How To Add Simple Ira In Quickbooks

If you made elective deferrals and they do not appear with code S in box 12 of your W-2 contract your employer to obtain a corrected W-2. Cost typically lower than 401k A 25 one-time setup fee and an annual 25 fee both per participant.

Contact Proadvisor Support Service And Sales Phone Chat H Quickbooks Learn Support Quickbooks Supportive Learning

Contact Proadvisor Support Service And Sales Phone Chat H Quickbooks Learn Support Quickbooks Supportive Learning

Click the Payroll Item list button and then choose New.

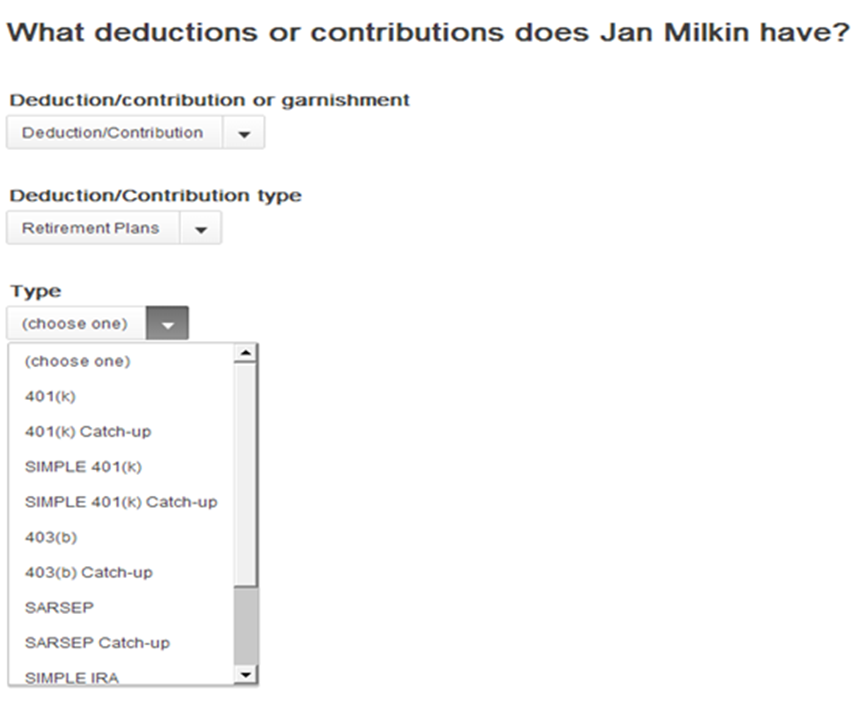

How to add simple ira in quickbooks. For Category select Retirement Plans. Learn more from The Hartford about what SIMPLE IRAs are and how they work. SIMPLE IRA contribution limits are not cumulative with traditional and Roth IRA limits.

From the QuickBooks Lists menu choose Payroll Item List. Under Payroll select Deductions Contributions. Enter the name of the provider or plan.

We want QuickBooks to show the SIMPLE IRA company contribution amounts to show as due by the 10 th of the following month. Set up a payroll item for retirement benefits 401K Simple IRA etc Print pay stubs in QuickBooks Online Payroll and Intuit Online Payroll Please stay posted if you have any other payroll questions Im always here to help you. Excel is easier for just that one item.

How to set up SEP IRA contribution. Open Screen 24 Adjustments to Income. One for employee deduction one for company match including corresponding expense account.

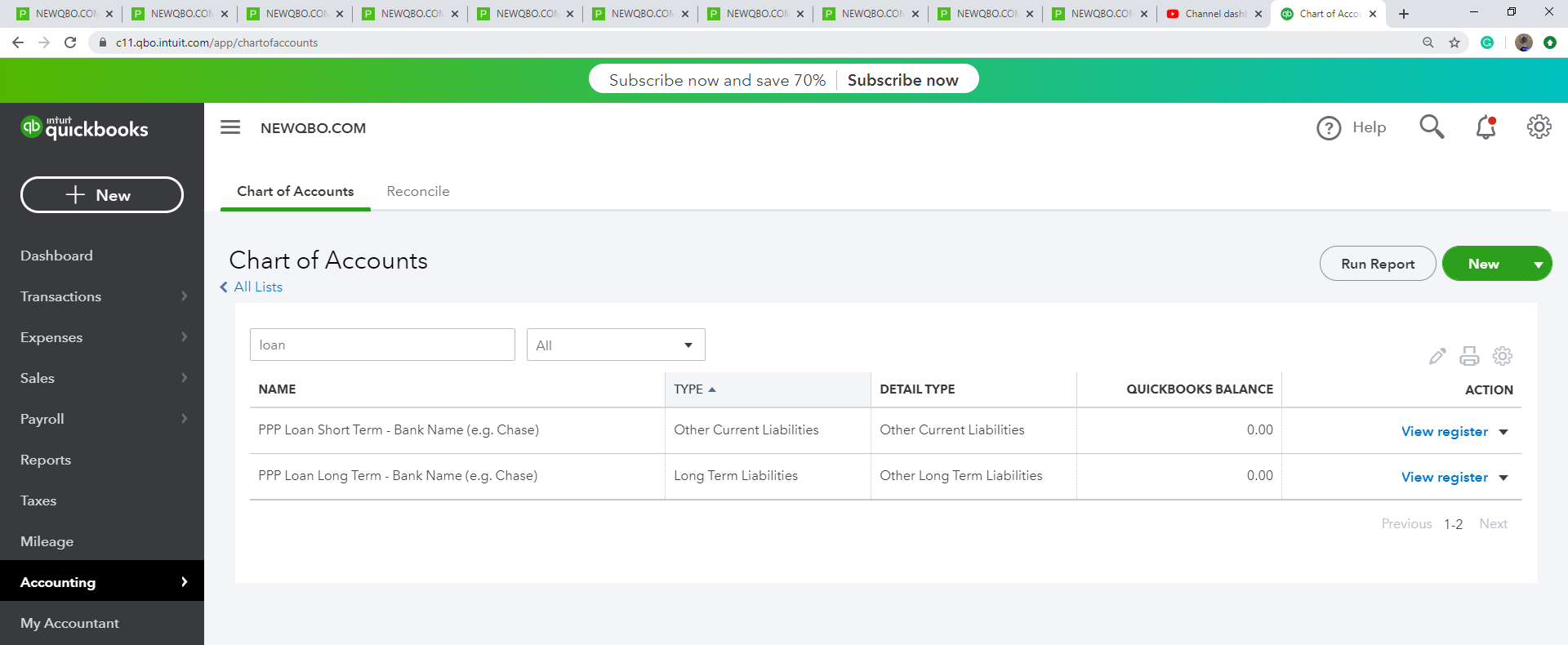

Using a separate account though gives us a much greater ability to track down any discrepancies should one occur. In addition to many of the same benefits as a SIMPLE IRA SIMPLE IRA Plus offers. The first account SIMPLE IRA Payable is a current liability account.

For Type select the applicable retirement plan. In the Agency for employee-paid liability window choose the correct vendor name. What expense account do I use.

QuickBooks Online Payroll Enhanced. From the left menu select the Gear icon. According to QB instructions I am to set up 2 payroll items.

We should set the employee deduction item for the IRA contributions to the same schedule. SOLVED by QuickBooks QuickBooks Desktop Payroll 6 Updated 1 year ago Overview This article has the instructions and details on setting up benefits using both EZ and Custom Setup in QuickBooks Desktop for 401k 403b 408k6 SEP Elective 457b 501c18D and SIMPLE IRA. A SIMPLE IRA is an employer-sponsored retirement plan designed specifically for small businesses.

An IRA is a long-term asset so make one up in that category. Select Custom Setup and then click Next. A Savings Incentive Match Plan for Employees IRA SIMPLE IRA is an employer-sponsored retirement plan similar to a 401k in which employees and employers can both contribute to the employees.

Those payroll items still exist in the sample file. Examples of administrative procedures include using checklists software manuals and methods for calculating compensation and required contributions. Yes If all requirements are met.

Were starting a simple IRA plan for our small office. Click Payroll Item List. Choosing the SIMPLE IRA-Company Portion and clicking on the Edit button brings up the following screen.

SIMPLE IRAs give employees and employers a simple tax-deferred way to save for retirement. Click Lists at the top. Right-click on the Simple IRA employeeemployer item then click Edit Payroll Item.

This video will explain how SIMPLE I. Select Addition Bonus Mileage Reimbursement and then click Next. In the Section list click Traditional IRA.

A 401k-style experience with a plan-level advisor relationship. However SIMPLE IRA limits are cumulative with the contribution limits for other employer-sponsored plans such as 401k plans and 403b plans. Then select Payroll Settings.

We have made a selection in this window. The administrators should make sure that plan procedures follow the plan terms for the amount of contributions. Select Add a New DeductionContribution.

Enter contributions in IRA Contributions 1 Maximum Deductioncode 1 Taxpayer code 51 Spouse field enter amount of contribution or enter 1 to calculate the maximum deductible contribution allowed for the taxpayer and spouse IRA worksheets. When you reach this point in the setup QuickBooks will suggest Payroll Liabilities. Simple IRA not included on W2 Only amounts deferred from your paycheck to the SIMPLE IRA are to be reported on your W-2 not employer contributions.

QuickBooks will also suggest Payroll Expenses as the expense account. To create the liability check to pay the retirement plan administrator i. The SIMPLE IRA plan administrators should be familiar with the plan document terms.

The left hand column is for Taxpayer information and the right hand column is for Spouse information. If you are using QB for your personal finances. A simple plan is considered being covered by a retirement plan at work so the traditional IRA may have limits on the.

Quickbooks Error 1601 Resolve Methods To Fix In 2020 Quickbooks Installation First Class Flights

Quickbooks Error 1601 Resolve Methods To Fix In 2020 Quickbooks Installation First Class Flights

Quickbooks Online Client Discounts For Accountants Intuit Quickbooks Quickbooks Online Accounting

Quickbooks Online Client Discounts For Accountants Intuit Quickbooks Quickbooks Online Accounting

Create And Print Timesheets In Quickbooks In 2020 Quickbooks Accounting Software Print

Create And Print Timesheets In Quickbooks In 2020 Quickbooks Accounting Software Print

Chart Of Accounts Template Uncommon Non Profit Accounting Software Quickbooks Desktop Enterpr Chart Of Accounts Non Profit Accounting Accounting

Chart Of Accounts Template Uncommon Non Profit Accounting Software Quickbooks Desktop Enterpr Chart Of Accounts Non Profit Accounting Accounting

How To Set Up The Chart Of Accounts In Quickbooks Online Chart Of Accounts Quickbooks Quickbooks Online

How To Set Up The Chart Of Accounts In Quickbooks Online Chart Of Accounts Quickbooks Quickbooks Online

Update Quickbooks Desktop To The Latest Release Quickbooks Quickbooks Help Software Update

Update Quickbooks Desktop To The Latest Release Quickbooks Quickbooks Help Software Update

Recurring Transactions Let S Automate Quickbooks Online Invoice Template Quickbooks

Recurring Transactions Let S Automate Quickbooks Online Invoice Template Quickbooks

Download Center Quickbooks Online Quickbooks Accounting Training

Download Center Quickbooks Online Quickbooks Accounting Training

Quickbooks Training Set Up Budget Youtube Quickbooks Training Quickbooks Budgeting

Quickbooks Training Set Up Budget Youtube Quickbooks Training Quickbooks Budgeting

Quickbooks Management Reports Step By Step Guide Quickbooks Quickbooks Online Management

Quickbooks Management Reports Step By Step Guide Quickbooks Quickbooks Online Management

Quickbooks 2014 Screenshots Quickbooks And Your Business Quickbooks Windows Server Server

Quickbooks 2014 Screenshots Quickbooks And Your Business Quickbooks Windows Server Server

Retirement Plan Deductions Contributions

Retirement Plan Deductions Contributions

Post a Comment for "How To Add Simple Ira In Quickbooks"