How To Get A Roth Ira Chase

If youre converting a traditional IRA to a Roth IRA youll need to take a few extra steps to manage your tax liability. If you qualify you can do an eligible rollover distribution from your old 401 k directly to a Roth IRA.

Chase Roth IRA interets tae.

How to get a roth ira chase. Qualified distribution is any payment or distribution from your Roth IRA that meets the following requirements. A Roth IRA is a retirement savings account that allows you to withdraw your money tax-free. Backdoor Roths can be a great way for people who earn too much to contribute to the Roth IRA to get money into a Roth IRA.

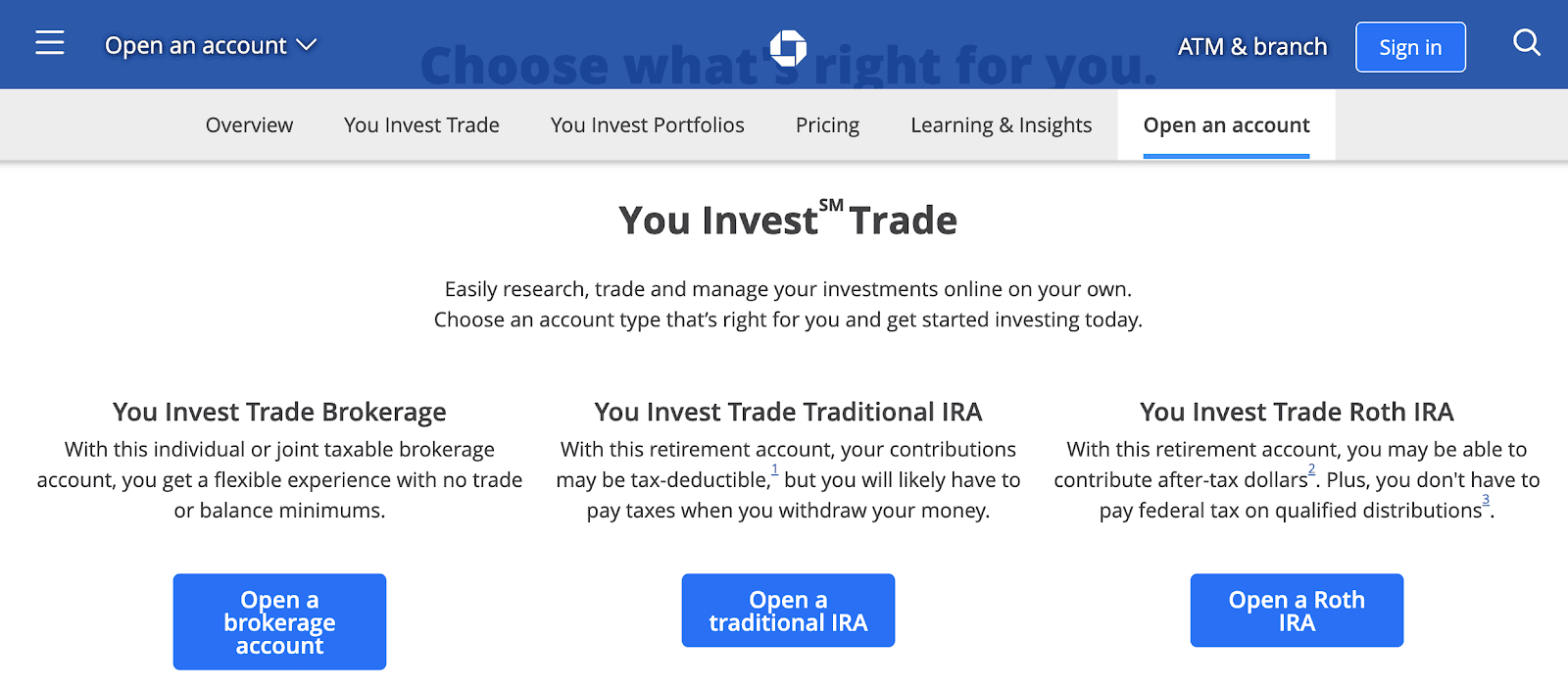

Rollover your account from your previous employer and compare the benefits of Brokerage Traditional IRA and Roth IRA accounts to decide which is right for you. If you do so youll get a personal financial advisor who will be able to answer all of your questions and develop a customized financial plan to guide you to retirement. Chase Roth IRA Interets Tae.

But you dont have to handle the process on your own. Convert Your Traditional Rollover or SEP-IRA. While this means youll pay taxes now contributing to a Roth IRA can make a big difference in the future.

You could open a SIMPLE IRA through the wealth management division of JPMorgan Chase in addition to the other IRAs Chase offers. The difference is that in addition to common securities stocks bonds mutual fund investments CDs and ETFs this account. Youll owe taxes on the amount of pretax assets you roll over.

Unlike a Traditional IRA a Roth IRA account lets you make contributions with after-tax dollarsThis means you pay income taxes on the money before you move it your Roth IRA. Education Planning Funding for education can come from any combination of options and a JP. Chase Roth IRA interets tae.

Its my pleasure to present Ben Barker from Accuplan so welcome Ben as well as thank you for joining us today. Open an IRA account with your new bank fill out a transfer instruction form then allow 3 to 5 business days to complete the transfer. This option comes with a one-on-one working relationship with a traditional human advisor.

And its affiliates collectively JPMCB offer investment. Education Planning Funding for education can come from any combination of options and a JP. You can open a Roth IRA at any online broker or robo-advisor typically online in about 15 minutes.

If your bank doesnt offer Roth IRA accounts you can open one with a brokerage firm. Rollover your account from your previous employer and compare the benefits of Brokerage Traditional IRA and Roth IRA accounts to decide which is right for you. Education Planning Funding for education can come from any combination of options and a JP.

Note also if you have assets in a Designated Roth Account ie Roth 401 k and would like to roll these to an IRA the assets must be rolled into a Roth IRA. You can open a Roth IRA at an online broker and then choose. 1 It is made after the 5-year period beginning with the first taxable year for which a contribution was made to a Roth IRA set up for your.

Im excited to be here. However Chase requires 50000 in assets 100000 in some cases to open an IRA through this channel. Knowing how to open a Roth IRA starts with knowing your investing preferences.

Learn why a Roth IRA may be a better choice than a traditional IRA for some retirement savers. Morgan Advisor can help you understand the benefits and disadvantages of each one. Tell Us About Your Accounts.

Opening a Roth IRA can be as simple as visiting your banks website and filling out an online application. Morgan Advisor can help you understand the benefits and disadvantages of each one. If youre a do-it-yourself investor choose a brokerage.

However you have to pay attention to the pro-rata rules. To Your Roth IRA. But most people dont fully understand how the work or how to use them that will maximize their true long-term.

Rollover your account from your previous employer and compare the benefits of Brokerage Traditional IRA and Roth IRA accounts to decide which is right for you. Most large firms also offer online access to start the account application. Currently weve been working together for years currently and also I can confirm a great deal of sector knowledge.

JPMorgan Chase Bank NA. If you have more than 50000 to put into your IRA you could open an account with JPMorgan Securities. Chase Wealth Management Accounts.

The process is easy as can be. Morgan Advisor can help you understand the benefits and disadvantages of each one. This can be either a traditional IRA or a Roth IRA.

The Roth IRA account is one of the very best financial accounts anyone can have.

Chase You Invest Ira Fees Retirement Account Cost 2021

Chase You Invest Ira Fees Retirement Account Cost 2021

Trying To Consolidate Investments Accounts Into Vanguard Could Use Some Advice Bogleheads Org

Trying To Consolidate Investments Accounts Into Vanguard Could Use Some Advice Bogleheads Org

Chase College Checking Account Review 2021 A Great Student Option

Chase College Checking Account Review 2021 A Great Student Option

Chase You Invest Review My Experience Using You Invest

Chase You Invest Review My Experience Using You Invest

Chase You Invest App Review 2021 Commission Free Investing

Chase You Invest App Review 2021 Commission Free Investing

Roth Vs Traditional Iras What S The Difference Learning And Insights Chase Com

Roth Vs Traditional Iras What S The Difference Learning And Insights Chase Com

Which Should I Save For First My Retirement Or My Child S College Education Learning And Insights Chase Com

Which Should I Save For First My Retirement Or My Child S College Education Learning And Insights Chase Com

Chase You Invest Review 2021 Pros And Cons Uncovered

Chase You Invest Review 2021 Pros And Cons Uncovered

Chase Brokerage Accounts The Complete Guide For 2019 Careful Cents

Chase Brokerage Accounts The Complete Guide For 2019 Careful Cents

Chase You Invest Penny Stocks Fees Rules Otc Pink Sheets 2021

Chase You Invest Penny Stocks Fees Rules Otc Pink Sheets 2021

4 Strategies For Getting The Most Out Of Your Ira Learning And Insights Chase Com

4 Strategies For Getting The Most Out Of Your Ira Learning And Insights Chase Com

Chase Ira Accounts Rates Roth Bank Fees 2021

Chase Ira Accounts Rates Roth Bank Fees 2021

Https Www Chase Com Content Dam Chase Ux Documents Personal Investments You Invest You Invest Contributions To Your Ira Pdf

Vanguard Vs Chase You Invest 2021

Vanguard Vs Chase You Invest 2021

/images/2020/11/09/you_invest_account_choices_crop.jpg) Chase You Invest Review 2021 Who It S Best For Financebuzz

Chase You Invest Review 2021 Who It S Best For Financebuzz

What Is Affiliate Marketing Your Guide To Affiliate Marketing In 2020 In 2020 Affiliate Marketing Email Marketing Strategy Affiliate Marketing Strategy

What Is Affiliate Marketing Your Guide To Affiliate Marketing In 2020 In 2020 Affiliate Marketing Email Marketing Strategy Affiliate Marketing Strategy

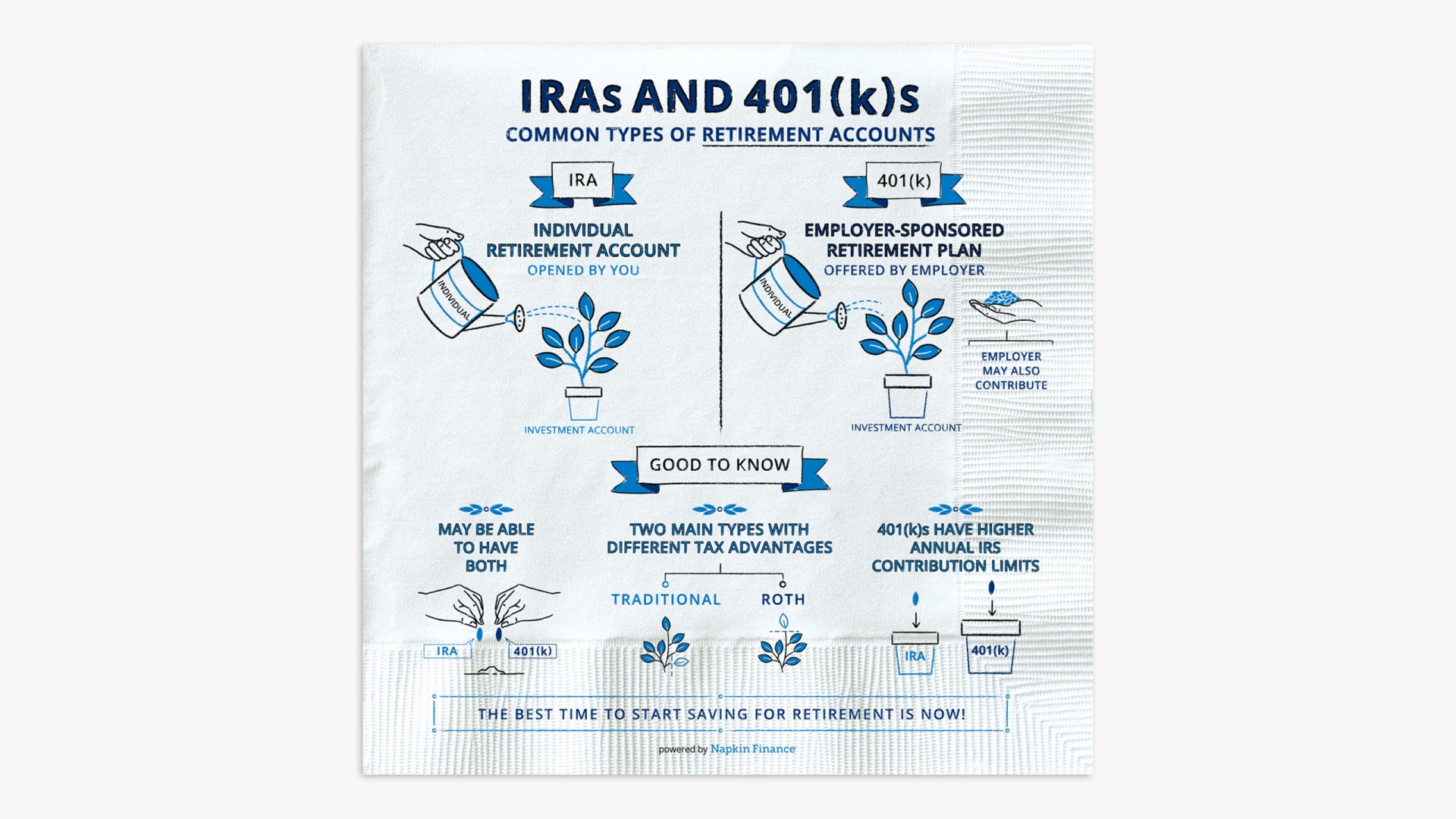

What Are Iras And 401 K S Learning And Insights Chase Com

What Are Iras And 401 K S Learning And Insights Chase Com

Fidelity Vs Chase You Invest 2021

Fidelity Vs Chase You Invest 2021

Post a Comment for "How To Get A Roth Ira Chase"