How To File For Unemployment As Independent Contractor

Im so sorry to have to ask here but I am overwhelmed trying to manage my family and my business. To find out how to appeal an unemployment determination select your state from the list at Collecting Unemployment Benefits.

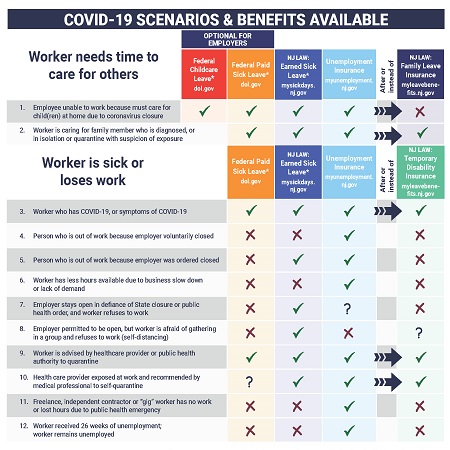

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Other than in special circumstances If you were paid as an independent contractor and receive a 1099 form you were not considered an employee and would not be eligible for unemployment.

How to file for unemployment as independent contractor. Employee or Independent Contractor. The new program is one way Congress boosted unemployment insurance for 2020 to help ease the economic pain for a record number of out-of-work Americans. The additional 600 per week is available no matter which unemployment program youre eligible for.

See the CARES Act page and the Pandemic Unemployment Assistance page for more information. If a worker passes one of the following tests he or she is an independent contractor. To be an independent contractor both of the following must be shown to the satisfaction of the department.

After a lengthy delay Californias gig workers the self-employed independent contractors and freelancers can now apply for unemployment insurance benefits. Failing to properly classify workers may result in additional premiums penalty and interest charges. In your appeal explain that your employer misclassified you as an independent contractor.

Total gross wages for the last week you worked. The individual has been and will continue to be free from control or direction over the performance of the services involved both under the contract of service and in fact and. If not he or she is an employee and should be reported on your quarterly unemployment tax report.

There is one test specifically for electrical and construction contractors and one for all other industries. The program gives independent workers who typically file 1099 tax forms and. The state opened its Pandemic Unemployment Assistance PUA portal which you can access at this link this morning.

Gig workers independent contractors and the self-employed have a more roundabout process to file for unemployment benefits than traditional salaried workers experts say. In Pennsylvania a website opened on April 23 but there have been initial glitches. Thats because eligibility for unemployment is based upon being employed by an organization that was paying into the unemployment insurance fund.

If you qualify for Pandemic Unemployment Assistance your benefits will be administered through your states unemployment office. How to apply for unemployment as an independent contractor. You should apply for unemployment benefits claiming that you were really an employee.

0000 - How does unemployment work for independent contractors0041 - What benefits are self employed entitled to0109 - Are gig workers considered self em. UI and Independent Contractors. NFIB wants to be sure our members who are independent contractors freelancers self-employed or gig workers know that they can apply for unemployment benefits under the new Pandemic Unemployment Assistance PUA recently passed by Congress.

Under the relief law people who are self-employed including independent contractors and gig workers and not eligible for regular unemployment insurance can still receive unemployment benefits. Employers often utilize independent contractors as a way to save money and avoid the payment of employment taxes. Independent contractors who are not traditionally eligible for Unemployment Insurance may qualify for Pandemic Unemployment Assistance under the federal CARES Act.

If your claim is denied you should appeal. Ten states have begun sending unemployment benefits to self-employed workers and independent contractors who are eligible for such payments for the first time under the CARES Act. If you are a business owner independent contractor or self-employed worker and only received a 1099 tax form last year you are most likely eligible for Pandemic Unemployment Assistance.

Mailing address and phone number. If you are self-employed a business owner or an independent contractor list yourself as your last employer. If you are self-employed or an independent contractor you will need your net income total after taxes.

A worker is considered to be an employee unless proven otherwise. To find out if you qualify and to apply online log onto the CareerOneStop website and select your state from the dropdown list. Generally youre either eligible for regular unemployment or the new PUA program for independent contractors but you cant receive both types of unemployment assistance at once.

Apply for Pandemic Unemployment Assistance if your work situation changed because of COVID-19 and you meet any of these requirements. I lost my latest client and am trying to figure out how I can maybe qualify for unemployment given that independent contractors are now available. I was hired as an independent contractor.

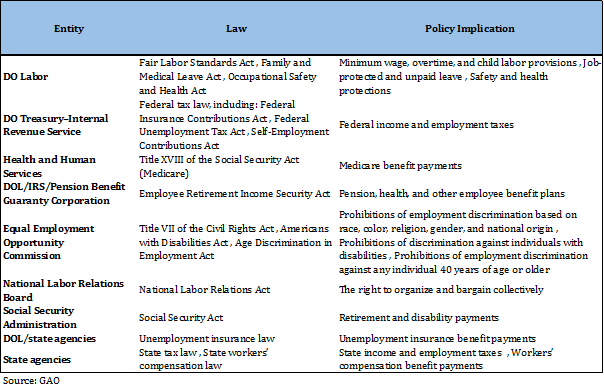

As an employer it is critical to correctly determine whether individuals rendering services are employees or independent contractors.

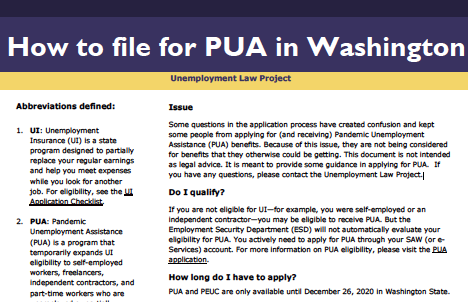

Video Guide How To File For Pua In Washington Unemployment Law Project

Video Guide How To File For Pua In Washington Unemployment Law Project

Applying For Pandemic Unemployment Assistance Pua Delaware Department Of Labor

Applying For Pandemic Unemployment Assistance Pua Delaware Department Of Labor

Https Does Dc Gov Sites Default Files Dc Sites Does Publication Attachments 2021 20ui 20pua 20faq V2 Pdf

How To Apply For Unemployment In La During Covid 19 Pandemic

How To Apply For Unemployment In La During Covid 19 Pandemic

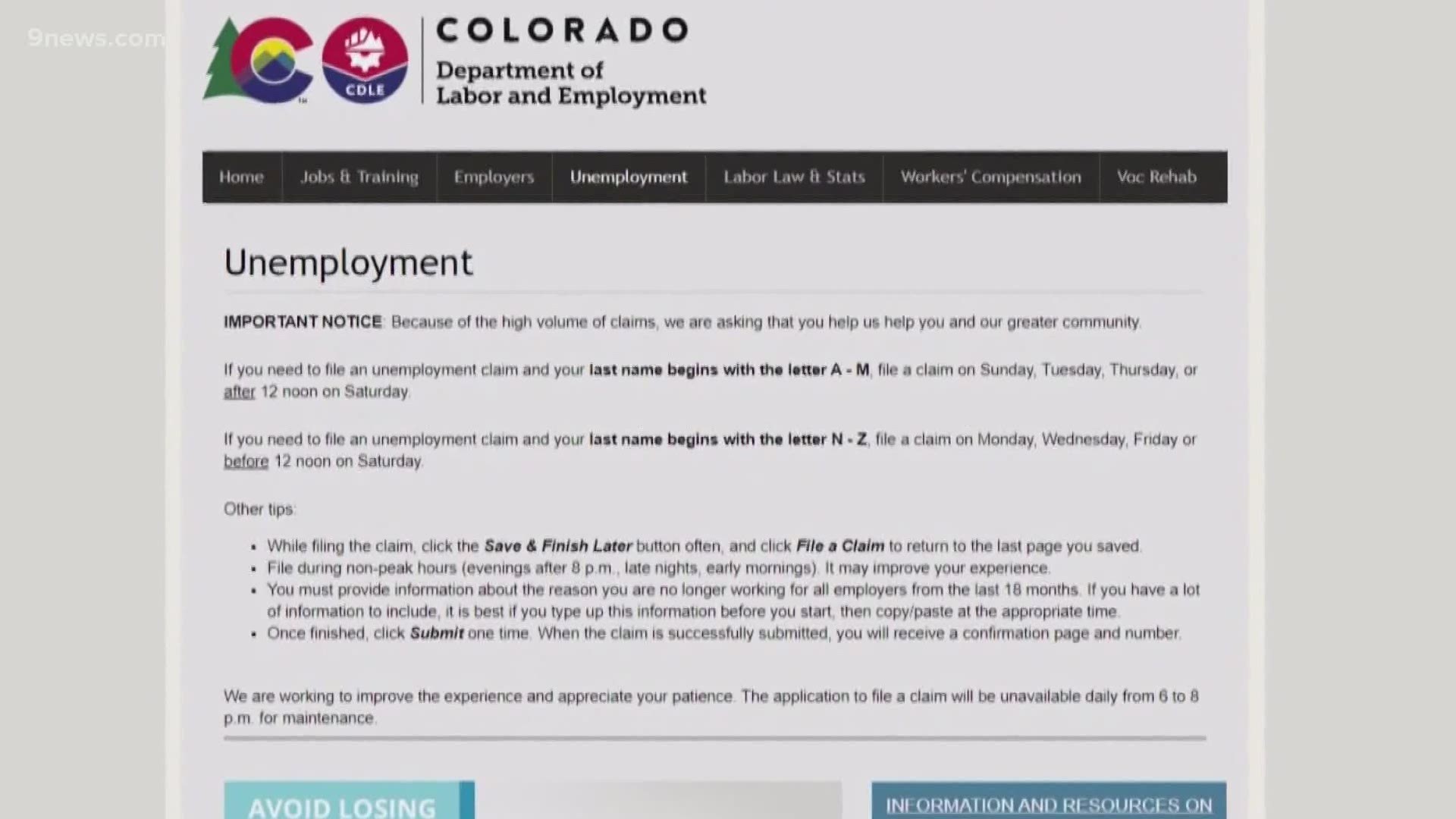

Here S How Colorado Self Employed Can Apply For Unemployment 9news Com

Here S How Colorado Self Employed Can Apply For Unemployment 9news Com

Baruch Promotes Pandemic Unemployment Assistance Program Amid Covid 19 Crisis The Ticker

Self Employed Independent Contractors Can Now Pre File For Unemployment Benefits Wosu Radio

Self Employed Independent Contractors Can Now Pre File For Unemployment Benefits Wosu Radio

Https Does Dc Gov Sites Default Files Dc Sites Does Publication Attachments Accessing 20unemployment 20quick 20guide R5 Pdf

Filing For Unemployment When Self Employed Or An Independent Contractor In Florida Unbehagen Advisors

Filing For Unemployment When Self Employed Or An Independent Contractor In Florida Unbehagen Advisors

Independent Contractors Applying For Unemployment Youtube

Independent Contractors Applying For Unemployment Youtube

![]() Workers Describe A Painful Wait For Unemployment Benefits During Coronavirus Shutdowns Wamu

Workers Describe A Painful Wait For Unemployment Benefits During Coronavirus Shutdowns Wamu

![]() Why Independent Contractor Vs Employee Status Matters Mga

Why Independent Contractor Vs Employee Status Matters Mga

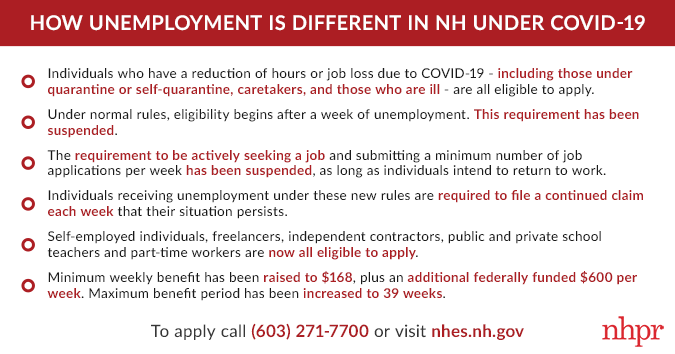

As Unemployment Surges In N H An Update On Changes To Benefits New Hampshire Public Radio

As Unemployment Surges In N H An Update On Changes To Benefits New Hampshire Public Radio

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Information For Self Employed And Independent Contractors Department Of Labor

Information For Self Employed And Independent Contractors Department Of Labor

Https Www1 Nyc Gov Assets Doh Downloads Pdf Imm Covid 19 Unemployment Health Insurance Pdf

Unemployed Contractors Self Employed Virginians Can Now File Weekly Claims Through Gov2go App Youtube

Unemployed Contractors Self Employed Virginians Can Now File Weekly Claims Through Gov2go App Youtube

How Rick Snyder Made Collecting Unemployment Benefits Harder Opinion

Tax Topics Employees And Independent Contractors In The Sharing Economy Aaf

Tax Topics Employees And Independent Contractors In The Sharing Economy Aaf

Post a Comment for "How To File For Unemployment As Independent Contractor"