How To Open A Roth Ira Uk

If youre ready to set up a Roth IRA for your kids or grandkids nieces and nephews the first step is to contact a brokerage that offers Roth IRAs for minors. The Roth IRA account is one of the very best financial accounts anyone can have.

How To Open A Roth Ira Smartasset Saving For Retirement Roth Ira Retirement Planning

How To Open A Roth Ira Smartasset Saving For Retirement Roth Ira Retirement Planning

Almost all investment companies offer Roth IRA accounts.

How to open a roth ira uk. You can also choose to open an IRA account as a supplement to your 401k plan. Decide Where to Open Your Roth IRA Account. 2 If you havent done so already open a Fidelity traditional rollover or Roth IRA.

If you have an existing traditional IRA the same company can probably open a Roth IRA for you. At others however the traditional version of the IRA or 401k has a strong allure as well. A Roth IRA offers many benefits to retirement savers.

A Roth indeed makes sense at certain points in your life. How to Start a Roth IRA. Fund your account.

Most large firms also offer online access to start the account application. A spousal IRA is simply an. Those age 50 and older can make an additional 1000 catch-up contribution for a maximum possible Roth IRA deposit of.

Children under the age of 18 need a custodial Roth IRA. You can open a Roth IRA at an online broker and then choose. In general youll head to the providers website choose the type of IRA you want to open Roth or traditional and fill in some personal details such as your Social Security number date of.

You can open a Roth IRA at any online broker or robo-advisor typically online in about 15 minutes. Roth IRA rules dictate that as long as youve owned your account for 5 years and youre age 59½ or older you can withdraw your money when you want to and you wont owe any federal taxes. He likens the IRA to a SIPP and the Roth IRA to an ISA - not sure if this is strictly accurate as both are still pension funds but apparently have different tax incentives.

Once youve opened your account there are several ways to fund it. Any employed individual can open an IRA account. Unlike a 401k where you have to be an employee of a participating employer any employed individual can open a Roth IRA to begin saving for retirement.

If youre ready to set up a Roth IRA for your kids or grandkids nieces and nephews the first step is to contact a brokerage that offers Roth IRAs for minors. See this page for income and other limits for both types of IRAs. If your bank doesnt offer Roth IRA accounts you can open one with a brokerage firm.

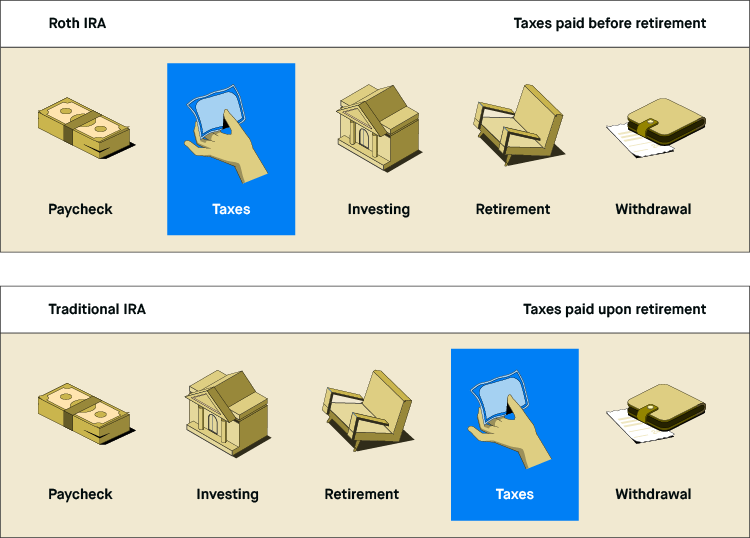

Who can open a Roth IRA. The process is easy as can be. The Roth IRA allows workers to contribute to a tax-advantaged account let the money grow tax-free and never pay taxes again on withdrawals.

Opening a Roth IRA can be as simple as visiting your banks website and filling out an online application. Our IRAs have no account fees or minimums to open 1 and commission-free trades. A Roth IRA can set teenagers up for a comfortable financial future.

Open a Fidelity IRA. A Roth IRA is an individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. Its quick and easy.

A nonworking spouse can open a traditional IRA or a Roth but only if he or she qualifies. But you dont have to handle the process on your own. That said traditional IRA withdrawal rules are stricter than Roth IRA withdrawal rules.

If youre a do-it-yourself investor choose a brokerage. How to open a Roth IRA for your kids. But most people dont fully understand how the work or how to use them that will maximize their true long-term.

Knowing how to open a Roth IRA starts with knowing your investing preferences. Workers age 49 and younger can contribute up to 6000 to a Roth IRA in 2021. Anyone with earned income can contribute to a Roth IRA.

He has an Individual Retirement Account IRA and a Roth IRA named after the Senator that introduce this hybrid version of the IRA. How to open a Roth IRA for your kids. With a traditional IRA you may be taxed and hit with a 10 early withdrawal penalty if you pull money out.

The Ultimate Guide To Traditional And Roth Iras For Millennials Finance Infographic Personal Finance Infographic Retirement Money

The Ultimate Guide To Traditional And Roth Iras For Millennials Finance Infographic Personal Finance Infographic Retirement Money

Roth Ira Vs Traditional Ira Vs 401k Vs Roth 401k Traditional Ira Roth Ira Ira

Roth Ira Vs Traditional Ira Vs 401k Vs Roth 401k Traditional Ira Roth Ira Ira

Planning For Retirement Finance Investing Retirement Planner Retirement Planning

Planning For Retirement Finance Investing Retirement Planner Retirement Planning

How To Use A Roth Ira To Become A Millionaire Dollar After Dollar Budgeting Money Money Saving Plan Weekly Savings Plan

How To Use A Roth Ira To Become A Millionaire Dollar After Dollar Budgeting Money Money Saving Plan Weekly Savings Plan

Quick Start Guide To A Self Directed Roth Ira Infographic Finance Investing Budgeting Money Money Saving Plan

Quick Start Guide To A Self Directed Roth Ira Infographic Finance Investing Budgeting Money Money Saving Plan

Pin By Naynay Peterson On Financial Freedom Financial Goals Saving For Retirement Mortgage Debt

Pin By Naynay Peterson On Financial Freedom Financial Goals Saving For Retirement Mortgage Debt

Traditional Ira Vs Roth Ira Deciding Between Them Finance Twins Roth Ira Traditional Ira Ira

Traditional Ira Vs Roth Ira Deciding Between Them Finance Twins Roth Ira Traditional Ira Ira

Planning For Retirement Infographic Preparing For Retirement Retirement Planning How To Plan

Planning For Retirement Infographic Preparing For Retirement Retirement Planning How To Plan

Roth Vs Traditional Ira How To Choose Family And Fi Traditional Ira Roth Ira Investing Roth Vs Traditional Ira

Roth Vs Traditional Ira How To Choose Family And Fi Traditional Ira Roth Ira Investing Roth Vs Traditional Ira

How To Use A Roth Ira To Become A Millionaire Dollar After Dollar Money Saving Plan Best Way To Invest Money Saving Tips

How To Use A Roth Ira To Become A Millionaire Dollar After Dollar Money Saving Plan Best Way To Invest Money Saving Tips

What Is An Individual Retirement Account Ira Robinhood

What Is An Individual Retirement Account Ira Robinhood

Wealthsimple Launches Socially Responsible Investing Portfolios In Uk Business Insider Robo Advisors Saving For College Investing

Wealthsimple Launches Socially Responsible Investing Portfolios In Uk Business Insider Robo Advisors Saving For College Investing

Traditional Ira Definition Rules And Options Nerdwallet

Traditional Ira Definition Rules And Options Nerdwallet

Tax Free Roth Ira Conversion For Expats Thanks To The Feie Online Taxman

Tax Free Roth Ira Conversion For Expats Thanks To The Feie Online Taxman

How To Invest An Essential Guide For Beginners Get Rich Slowly How To Get Rich Get Rich Slowly Investing

How To Invest An Essential Guide For Beginners Get Rich Slowly How To Get Rich Get Rich Slowly Investing

The Ultimate Guide On When To Make Traditional Ira Vs Roth Ira Contributions Ira Contribution Roth Ira Traditional Ira

The Ultimate Guide On When To Make Traditional Ira Vs Roth Ira Contributions Ira Contribution Roth Ira Traditional Ira

The Best Investment 2020 In Canterbury Kent Uk Investing Best Investments Best Way To Invest

The Best Investment 2020 In Canterbury Kent Uk Investing Best Investments Best Way To Invest

Get Answers To All Of Your Questions About Iras How To Open An Ira Ira Contribution Limits And The Different Types Of I Opening An Ira Ira Contribution Ira

Get Answers To All Of Your Questions About Iras How To Open An Ira Ira Contribution Limits And The Different Types Of I Opening An Ira Ira Contribution Ira

Post a Comment for "How To Open A Roth Ira Uk"