Can I Open A Roth Ira For My Husband

Married couples filing separately cannot contribute to a Roth if their AGI exceeds 10000. In fact theres even an exception for your spouse.

Roth Ira Vs Traditional Ira Know The Difference Finance Investing Finances Money Finance

Roth Ira Vs Traditional Ira Know The Difference Finance Investing Finances Money Finance

Thats your contribution limit for a Roth IRA.

Can i open a roth ira for my husband. 5 In order to take advantage of a spousal IRA you have to be married and your tax filing status must be married filing jointly You. For the 2015 tax year each spouse can contribute up to 5500 to their account and an. I understand we can make contributions for 2020 in 2021.

How to set up a custodial Roth IRA. Fortunately for married couples there is one way to make a contribution to an IRA if you dont have wagesa traditional or Roth spousal IRA. This means that a couple each age 73 with only one spouse working part-time and earning 15000 for the year can contribute 7000 to a Roth IRA for each spouse total of 14000.

My husband and I went with Fidelity due to our familiarity with the platform but a few other providers offer them. In fact as a married couple you can both contribute to your own separate IRA if you file your taxes jointly and at least one of you earns enough money to meet the funding rules for two IRAs. However if you want to contribute to a Roth IRA for your spouse or yourself there are income limits.

Most people are unaware that you can have a Roth IRA account for anyone and everyone in your family who has earned income. Traditional IRA Several differences exist between Roth IRAs and traditional IRAs. At your ages you can each contribute up to 6000 to a traditional IRA a Roth IRA or any combination of the two you choose.

My wife is 33. A husband and wife can only each start a Roth IRA if both meet these income requirements. If your spouse is earning low or no annual wages your spouse may be able to open a spousal IRA to save tax-efficiently for retirement.

We finally have some extra money for savings and want to put money in an IRA. Subtract that amount from 206000 the maximum AGI. Its not a joint account but rather a separate IRA set up in your spouses name.

For example if youre a married couple and you have a combined AGI of 200000 in 2020 youd. For 2020 a married couple filing jointly with a modified adjusted gross income MAGI of up. Under a spousal IRA.

This is a tax-advantaged retirement account designed specifically to allow a working spouse to make contributions on behalf of a nonworking spouse. Both spouses do not need to work but the working spouse will need earned income of at least 12000 for you to fully fund the two IRAs. At your ages you can each contribute up to 6000 to a traditional IRA a Roth IRA or any.

Theres no such thing as a joint. You must be married and filing a joint tax return in order to open a spousal IRA. Sam You have until April 15 2021 to make IRA contributions for tax year 2020.

Learn more about traditional IRAs. Only the individual in question can open and fund a Roth IRA. But if your spouse is working she indeed has earned incomeAnd you must have earned income to be eligible to.

IRA stands for individual retirement account which means only individuals can own IRAs. Although most IRA accounts require the account holder to have evidence of earned income a working spouse can open a Roth IRA account for a non-working spouse with no earned income. The spousal IRA exception.

Learn more about Roth IRAs. First your pension and Social Security income are not considered earned income. As a result you cant open a joint Roth IRA with a spouse.

Assuming you qualify to contribute to a Roth you need to open separate accounts for you and your spouse. You and your spouse can have separate Roth. You must be married and file jointly to open a spousal IRA.

Setting up a Roth IRA for children is simple.

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

Open An Ira For Your Non Working Spouse Opening An Ira Ira Roth Ira

Open An Ira For Your Non Working Spouse Opening An Ira Ira Roth Ira

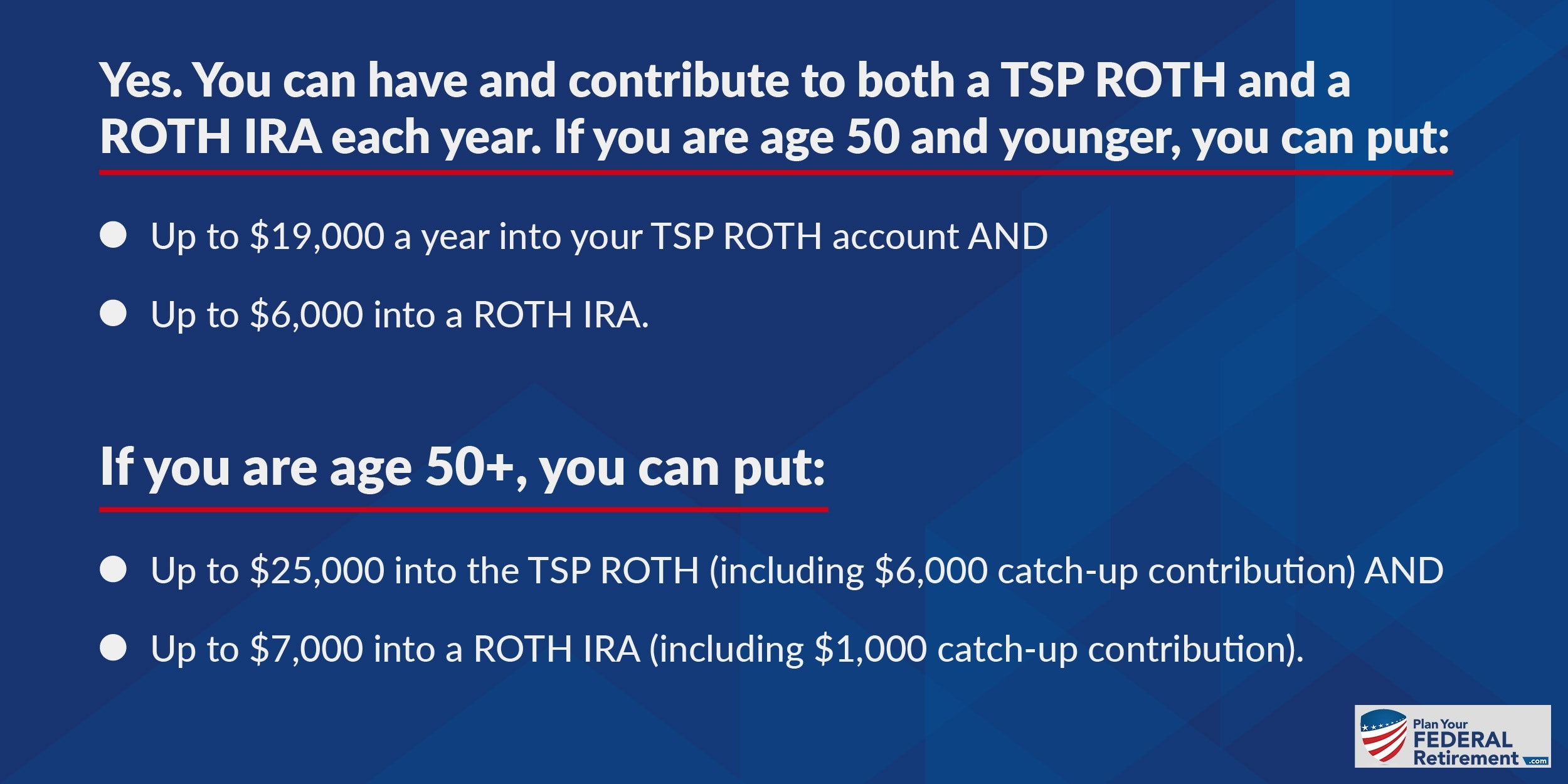

Can You Have A Roth Tsp And A Roth Ira Plan Your Federal Retirement

Can You Have A Roth Tsp And A Roth Ira Plan Your Federal Retirement

Can T Qualify For A Roth Ira There S A Back Door Park National Bank

Can T Qualify For A Roth Ira There S A Back Door Park National Bank

Why Most Pharmacists Should Do A Backdoor Roth Ira

Why Most Pharmacists Should Do A Backdoor Roth Ira

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

:max_bytes(150000):strip_icc()/roth-ira-vs-traditional-ira-written-in-the-notepad--1090754116-525e8e6001494031bda19fa01ad1cf2f.jpg) How To Set Up A Backdoor Roth Ira

How To Set Up A Backdoor Roth Ira

What S The Difference Between A 401k And Ira And Which Should You Invest In Money Under 30 Where To Invest Investing 401k

What S The Difference Between A 401k And Ira And Which Should You Invest In Money Under 30 Where To Invest Investing 401k

When To Make Traditional Ira Vs Roth Ira Contributions Traditional Ira Roth Ira Contributions Roth Ira

When To Make Traditional Ira Vs Roth Ira Contributions Traditional Ira Roth Ira Contributions Roth Ira

This Little Known 401 K Trick Can Open The Floodgates To Roth Ira Savings Roth Ira Roth Ira Investing Ira Accounts

This Little Known 401 K Trick Can Open The Floodgates To Roth Ira Savings Roth Ira Roth Ira Investing Ira Accounts

14 Best Roth Ira Accounts Of January 2021 Nerdwallet Best Roth Ira Ira Accounts Roth Ira

14 Best Roth Ira Accounts Of January 2021 Nerdwallet Best Roth Ira Ira Accounts Roth Ira

2021 Roth Ira Qualifications Are You Eligible To Open A Roth Ira

2021 Roth Ira Qualifications Are You Eligible To Open A Roth Ira

Why You Need A Roth Ira Kiplinger Roth Ira Ira Roth

Why You Need A Roth Ira Kiplinger Roth Ira Ira Roth

How To Create A Roth Ira Conversion Ladder

How To Create A Roth Ira Conversion Ladder

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

Fun D Fact Roth Iras Have Many More Rules To Differentiate Themselves From Other Iras These Are Just A Few If You Are Deb Ira Retirement Accounts Roth Ira

Fun D Fact Roth Iras Have Many More Rules To Differentiate Themselves From Other Iras These Are Just A Few If You Are Deb Ira Retirement Accounts Roth Ira

Roth Ira Vs Traditional Ira Comparison Traditional Ira Roth Ira Finance Investing

Roth Ira Vs Traditional Ira Comparison Traditional Ira Roth Ira Finance Investing

Fix Your Finances Shemakescents Traditional Ira Money Management Budgeting Money

Fix Your Finances Shemakescents Traditional Ira Money Management Budgeting Money

Post a Comment for "Can I Open A Roth Ira For My Husband"