Can I Open A Roth Ira If My Income Is Too High

While the Roth IRA is known for its strict income limits. Apparently if I go Roth solo 401k hire an employee and then I would need to roll over to Roth IRA.

Roth Vs Traditional Ira Retirement Basics Budget Like A Lady Roth Vs Traditional Ira Budgeting Money Traditional Ira

Roth Vs Traditional Ira Retirement Basics Budget Like A Lady Roth Vs Traditional Ira Budgeting Money Traditional Ira

However you can take prompt action to.

Can i open a roth ira if my income is too high. The same Roth IRA income limits also apply though these usually arent a problem for the under-18 crowd. My income is too high to open a Roth IRA. Excess Contribution Penalty You must pay an excess contribution penalty equal to 6 percent of the amount you contributed to your Roth IRA when you contribute even though youre not eligible.

If you earned less than 122000 in the previous tax year you can contribute up to 6000 to your Roth IRA annually. If youre 50 or older that jumps to 7000 If you earn between 122000 and 136999 you can still contribute to a Roth IRA but the amount you can contribute is reduced on a sliding scale depending on how much you make. Most people can contribute up to 6000 to a Roth IRA account as of 2021.

However the IRS still allows you to make a. The good news is that theres a loophole to get around the limit and reap. You can use a backdoor Roth IRA in which you contribute money to a traditional IRA and then convert it to a Roth IRA.

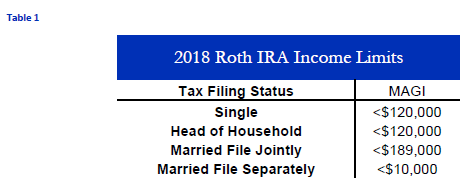

Anyone can contribute to a traditional IRA irrespective of income status. I dont currently have employees but Im sure I will in the future. Roth IRA Income Limits If your income is above a certain threshold each year you are not eligible to contribute DIRECTLY to a Roth IRA.

Your earnings will grow tax-free and you pay no taxes when you take withdrawals after 5 years and over the age of 59½. It seems my next best option is a solo 401k which I can only use if I have no employees. You can contribute to a traditional individual retirement account IRA no matter how high your income.

This means that any high-income earner whos priced out of opening a Roth account still has the opportunity to take advantage of one. For 2021 Roth IRA contributions are not allowed for single filers with a modified adjusted gross income MAGI of 140000 or more up from 139k in 2020 or married couples filing jointly whose. There are income limits though for contributing to Roth IRA accounts.

So even if you dont qualify for a Roth IRA because your income is above IRS income limits you can make after taxes contributions to a Roth 401 k. If you are single you can contribute the full amount to a Roth IRA if you earn up 124000 and make a partial. A single person can contribute the full 6000 if their income is under 124000 in 2020 or.

If you are close to the income limit cut off you would reducing your taxable income and could get your Modified Adjusted Gross Income MAGI below the amount needed to qualify for a Roth IRA and you may actually be able to make a Roth IRA contribution after all. Contributions to Roth IRAs are subject to income limits and if your income exceeds acceptable levels then your contributions are subject to tax penalties. For example if you make 100000 per year and your spouse does not have earned income you can make a contribution of 6000 to a Roth IRA account for both you and your spouse for a total of.

As long as you are earning money you can contribute to an IRA. For single taxpayers the limit is 137000. However there are income limits on who is allowed to contribute to a Roth IRA.

Money saved in Roth. For 2019 that limit is 203000 of modified adjusted gross income MAGI for someone who is married and files jointly. Contributions get phased out if your income.

As of 2010 the government eliminated income limits for converting a Traditional IRA to a Roth IRA. The best option for many high earners will be using the backdoor provision for opening a Roth IRA. Like their traditional 401 k counterparts Roth 401 ksunlike Roth IRAsdont have income phase out limits.

Or if your income is that high you may be better off contributing to a. Contributions can be reduced depending on your modified adjusted gross income MAGI and your filing status however. You can make an additional catch up contribution of 1000 a year for a total of 7000 if youre age 50 or older.

If your income is above certain thresholds the IRS does not allow you to deduct contributions into Traditional IRAs nor contribute into a Roth IRA. The Bottom Line High earners who exceed annual income limits set by the IRS cant make direct contributions to a Roth IRA. But my income would still be too high for.

For those who file their taxes as single contributions cannot be made to a Roth if your income exceeded 139000 in 2020 and exceeds 140000 in 2021.

Dear 20 Year Old Invest Now And Retire Early Savings Chart Retirement Savings Chart Investing

Dear 20 Year Old Invest Now And Retire Early Savings Chart Retirement Savings Chart Investing

Opening Up A Roth Ira For Your Kids Is Smart If You Want To Help Them Build Wealth Learn About Investing And Instill Roth Ira Good Work Ethic Wealth Building

Opening Up A Roth Ira For Your Kids Is Smart If You Want To Help Them Build Wealth Learn About Investing And Instill Roth Ira Good Work Ethic Wealth Building

Where To Keep An Emergency Fund In 2021 Finance Blog High Yield Savings Emergency Fund

Where To Keep An Emergency Fund In 2021 Finance Blog High Yield Savings Emergency Fund

Congratulations Your Income Is Too High Non Deductible Ira Contributions Part 1 Seeking Alpha

Congratulations Your Income Is Too High Non Deductible Ira Contributions Part 1 Seeking Alpha

How To Use A Roth Ira To Become A Millionaire Weekly Savings Plan Savings Plan Money Saving Challenge

How To Use A Roth Ira To Become A Millionaire Weekly Savings Plan Savings Plan Money Saving Challenge

What If I Make Too Much To Contribute To A Roth Ira

What If I Make Too Much To Contribute To A Roth Ira

How A Backdoor Roth Ira Conversion Works Yes You Can Still Contribute Even If You Earn Too Much He Roth Ira Roth Ira Conversion Roth Ira Contributions

How A Backdoor Roth Ira Conversion Works Yes You Can Still Contribute Even If You Earn Too Much He Roth Ira Roth Ira Conversion Roth Ira Contributions

Why A Roth Ira Makes Sense For Millennials And Everyone Else Good Money Sense Money Sense Roth Ira Ira

Why A Roth Ira Makes Sense For Millennials And Everyone Else Good Money Sense Money Sense Roth Ira Ira

Over Roth Ira Income Limits Congrats But

Over Roth Ira Income Limits Congrats But

When Is It Too Late To Have Nothing Saved For Retirement Traditional Ira Roth Ira Ira

When Is It Too Late To Have Nothing Saved For Retirement Traditional Ira Roth Ira Ira

![]() Are You Too Old To Open And Contribute To A Roth Ira Mybanktracker

Are You Too Old To Open And Contribute To A Roth Ira Mybanktracker

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance

Five Awesome Reasons To Open A Roth Ira Account And Start Investing In Retirement Today Investing Start Investing Roth Ira

Five Awesome Reasons To Open A Roth Ira Account And Start Investing In Retirement Today Investing Start Investing Roth Ira

High Income Earners Can Rush To Open A Non Deductible Ira Up To 5 500 And Then If You Jump Through A Few Hoops You Are Able To Convert Th Ira Roth Ira Roth

High Income Earners Can Rush To Open A Non Deductible Ira Up To 5 500 And Then If You Jump Through A Few Hoops You Are Able To Convert Th Ira Roth Ira Roth

Start A Roth Ira For Kids For A Financial Slam Dunk Roth Ira Kids Money Management Teaching Kids Money Management

Start A Roth Ira For Kids For A Financial Slam Dunk Roth Ira Kids Money Management Teaching Kids Money Management

How To Open A Backdoor Roth Ira

How To Open A Backdoor Roth Ira

Are You Too Old To Open A Roth Ira Nerdwallet

Are You Too Old To Open A Roth Ira Nerdwallet

![]() Can I Contribute To A Roth Ira If My Income Is Too High The Backdoor Roth Ira

Can I Contribute To A Roth Ira If My Income Is Too High The Backdoor Roth Ira

Post a Comment for "Can I Open A Roth Ira If My Income Is Too High"