How To Open A Roth Ira With Robinhood

Second of all there are limitations on who can contribute to a Roth IRA based on income. All you need is to be 18 years or older have a valid Social Security number and a US.

Robinhood Ira Account Fees Roth Ira Rates 2021

Robinhood Ira Account Fees Roth Ira Rates 2021

You cant connect separate brokerage accounts currently.

How to open a roth ira with robinhood. Certain limitations and fees may apply. In this video I talk about my 2021 goal to max out my Roth IRA within the M1 finance application. It is super easy to open a Bitcoin IRA so you can turbo-speed your retirement plan.

You fund your account and choose investments. Open ROTH IRA through Robinhood. As of 2019 you can contribute up to 6000 a year or 7000 a year if youre over 50 and can deduct part or all of that amount on your income taxes depending on your income.

In order to do this you must file taxes jointly and your spouse must earn at least as much as you contribute to your Roth IRA and your spouses Roth IRA combined. In fact weve been waiting on this day because 2013 actually. If your bank doesnt offer Roth IRA accounts you can open one with a brokerage firm.

If youre new to investing start with a small amount of money youre OK with losing and stick to stocks and ETFs. By contrast you can split. Stupid Name Smart Idea.

Robinhood minimum balance requirement for brokerage account. It means if you contribute the full 6000 to a Roth IRA with one broker you cannot make contributions to a second. In 2021 big institutions began purchasing Bitcoin at astonishing levels.

How to start investing with Robinhood Investing through Robinhood is as easy as opening an account. That includes both Roth IRAs and traditional IRAs. Robinhood Roth Ira How to Begin a cryptocurrency retirement plan The Best Way to Enter into Bitcoin Robinhood Roth Ira.

While theres a Roth IRA maximum contribution amount theres no minimum according to IRS rules. If you have an existing traditional IRA the same company can probably open a Roth IRA for you. I have elected to go with the lazy mans portfolio by inv.

There are no Traditional IRA Roth IRA SEP or SIMPLE retirement accounts at this broker. And Vanguard has a higher minimum to get started than Im looking to do I think its like 3K to start a Roth. Every few years the limits surrounding Roth IRAs change.

It may have a kind of silly name but a Roth IRA should be every investors best friend. Its a special retirement account that most people are eligible to open. But you dont have to handle the process on your own.

IRA accounts are not offered at Robinhood. A Roth IRA The no-fee trading app is a fine tool for investing -- but not the wisest place to start your retirement savings. For a 0 commission IRA company see Ally Invest review.

So if your child only makes 2000 in a year then they can only put 2000 into the Roth IRA. You could use your RobinHood account as a separate IRA but remember there are rules about IRAs you will need to understand in order to be effective. You can open a Roth IRA even if you dont have earned income as long as your spouse does.

BTW I am a college student with little disposable income to invest 200 a month. Almost all investment companies offer Roth IRA accounts. All income limits still apply.

You can also open a standalone retirement account for 2 per month by contacting customer service. Lets say you want to start saving money for retirement. Most large firms also offer online access to start the account application.

You do your research and decide that a Traditional IRA is right for you. Roth IRA Contribution And Income Limits. First of all the maximum contribution for 2021 is 6000 7000 if age 50 or older.

A Young Retirement Investor Weighs Robinhood vs. The good news is that the IRS doesnt require a minimum amount to open a Roth IRA. The contribution limit is 6000 for 2020 or 100 of earned income whichever is less.

Decide Where to Open Your Roth IRA Account. View Robinhood Financials fee schedule at rbnhdcofees to learn more. Commission-free investing plus the tools you need to put your money in motion.

Robinhood minimum initial deposit to open ROTH IRA Traditional IRA Simple IRA or SEP IRA. Unfortunately Robinhood Financial does not offer any IRA accounts at this time. Sign up and get your first stock for free.

A Roth or Traditional IRA is included in Stash Growth 3mo and Stash 9mo plans. Opening a Roth IRA can be as simple as visiting your banks website and filling out an online application. Both account types have 1 investing minimums 5 for investments priced over 1000 per share and maximum contributions to both accounts types are capped.

I currently trade using the Robinhood app but is there any way possible to open a ROTH IRA account for tax purposes.

Weekly Lesson 2 Of 52 Why The Roth Is The King Of Tax Shelters Retirement Income Roth Ira Financial Fitness

Weekly Lesson 2 Of 52 Why The Roth Is The King Of Tax Shelters Retirement Income Roth Ira Financial Fitness

This Post Is Part Of A Larger Attempt To Share My Personal Systems That Help Me Organize My Life I M No Expert B Where To Invest Ira Accounts Chase Freedom

This Post Is Part Of A Larger Attempt To Share My Personal Systems That Help Me Organize My Life I M No Expert B Where To Invest Ira Accounts Chase Freedom

How To Start Investing In Stocks With Robinhood Fitbit College Student Presentation Youtube Investing Student Presentation Start Investing

How To Start Investing In Stocks With Robinhood Fitbit College Student Presentation Youtube Investing Student Presentation Start Investing

403 B Plan Vs Roth Ira Infographic Inside Your Ira Roth Ira Investing For Retirement Roth

403 B Plan Vs Roth Ira Infographic Inside Your Ira Roth Ira Investing For Retirement Roth

The Best Robinhood Alternatives To Start Investing Your Money Investing Investing Apps Investing Money

The Best Robinhood Alternatives To Start Investing Your Money Investing Investing Apps Investing Money

Robinhood Vs Acorns A Tale Of Two Strategies The Finance Twins Personal Savings Finance Investments Options

Robinhood Vs Acorns A Tale Of Two Strategies The Finance Twins Personal Savings Finance Investments Options

How To Get Two Free Stocks On Webull 5 Easy Steps Thirtyeight Investing Real Time Quotes Smart Money Investing Apps

How To Get Two Free Stocks On Webull 5 Easy Steps Thirtyeight Investing Real Time Quotes Smart Money Investing Apps

How To Get Started In Stocks With Robinhood Investing Apps Investing Money Real Estate Investing Quotes

How To Get Started In Stocks With Robinhood Investing Apps Investing Money Real Estate Investing Quotes

Robinhood Get A Free Stock No Fees Ever Investing Easy Money How To Get

Robinhood Get A Free Stock No Fees Ever Investing Easy Money How To Get

Robinhood Investing With No Fee S You Get A Free Stock Investing Apps Trading Quotes Day Trading

Robinhood Investing With No Fee S You Get A Free Stock Investing Apps Trading Quotes Day Trading

How To Use Apps To Save Invest Investing Financial Motivation Investing Money

How To Use Apps To Save Invest Investing Financial Motivation Investing Money

Robinhood App Set Up Tutorial For Robinhood Get A Free Stock Youtube

Robinhood App Set Up Tutorial For Robinhood Get A Free Stock Youtube

Investing Is Not That Hard Investing Start Investing Robinhood App

Investing Is Not That Hard Investing Start Investing Robinhood App

Dividend Investing Robinhood Challenge For Monthly Passive Income Week 8 Cherry Tung Youtube Dividend Investing Investing Investing Books

Dividend Investing Robinhood Challenge For Monthly Passive Income Week 8 Cherry Tung Youtube Dividend Investing Investing Investing Books

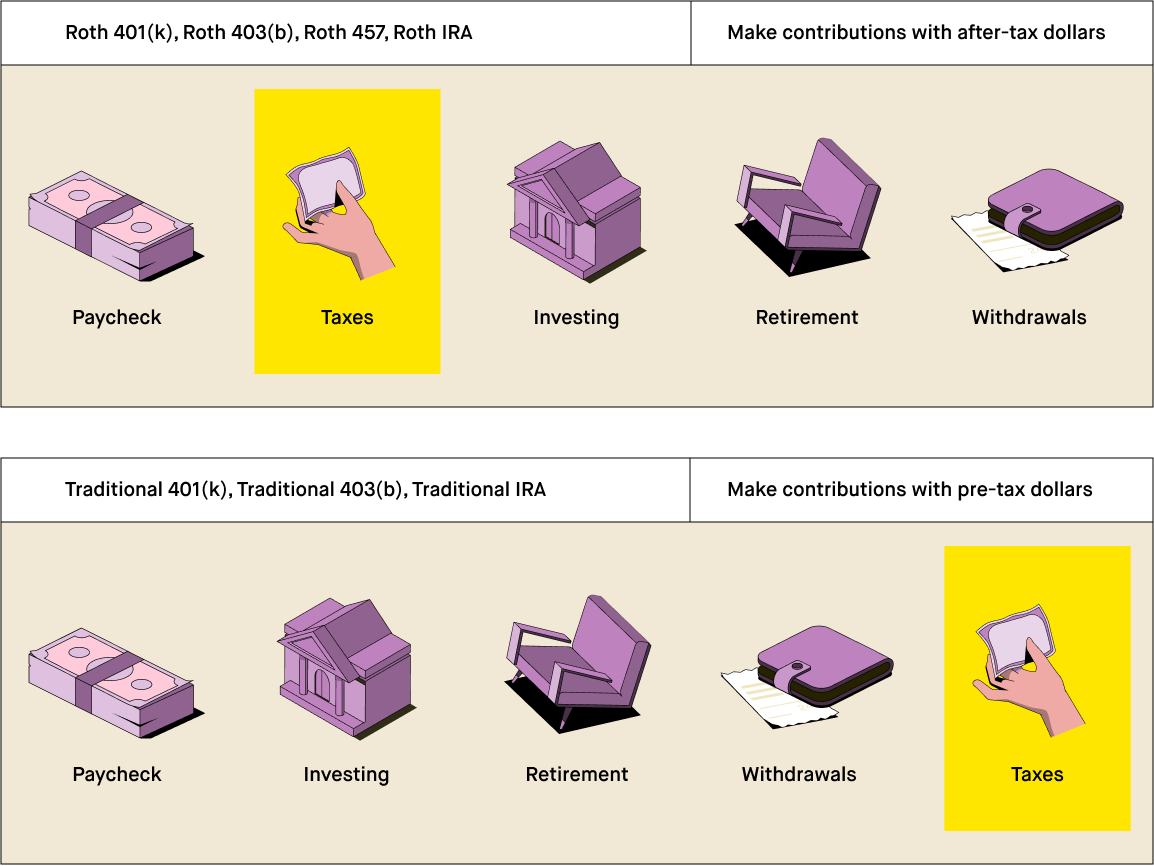

What Is A Roth 401 K 2020 Robinhood

What Is A Roth 401 K 2020 Robinhood

Robinhood Review Are Free Trades Too Good To Be True One Smart Dollar In 2020 Investing In Stocks Penny Stocks Investing Finance Investing

Robinhood Review Are Free Trades Too Good To Be True One Smart Dollar In 2020 Investing In Stocks Penny Stocks Investing Finance Investing

Robinhood S Halted Foray Into Banking Prompts Lawmaker Scrutiny Online Stock Trading Investing Robinhood App

Robinhood S Halted Foray Into Banking Prompts Lawmaker Scrutiny Online Stock Trading Investing Robinhood App

Is Robinhood Right For You With Images Investing Money Investing Online Broker

Is Robinhood Right For You With Images Investing Money Investing Online Broker

Robinhood Review Is Robinhood Legit Investing Forex Trading Training Securities And Exchange Commission

Robinhood Review Is Robinhood Legit Investing Forex Trading Training Securities And Exchange Commission

Post a Comment for "How To Open A Roth Ira With Robinhood"