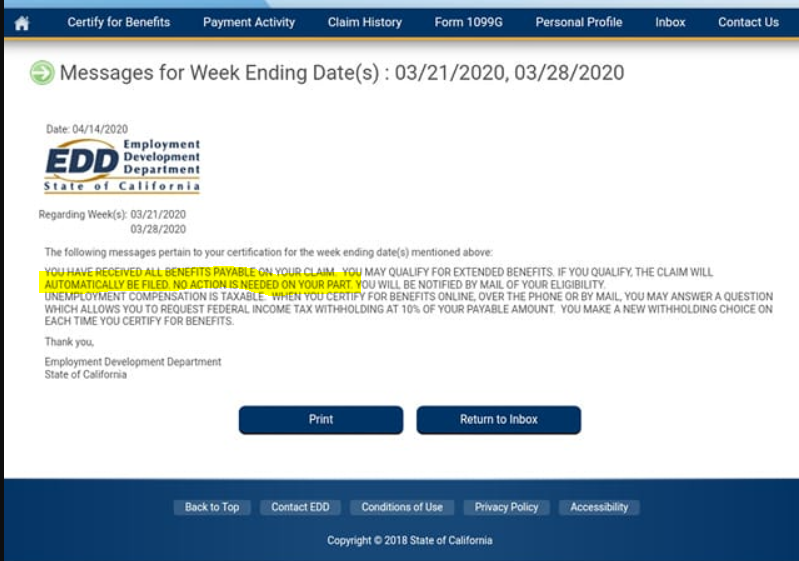

Are you eligible for unemployment. If you are a business owner independent contractor or self-employed worker and only received a 1099 tax form last year you are most likely eligible for Pandemic Unemployment Assistance. Your work history should include any traditional W-2 employment gig work and self-employment.

File a new claim if you have already applied for UI but are eligible for PUA Pandemic Unemployment Assistance because you are a business owner independent contractor self-employed worker. If you have already filed a claim for unemployment and need to verify your identity you will get a message to do one of the following. Burns calculates the maximum that one of her self-employed.

File an Initial application for benefits. Bank account number and routing number for direct deposit if thats how your state pays unemployment claims. To receive unemployment insurance benefits you need to file a claim with the unemployment insurance program in the state that you work.

Note that if you can work from home with pay youre not eligible for unemployment. However during the year 2020 self employed contractors are able to file for unemployment. Visit your UI Online homepage and select Upload Identity Documents.

Keeping documentation about your previous income and wages as a freelancer independent contractor or self-employed worker is important and will help you when filing for unemployment. To use the expanded unemployment benefits as a self-employed individual you will need to self-certify that youre self-employed and seeking part-time employment. We would like your feedback about the clinic and the PUA program.

If you are self-employed enter your business name if one exists or your name as the EMPLOYER NAME. Pandemic Unemployment Assistance for the Self-Employed. If you were self-employed the entire time you will typically list yourself as the employer and.

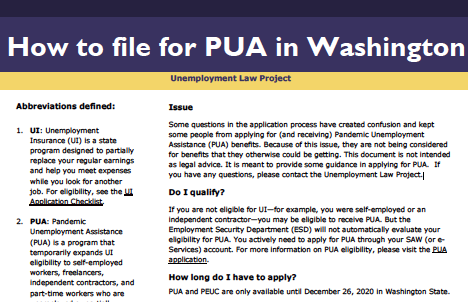

Apply for Pandemic Unemployment Assistance if your work situation changed because of COVID-19 and you meet any of these requirements. The rare exception currently is in California where you can file for unemployment benefits. If so you may be wondering if you qualify for unemployment benefits.

However if you want to buy into the California EDDs unemployment insurance benefit program its called elective coverage go to this information sheet provided by the CA EDD. The legal clinic has now ended and we know not everybody received benefits nor had the same experiences while applying. View the updated UI Online.

For drivers who primarily rely on income from gig economy work like driving for rideshare you are self-employed according to PUA regulations and so you are eligible for the new PUA program for self-employed people and independent contractorsThis is the case even if you have part-time earnings from a regular job like working in a bookstore 10 hours per week because you. Normally only workers who get a W2 from their job either part time or full time are eligible for unemployment benefits. As part of the PPP loan program business owners can apply for 25 times their average monthly payroll costs up to 100000 per year.

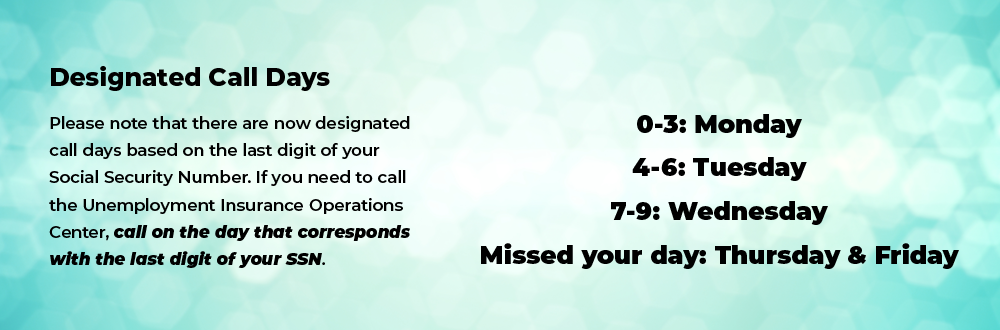

Depending on the state you may be able to file a claim online by phone or in person. Contact your states unemployment insurance program as soon as you can after becoming unemployed. Check my claim status.

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Labor And Economic Opportunity Mixed Earners Unemployment Compensation Meuc

Labor And Economic Opportunity Mixed Earners Unemployment Compensation Meuc

Coronavirus Unemployment Getting Answers For The Self Employed Cbs Sacramento

Coronavirus Unemployment Getting Answers For The Self Employed Cbs Sacramento

Https Www Labor Alabama Gov Covid Adol Howtofilepuaclaim Pdf

Https Dlt Ri Gov Documents Pdf Ui Uiguide Pdf

Https Www Oregon Gov Employ Documents 05 12 20 20pua 20secure 20upload 20updates Final Pdf

Self Employed How To Claim 600 Week Unemployment Youtube

Self Employed How To Claim 600 Week Unemployment Youtube

Https Does Dc Gov Sites Default Files Dc Sites Does Publication Attachments 2021 20ui 20pua 20faq V2 Pdf

Unemployment Benefits Workforce Solutions

Unemployment Benefits Workforce Solutions

Https Does Dc Gov Sites Default Files Dc Sites Does Publication Attachments Mixed 20earners 20unemployment 20compensation 20 28meuc 29 5b1 5d Pdf

Https Floridajobs Org Docs Default Source Reemployment Assistance Center Cares Act Peuc To Pua Guidance Pdf Sfvrsn 651a4bb0 2

Stimulus 2020 Unemployment Insurance For Self Employed Individuals Turbotax Tax Tips Videos

Stimulus 2020 Unemployment Insurance For Self Employed Individuals Turbotax Tax Tips Videos

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Video Guide How To File For Pua In Washington Unemployment Law Project

Video Guide How To File For Pua In Washington Unemployment Law Project

File My Initial Claim Nh Unemployment Benefits

File My Initial Claim Nh Unemployment Benefits

Https Www Iowaworkforcedevelopment Gov Sites Search Iowaworkforcedevelopment Gov Files Content Files Webinar 20q 26a 20 20april 2016 Pdf

Post a Comment for "How To File For Unemployment If You Are Self Employed"