Can I Open A Roth Ira If I Make Over 100k

However if youre rolling over traditional IRA accounts that include non-tax-deductible contributions that portion of the rollover will not be subject to ordinary income tax. You can open a Traditional IRA however.

Can I Get A Roth Ira If I Make Over 100k

Can I Get A Roth Ira If I Make Over 100k

For most households the Roth IRA contribution limits in 2020 and 2021 will be the smaller of 6000 or your taxable income.

Can i open a roth ira if i make over 100k. In 2020 you can make a full contribution to a Roth IRA up to an income of 124000 for a single filer or 196000 for a married couple. For example if you make 100000 per year and your spouse does not have earned income you can make a contribution of 6000 to a Roth IRA account for both you and your spouse for a total of. That will make the Roth IRA conversion less taxing and even more attractive.

The maximum contribution of 7000 can be. Use this calculator to find out how much your Roth IRA contributions could be worth at retirement and what you would save in. Your income is already over the limit for Traditional IRA deduction bummer so it would seem there is little point to opening an IRA at all.

Contribution limits for Roth IRAs. Currently only one kind of taxpayer cant open a Roth IRA account if he earns over 100000 annually. If you are limited to a 19500 contribution to your 401k then making the 401k tax-deferred and also maxing out backdoor Roth IRAs should provide you the tax diversification that you.

Once you hit 137000 you are no longer eligible to contribute to a Roth IRA. This would mean taking funds from traditional IRAs paying ordinary income tax on those funds and rolling them into a Roth IRA. Roth IRA contributions are allowed without age limit as long as an older individual has earnings from employment and doesnt exceed the earnings limit.

You can withdraw your principal from a Roth at any time without having to. But you can contribute to an IRA only if you make under a certain amount. However the very next day you convert the Traditional IRA into a Roth IRA.

You can open up a Traditional IRA and for tax purposes it will be non-deductible when you file taxes. Roth IRA contributions are off-limits for high-income earners -- thats anyone with an annual income of 140000 or more if filing taxes as single or head of household in 2021 up from a 139000. That can represent a big chunk of the converted balance.

After you make over 140000 as an individual or 208000 as a married couple for 2021 you cant contribute to a Roth IRA. It is still unknown how the government comes up with such arbitrary amounts independent of location. The IRS typically changes the maximum income limit for Roth IRA account holders from one year.

The Backdoor Roth IRA Strategy The removal of a 100000 MAGI limit for Roth conversions in 2010 created a loophole in the tax code that allows high-income filers to legally make indirect. Converting some or all of the funds in a Traditional IRA into a Roth IRA is another option. Unlike traditional IRA rules which prohibit you from making contributions if you are older than 70 12 and require you to take distributions you can contribute to a Roth IRA throughout your lifetime.

Retired men and women of any age can open Roth individual retirement accounts or IRAs. If you earn between 122000 and 136999 you can still contribute to a Roth IRA but the amount you can contribute is reduced on a sliding scale depending on how much you make. If youre age 50 or older you can.

In 2021 a married couple can contribute 6000 7000 if over 50 each to a Roth IRA each year usually via the back door for most high-income professionals since they make too much to contribute directly. A Roth IRA is powerful tax-advantaged way to save for retirement. There are income limits though for contributing to Roth IRA accounts.

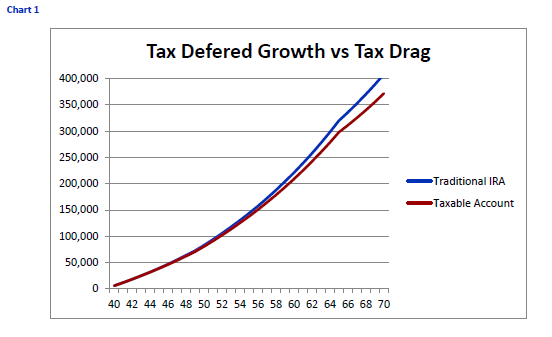

This can make sense particularly if you expect to be in a higher tax bracket in the future and have a long-time horizon. Rules for Roth IRAs. You can contribute to a traditional individual retirement account IRA no matter how high your income.

Between that amount and 139000 and 206000 respectively you can make a partial contribution to a Roth IRA but above these amounts you cannot contribute to a Roth IRA. IRA issues - As you already realized you make too much to directly open and contribute to a Roth IRA. If you leave the contribution in as cash and didnt buy any stock or earn any interest you will not be required to pay any taxes on the earnings.

You can contribute the max if you earn 125000 or less as an individual or 198000 or less as a married couple. You fund a Roth IRA with after-tax contributions but the money that you invest in a Roth grows tax-deferred.

How To Save 100k Money Saving Tips Growthrapidly Best Money Saving Tips Saving Money Save Money Fast

How To Save 100k Money Saving Tips Growthrapidly Best Money Saving Tips Saving Money Save Money Fast

Systematic Partial Roth Conversions Recharacterizations

Systematic Partial Roth Conversions Recharacterizations

Investing For Beginners Life Acornsinvestingvideos Real Estate Investing Marketing Investingide Budgeting Finances Best Way To Invest Investment Quotes

Investing For Beginners Life Acornsinvestingvideos Real Estate Investing Marketing Investingide Budgeting Finances Best Way To Invest Investment Quotes

How Does Retirement Work How To Maximize Benefits

How Does Retirement Work How To Maximize Benefits

How A High Earner Couple Got 100 000 Into Roth Iras Via The Backdoor

How A High Earner Couple Got 100 000 Into Roth Iras Via The Backdoor

9 Of The Best Ways To Invest For Retirement To Catch Up Magnifymoney Investing 401k Extra Money

9 Of The Best Ways To Invest For Retirement To Catch Up Magnifymoney Investing 401k Extra Money

The Ultimate Roth Ira Conversion Guide For 2021 Rules Taxes

The Ultimate Roth Ira Conversion Guide For 2021 Rules Taxes

How To Invest 100k A Complete Guide

How To Invest 100k A Complete Guide

What Is A Roth Ira Roth Ira Investing Money Personal Finance Investing Money

What Is A Roth Ira Roth Ira Investing Money Personal Finance Investing Money

Jvzoo Referrer Change How To Get Rich Money Management Advice Ways To Get Rich

Jvzoo Referrer Change How To Get Rich Money Management Advice Ways To Get Rich

Alternative Investments Visual Ly Investing Real Estate Investing Invest Wisely

Alternative Investments Visual Ly Investing Real Estate Investing Invest Wisely

How To Start Investing Personal Finance Saveandinvestingvideos Dave Ramsey Investing Chart Howinvestingmone Investing Finance Investing Investing Money

How To Start Investing Personal Finance Saveandinvestingvideos Dave Ramsey Investing Chart Howinvestingmone Investing Finance Investing Investing Money

2021 Roth Ira Income And Contribution Limits Money Under 30

2021 Roth Ira Income And Contribution Limits Money Under 30

Disadvantages Of The Roth Ira Not All Is What It Seems

Disadvantages Of The Roth Ira Not All Is What It Seems

Doin It By The Decade The Wealthy Barber Review Brokegirlrich Money Saving Plan Budgeting Money Money Saving Tips

Doin It By The Decade The Wealthy Barber Review Brokegirlrich Money Saving Plan Budgeting Money Money Saving Tips

Congratulations Your Income Is Too High Non Deductible Ira Contributions Part 1 Seeking Alpha

Congratulations Your Income Is Too High Non Deductible Ira Contributions Part 1 Seeking Alpha

Understanding The Mega Backdoor Roth Ira

Understanding The Mega Backdoor Roth Ira

Post a Comment for "Can I Open A Roth Ira If I Make Over 100k"