How To Open A Roth Ira Usaa

Cost of opening a Roth IRA with usaa. Almost all investment companies offer Roth IRA accounts.

How To Setup An Automatic Roth Ira

How To Setup An Automatic Roth Ira

You may also fund your IRAs with a USAA Certificate of Deposit CD after a minimum of 250 deposit.

How to open a roth ira usaa. Second by setting up your first IRA youll take a major step in saving for your future. I started the process of transferring these assets on 24 March 2020 by opening new accounts at Vanguard. Thats a total of three accounts at USAA.

Vanguard should be able to help you with the paperwork and it should be a fairly painless process. Knowing how to open a Roth IRA starts with knowing your investing preferences. How to Open a Roth IRA for Your Child First you need to find a broker that offers custodial IRAs.

This Disclosure Statement outlines the basic provisions of an Individual Retirement Account IRA as well as certain features unique to USAA Federal Savings Bank traditional IRAs. Effective December 18 2020 USAA is only able to establish a new IRA for existing USAA Federal Savings Bank. If you have an existing traditional IRA the same company can probably open a Roth IRA for you.

But you dont have to handle the process on your own. You can open a Roth IRA at an online broker and then choose. Cost of opening a Roth IRA with usaa.

Its my pleasure to introduce Ben Barker from Accuplan so welcome Ben and thank you for joining us today. 210-531-USAA 8722 800-531-8722 Mobile. The costs are too high.

Money can then be deposited by the individual into the account or there is a feature to set up regular contributions from a checking or other banking account. I do not believe Vanguard will charge you anything. USAA funds are open to investors as are a selected number of Non-USAA Mutual funds.

If youre a do-it-yourself investor choose a brokerage. For an interpretation of the applicable IRA and tax laws contact your tax adviser or district IRS. The Roth IRA account is one of the very best financial accounts anyone can have.

USAA focuses on soldiers and their families but a securities account can be opened by anyone. Lets answer some of the other member questions. There are Roth and Traditional IRAs for just about everyone while SEP and SIMPLE plans are designed for small businesses and self-employed persons.

It took me a couple of days to get to the actual business. TRADITIONAL AND ROTH IRA APPLICATION FORM. Get out of USAA for your Roth IRA.

Liquidate the assets inside the USAA Roth IRA and rollover the account to Vanguard. The broker requires a 2500 deposit to open a taxable account. Derivatives at USAA cost 65 on top of the base charge.

Opening a Roth IRA can be as simple as visiting your banks website and filling out an online application. So once again Fidelity is cheaper. Prior to requesting an IRA rollover from a qualified retirement plan account consider whether such rollover is appropriate for you.

Now weve been working together for many years currently and I can confirm a good deal of sector understanding. There are a ton of online brokerage firms that let you open a Roth IRA and invest in various funds. 8722 BANK 064527946 IRAPP USAA Federal Savings Bank 10750 McDermott Freeway San Antonio Texas 78288-0544.

But most people dont fully understand how the work or how to use them that will maximize their true long-term. Too often people find a reason not to start and I know there are plenty but I commend you for getting the ball rolling. The best Roth IRA accounts are easy to open online.

Not all brokers offer them and many robo advisors dont offer custodial accounts. USAA offers a selection of Individual Retirement Accounts that carry the same pricing schedule as a regular trading account does. USAA allows anyone to open a Roth IRA with as little as a 50 investment with a 50 or more automatic monthly contribution depending on the fund.

If youve bought shares in any USAA mutual funds or ETFs youre still the owner of those shares. At USAA ETF and stock trades are 0. I only had to open two accounts because both of my Roth IRAs can be together.

To help you with your search for the best Roth IRA account we compared more than 30 financial companies to find out which ones offer the best Roth IRA accounts in terms of investment options investment help and fees involved. If your bank doesnt offer Roth IRA accounts you can open one with a brokerage firm. Give one of our advisors a call at 800-771-9960 to learn more about setting up an IRA with USAA.

At USAA I had an SEP IRA and I had two Roth IRAs at USAA. Decide Where to Open Your Roth IRA Account. There is a 3000 minimum opening deposit requirement.

Most large firms also offer online access to start the account application. Although IRA rollovers may have certain advantages qualified retirement plan accounts have advantages you should consider before proceeding which may include but are not limited to low administrative and investment expenses and if you separate from service at. Opening an IRA at USAA is very simple and takes only a few steps along with the 500 minimum opening contribution.

The funds still have the same USAA brand name. This is merely a general summary for your information. There is a 35 charge to close an IRA though.

Cost Of Opening A Roth IRA With Usaa. If you have any investment accounts with USAA including 529s IRAs and taxable brokerage accounts then youre still the owner of those accounts. The cost of switching should be minimal.

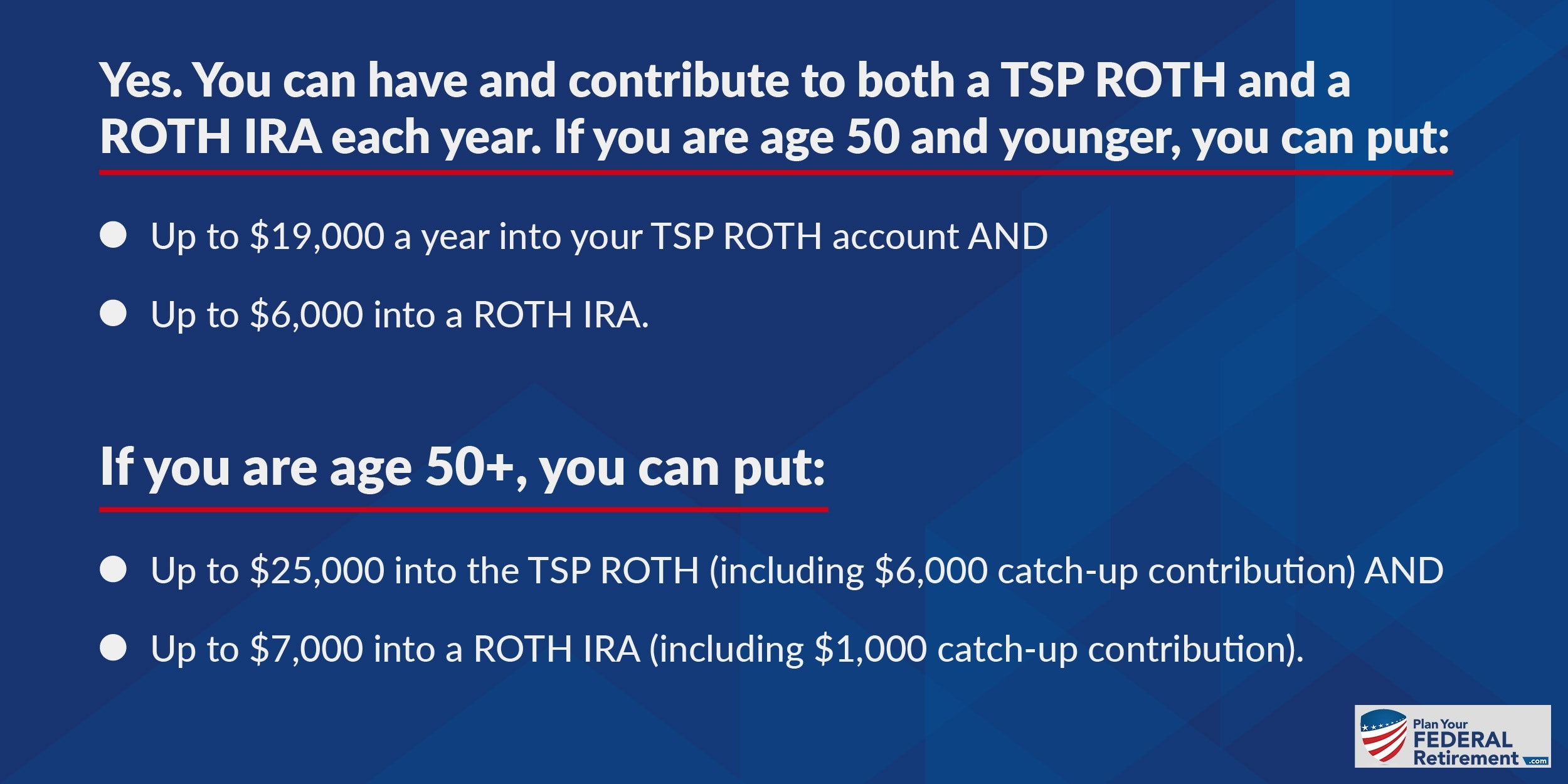

Can You Have A Roth Tsp And A Roth Ira Plan Your Federal Retirement

Can You Have A Roth Tsp And A Roth Ira Plan Your Federal Retirement

Retirement Plans Faqs Regarding Iras Rollovers And Roth Conversions Irs 2019 Retirement Planning How To Plan Ira

Retirement Plans Faqs Regarding Iras Rollovers And Roth Conversions Irs 2019 Retirement Planning How To Plan Ira

Usaa Ira Fees Rates Review Roth Traditional Ira Account 2021

Usaa Ira Fees Rates Review Roth Traditional Ira Account 2021

Pat Molnar For Usaa Commercialphotography Ad Usaa Germanshepherd Military Commercial Photographer Best Commercials Commercial Photography

Pat Molnar For Usaa Commercialphotography Ad Usaa Germanshepherd Military Commercial Photographer Best Commercials Commercial Photography

Seven Things To Avoid In Usaa Credit Card Statement Usaa Credit Card Statement Https Cardneat Com Seve Credit Card Statement Credit Card Junior Achievement

Seven Things To Avoid In Usaa Credit Card Statement Usaa Credit Card Statement Https Cardneat Com Seve Credit Card Statement Credit Card Junior Achievement

Usaa Roth Ira Everything You Need To Know Fatroth

Usaa Roth Ira Everything You Need To Know Fatroth

Can I Transfer My Roth Ira To My Roth Tsp Military Guide

Can I Transfer My Roth Ira To My Roth Tsp Military Guide

Changes Retirement Savers Need To Know About 2021 In 2021 Retirement Savings Plan Retirement Planning Retirement

Changes Retirement Savers Need To Know About 2021 In 2021 Retirement Savings Plan Retirement Planning Retirement

Best Places To Open A Roth Ira In 2021

Best Places To Open A Roth Ira In 2021

Asset Management Living Wills Infographic Usaa Asset Management Estate Planning Infographic

Asset Management Living Wills Infographic Usaa Asset Management Estate Planning Infographic

Primerica Roth Ira Review 2021

Primerica Roth Ira Review 2021

Why My 3 Year Old Has A Roth Ira And Why Yours Should Too Natali Morris Roth Ira Investing Dividend Investing Roth Ira

Why My 3 Year Old Has A Roth Ira And Why Yours Should Too Natali Morris Roth Ira Investing Dividend Investing Roth Ira

2021 Roth Ira Qualifications Are You Eligible To Open A Roth Ira

2021 Roth Ira Qualifications Are You Eligible To Open A Roth Ira

What Usaa Members Should Know About The Move To Charles Schwab In 2020 Charles Schwab Military Military Life

What Usaa Members Should Know About The Move To Charles Schwab In 2020 Charles Schwab Military Military Life

Pay Yourself First Fund Your Retirement Man I Hope We Get To Retire Roth Ira Rules For 2011 Roth Ira Roth Ira Contributions Roth Ira Rules

Pay Yourself First Fund Your Retirement Man I Hope We Get To Retire Roth Ira Rules For 2011 Roth Ira Roth Ira Contributions Roth Ira Rules

How To Use A Roth Ira To Become A Millionaire Dollar After Dollar

How To Use A Roth Ira To Become A Millionaire Dollar After Dollar

What Is A 702 J Retirement Plan Retirement Planning Retirement Savings Plan How To Plan

What Is A 702 J Retirement Plan Retirement Planning Retirement Savings Plan How To Plan

Post a Comment for "How To Open A Roth Ira Usaa"